Highlights

- A prospectus is a legal document that provides information about the company so that investors can make their investment decisions.

- It is registered with the Securities and Exchange Commission (SEC).

- A mutual fund prospectus includes all important details about the mutual fund.

Generally, we read the prospectuses of schools or colleges before applying for admissions. Similarly, public companies issue prospectuses to the public so that they can make their decisions and invest in companies.

It is like inviting someone to a party. In this article, we will learn detailed information about prospectuses.

What Is an IPO Prospectus & How Does It Help with Investment Decisions?

Prospectus explained

It is a legal document that provides information about the company so that investors can make their investment decisions. It is registered with the Securities and Exchange Commission (SEC), which is responsible for regulating securities, and enables the company to issue bonds or stock to the public for sale.

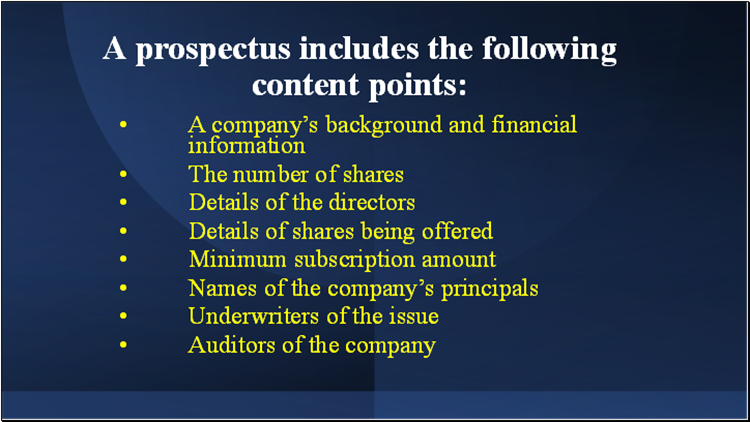

A prospectus contains all the details of the company, including facts, objectives, financial statements, management information, goals, type of securities, number of shares, the company’s background, and other necessary details. All these factors help potential investors.

Also read: Source Rock Royalties IPO: How to buy Calgary-based SRR stock?

IPO prospectus

An IPO prospectus is a legal document that is linked with an initial public offering (IPO) and provides all the details about the issuing company to investors for raising funds. An IPO prospectus includes all the important details of a company including the terms and conditions of the initial stock offering, company background, financial condition, share information, regulatory landscape, etc.

By reviewing an IPO prospectus, investors can gain information about the company’s business management and strategy, details of securities, risk factors, background information, etc.

Image credit: © 2022 Kalkine Media®

What are preliminary & final prospectuses?

The company issues preliminary and final prospectuses. A preliminary prospectus provides information on the company and the proposed sales transaction details before issuing the securities. However, it, generally, does not include price information and details of how many shares it will issue to shareholders or investors.

A final prospectus is a finalized prospectus of the securities offered to the public. It contains the complete details of the offering. It is issued when a company takes the final decisions.

The final prospectus includes information about the company’s goals, the number of shares it will offer, financial information, business models, dividend policies, and all the necessary details. The main goal of the final prospectus is to provide detailed information about the company to the investors so it can help in making investment decisions.

Also read: What stocks to buy as Canada's inflation rises?

Prospectus uses

With the prospectus, investors can take their decisions and decide whether this particular company is right for investing or not. It informs them of the risks and factors associated with the investment. The risks are usually mentioned at the beginning of the prospectus and described later in detail.

The risk column in the prospectus provides information about, interest rate risk, credit risk, market risk, and various other risks associated with funds.

So, before investing in stocks or bonds, an investor should analyze or review all the financial information of the company and other details in the prospectus.

Also read: Three bond market risks that investors can watch out for

What is a mutual fund prospectus?

A mutual fund prospectus is a document that includes information about the objectives of investments, investment strategies, risks, fees, expenses, fund managers and financial details, and all other information about the mutual fund. Mutual fund companies are responsible for issuing prospectus copies to the public before they buy the company’s stocks.

An investor can get the documents directly from the funding company through mails, the company’s website, or a financial planner or advisor. These types of documents help investors to make the right decision before investing in mutual funds.

Also read: Curious about Mutual funds? Here's why one should invest in them.

Bottom line

A prospectus provides details about the company’s operations, plans, and business model to potential investors. With the prospectus, investors can have a better understanding of the company, including the risks associated with securities, the company's financial condition, and other details. All these factors can help them decide whether to invest in a particular security or not.

_06_20_2025_02_57_35_613912.jpg)