Summary

- Covid-19 pandemic appears to boost the market opportunity for biotech companies, mainly involved in the development of COVID-19 related tests kits, drugs, or vaccines.

- Increase in the testing burden with economic reopening is anticipated to provide further growth opportunities to testing kit provider Genetic Signatures concerning international expansion and customer acquisition.

- Mesoblast is carrying out its interim analysis in the current Phase 3 trial of remestemcel-L in ventilator-dependent COVID-19 patients, who have moderate-to-severe Acute Respiratory Distress Syndrome (ARDS).

Most countries are in the eye of the storm concerning repercussions brought by COVID-19 pandemic, which seems to have left the economies tottering, while they brace against the series of setbacks. The situations for many businesses are on the skids as the ebb and flow of the infection scenario often seems to impede the flow of operations. The stabilising situation post the reopening in Australia again took a U-turn with spike in cases in Victoria, leading to the declaration of a state of disaster.

Amidst such scenario, while most of us choose to call COVID-19 pandemic as the Black Swan Event, a few may look at it with an alternative perspective, bringing the current status quo of the crisis into question. A holistic view may potentially suggest the pandemic to possess a grey character, prejudiced against a majority of the sectors while patronising few industries and stocks.

Gold prices repeatedly smashing new records and many innovative digital solutions picking up steam is a clear testament of pandemic-induced domino effect, favouring tech players and bullion market. Meanwhile, the burgeoning focus on health has brought the pharmaceutical and biotech players under the spotlight.

Investors have their eyes set on the vaccine development and virus cases amidst the pandemic, as the Companies endeavour to fast-track their operations to build testing kits, vaccines and other needed medical products and equipment. Contemporaneously, the psychological shift has also widened the field angle in reference to the healthcare sector, with investors also attaching importance to other areas of healthcare and biotech sectors.

ALSO READ: Did you miss the latest updates from small-cap healthcare players Recce and AnteoTech?

Let us look at varying spheres and aspects pertaining to COVID-19, where different biotech and pharma players are not only putting their efforts, but also witnessing significant popularity.

Mesoblast (ASX:MSB) Zooms Up 39%, ODAC Votes in Favor of Remestemcel-L for GvHD

The global leader in allogeneic cellular medicines for inflammatory diseases, Mesoblast Limited, (ASX:MSB) is in the spotlight with its significant developments concerning the treatment of patients with acute respiratory distress syndrome (ARDS) caused by COVID-19.

The Company’s allogeneic mesenchymal stem cell (MSC) product candidate remestemcel-L, which is to be administered via intravenous infusions, has advanced significantly bolstering Mesoblast’s growth prospectd. As of now, no approved treatment for COVID-19 ARDS exists, which is considered as the primary cause of COVID-19 patient’s death.

ALSO READ: Mesoblast Share Price Goes Berserk: Investors had a Sunny Day

Mesoblast is carrying out its first interim analysis in the ongoing Phase 3 trial of remestemcel-L in ventilator-dependent COVID-19 patients having moderate to severe ARDS. A date for early September has been set by the independent Data Safety Monitoring Board (DSMB) for the completion of the first interim analysis.

Significantly, the Company on 14 August 2020 also reported that the Oncologic Drugs Advisory Committee (ODAC) of the FDA voted overwhelmingly in favour of remestemcel-L (RYONCIL™) for efficacy in pediatric patients with steroid-refractory acute graft versus host disease (SR-aGVHD).

By the end of the trading session on 14 August 2020, MSB stock last traded at $4.70, up by 39% intraday. The stock has generated a return of ~65% on the Year-to-date basis.

Genetic Signatures (ASX:GSS) Riding High on Testing Kit Requirement

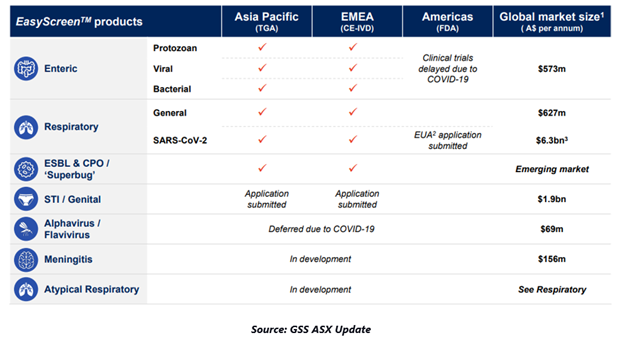

ASX-listed Genetic Signatures Limited (ASX:GSS) is witnessing window of opportunities with the onset of pandemic as it eyes global expansion. The supplier of molecular diagnostic solutions has been typically gaining investor’s interest with its EasyScreenTM SARS-CoV-2 Detection Kit, which is designed for providing rapid and accurate detection of SARS-CoV-2.

The kit involving PCR-based test detects the genetic material of virus, the process recognised as the ‘gold testing’ for testing COVID-19 infection.

ALSO READ: Is Healthcare Rally Coming to an End? A needle on CSL, RMD, CUV

The Company’s diverse product pipeline with significant potential and market expansion plans underpin long-term growth for Genetic Signatures.

With countries reopening their economies, the Company believes that the burden on testing is further expected to enhance significantly, thereby generating prospects for Genetic Signatures to boost its international expansion and expand customer acquisitions

The Company appears on track towards achieving multiple commercial milestones in FY21, which could further accelerate the revenue growth.

As on 14 August 2020, GSS stock closed the day’s trade at $2.30, up by 1.3% intraday. The Company has witnessed share price increase of ~125% on the Year-to-date basis.

Dimerix Limited (ASX:DXB) : Positive Top-Line Results in FSGS Phase 2a Clinical Study

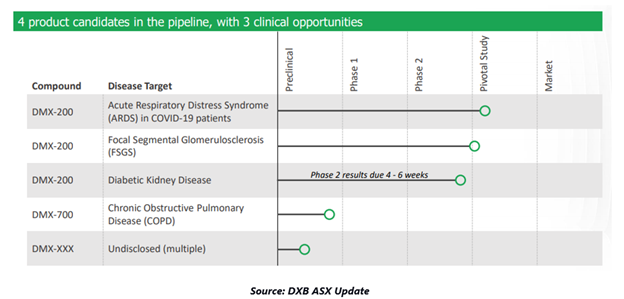

Australian clinical-stage biopharmaceutical company, Dimerix Limited (ASX:DXB) is focussed on the development of its proprietary product DMX-200 for Acute Respiratory Distress Syndrome (ARDS), Diabetic Kidney Disease and Focal Segmental Glomerulosclerosis (FSGS).

FSGS is a rare kidney disorder without having approved pharmacologic treatment, often leading to end-stage kidney failure. Notably, the Company recently received top-line results from the Phase 2a ACTION study of DMX-200 for treating FSGS.

The Company continues to work in close association with REMAP-CAP for supporting global study protocol, including DMX-200 for ARDS caused by COVID-19. DMX-200 clinical experience has received compelling data leading to its Phase 3 clinical study for FSGS patients.

DXB stock edged up by 15% on 14 August 2020 to close at $0.575. The stock has noted price-return of over 284% on the year-to-date basis.

ALSO READ: Australian Healthcare Players in Race to Develop COVID-19 Treatment – NOX, MSB, DXB