Summary

- Healthcare has been at the forefront amid the COVID-19 pandemic with services ranging from the manufacturing of protective gear to testing units and ventilators.

- Biotech giant CSL Limited is in the race of developing COVID-19 vaccine in partnership with the University of Queensland.

- ResMed had impressive FY results with YoY revenue growth of 9% ($US770.3 million), and net operating profit up 40%.

- CLINUVEL continued generating cash amid the challenging atmosphere with cash receipts of ~A$10.40 million for the June quarter in FY20; expanded European supply of SCENESSE®.

COVID-19 pandemic has stress-tested the world, and so far, affected more than 18.61 million people including 702,642 reported deaths (as per WHO 3:17 PM CEST, 6 August 2020).

The Australian government’s response to the spread of SAR-CoV-2 was considered among the most effective across the globe. However, the country is now experiencing a second wave of coronavirus after limiting the spread initially.

RELATED: Second Wave of Infection: NSW Under Spotlight with Surge in Coronavirus Cases

During this reporting season, some companies, despite the challenges, have reported impressive results for the June quarter and the fiscal year 2020. But now the hopes of equity markets are on vaccine developers and finding an effective vaccine is the top priority.

A few of the top pharmaceutical companies have demonstrated positive development for their respective vaccine candidates and are confident of successfully developing a safe and effective COVID-19 vaccine by the end of 2020. However, an air of uncertainty remains, and a recent statement by the WHO highlighting that there might never be a ‘silver bullet’ for the pandemic sounds somewhat discouraging.

FOR FURTHER INFORMATION, READ: Coronavirus Vaccine - ‘Silver bullet’ OR NOT as per WHO

Now let us discuss three ASX- listed healthcare stocks and how they have fared during the period- CSL, RMD, CUV.

CSL Limited a part of the race to develop a COVID-19 vaccine via collaboration with the University of Queensland, Clinical study ongoing

Melbourne-headquartered leading biotech Company CSL Limited (ASX:CSL) is into the development and delivery of novel biotherapies as well as influenza vaccines for saving lives and providing support to patients having life-threatening diseases.

On 16 July 2020, CSL appointed Mr Pascal Soriot as an Independent Non-Executive Director, effective from 19 August 2020. Mr Soriot is the CEO of UK-based healthcare Company AstraZeneca.

Partnership to develop COVID-19 vaccine; Human trials began in mid-July

On 13 July 2020, CSL revealed that clinical trials for COVID-19 vaccine candidate by University of Queensland’s (UQ) had started with the first dose being administered to healthy volunteers.

Earlier, in June 2020, the Company had announced that it had entered a partnering agreement with UQ and CEPI to fast-track the development, production, and the delivery of COVID-19 vaccine candidate.

DO READ: How is the Global Biotech Player CSL Limited Responding to COVID-19?

CSL to Acquire exclusive global license rights for AMT-061 from uniQure

On 25 June 2020, CSL stated that it had agreed to acquire exclusive global license rights from uniQure for commercialisation of AMT-061 to treat haemophilia B.

AMT-061 program is currently under Phase 3 clinical trials and could be among the first gene therapies providing potentially long-term benefits to haemophilia B patients.

As per the terms of this agreement, upon closing the transaction, CSL will have the exclusive global commercialisation right for AMT-061 and uniQure will obtain an upfront cash payment of nearly US$450 million.

Stock Information: On 7 August 2020, CSL stock was trading at A$275.560 (at 02:11 PM AEST), down by 0.788% with a market capitalisation of A$126.11 billion.

ResMed’s FY2020 Revenue Increased by 13%

Digital health player ResMed Inc (ASX:RMD) offers advanced solutions for the treatment of people and to keep them away from the hospital. The medical devices provided by ResMed are cloud-connected and transform care for patients having COPD, sleep apnea, and other prolonged illness.

On 5 August 2020, announced results for its fourth quarter and full-year 2020 highlights-

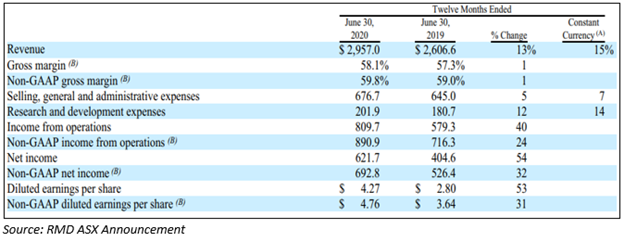

Financial highlights for the fourth quarter:

- Fourth-quarter revenue of ResMed rose by 9% to US$770.3 million and up by 10% on a constant currency (cc) basis.

- The GAAP gross margin in 4Q FY20 was 58.3% with non-GAAP gross margin expanding by 60 bps to 59.9%.

- ResMed’s net operating profit climbed by 84% and non-GAAP operating profit increased by 24%.

- The GAAP diluted earnings of RMD recorded US$1.22 per share and non-GAAP diluted earnings recorded US$1.33 per share.

Financial highlights Full Year 2020:

- The full-year 2020 revenue recorded to US$3.0 billion increased by 13% on pcp.

- GAAP gross margin was 58.1% and non-GAAP gross margin expanded 80 bps to 59.8%

- Net operating profit for 2020 rose by 40% and non-GAAP operating profit climbed by 24%.

- The GAAP diluted earnings recorded US$4.27 per share and non-GAAP diluted earnings recorded to be US$4.76 per share.

ResMed’s CEO Mick Farrell stated-

Highlights from Operational Front:

Launch of cloud-based remote monitoring software- The Company accelerated the launch of cloud-based remote monitoring software for ventilators along with Lumis devices across Europe, via the AirView platform.

Launch of ResMed MaskSelector- ResMed launched a digital tool ResMed MaskSelector to make remote patient mask selection and sizing easier and more effective, helping patients receive the care they need from home.

The MaskSelector assists patients when they are not able to set by themselves due to physical distancing by enabling HMEs.

Stock Information: On 7 August 2020, RMD stock was trading at A$25.080 (at 02:11 PM AEST), down by 3.091% with a market capitalisation of A$37.5 billion.

CLINUVEL Reported A$7.17 million net cash flow in 4Q FY20

A global biopharmaceutical player, CLINUVEL PHARMACEUTICALS LTD (ASX:CUV) is in the development of therapies for patients with severe hereditary and skin disorders. The Company is a leader in photomedicine, and its research & development has led to innovative treatments for patients with a need for treating repigmentation, photoprotection, and genetic deficiencies.

On 31 July 2020, CLINUVEL disclosed its quarterly cash flow report along with the activity report for the fourth quarter (ended 30 June 2020).

- CLINUVEL had cash receipts worth approximately A$10.40 million for the June quarter.

- The net cash flow in the June quarter reported at nearly A$7.17 million.

- Cash and cash equivalents climbed by 7% over the quarter.

- The Company expanded worldwide for supporting the development and continues to expand SCENESSE® supply in Europe.

- CUV disclosed that first US patients treated with SCENESSE® from April.

Furthermore, the Company continues to work for evaluation of SCENESSE® with the TGA under a priority registration pathway as the 1st proposed therapy for adult EPP patients across Australia.

During the assessment, a sequence of discussions happened between the TGA and CLINUVEL, as is typically expected under a scientific review. CLINUVEL projects that the TGA would complete its evaluation by the end of the calendar year 2020.

Moreover, the Company continued to work to prepare for upcoming clinical programs for the development of new therapies for patients with severe genetic and skin disorders.

Stock Information: On 7 August 2020, CUV stock was trading at A$21.690 (at 02:11 PM AEST), down by 2.735% with a market capitalisation of A$1.1 billion.

DO READ: Are these Healthcare Stocks for Brave Investors: Osprey, Clinuvel, Ramsay

Bottomline

The healthcare industry, along with consumer staples and information technology, has been one of the few bright spots in 2020. The impressive rally the sector has witnessed might seem to wane of late. However, the demand for pandemic-related products and services might continue given the rising COVID-19 cases in the country and around the world. A bit too early to believe the rally is coming to an end, maybe?

.jpg)