Summary

- Middle Island announced the completion of updated resource estimates for Shillington and Wirraminna deposits.

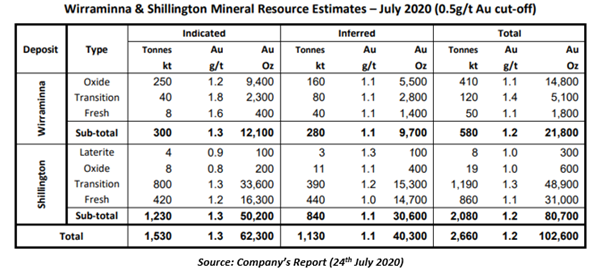

- A 52 per cent or 27,800oz increase in the gold resource to 80,700oz has been reported for the Shillington deposit.

- Indicated Mineral Resource at Shillington has risen by 17 per cent or 7,200oz.

- Following updated resource estimates, Sandstone’s Mineral Resources have soared to 650,500oz gold.

- The Shillington and Wirraminna deposits will be re-optimised to ascertain the in-pit Mineral Resources expected to contribute to the feasibility study.

A day after posting robust quarterly results for June 2020 quarter, Middle Island Resources Limited (ASX:MDI) has declared completion of updated resource estimates for Shillington and Wirraminna deposits within its flagship Sandstone gold project.

The Shillington deposit is located about 2.5km to northeast of the Sandstone Mill, while the Wirraminna deposit is situated around 1.2km to west-northwest of the mill.

The updated estimates have been announced following the conclusion of limited infill and extension drilling conducted in 2020 as part of over 30,000m exploration and resource definition drilling campaign at Sandstone.

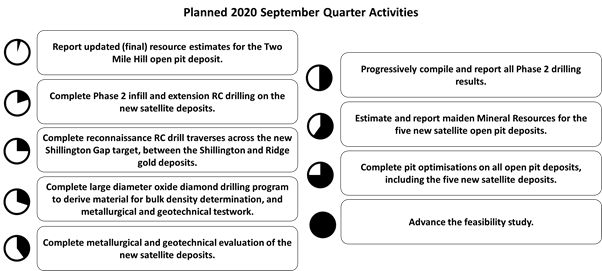

Middle Island has recently completed Phase 1 RC drilling campaign and commenced Phase 2 RC and diamond drilling at Sandstone, which is targeted at delineating additional open pit Mineral Resources before their inclusion for evaluation as Ore Reserves into the 2020 feasibility study (FS).

Interesting Read! Year 2020 Seems to be Ruling in Favor of Middle Island, Up 5x Know Why!

Updated MREs for Shillington and Wirraminna Deposits

Latest drilling at Shillington deposit has resulted in a 52 per cent or 27,800oz rise in gold resource to 80,700oz and a 17 per cent or 7,200oz increase in Indicated Mineral Resource at the deposit. Shillington is one of the numerous Sandstone deposits that is the subject of Company’s ongoing 2020 drilling campaign.

While a massive increase in gold resource has been derived for Shillington deposit, the re-estimation of Wirraminna deposit has led to a minimal change in resource at 21,800oz gold.

Following the updated Mineral Resource estimates (MREs) for Shillington and Wirraminna deposits, Sandstone’s total project Mineral Resources have soared to 650,500oz gold.

Mr Shaun Seale of Ashmore Advisory Pty Ltd has prepared a summary of the updated MREs for Shillington and Wirraminna gold deposits, as provided in the table below:

At Shillington deposit, gold mineralisation is hosted within banded iron formation (BIF) units, largely occurring at fault intersections, with most of the gold mineralisation occurring in the transitional zone. However, gold mineralisation is hosted in a quartz-ironstone shear zone at Wirraminna deposit, with the majority of gold mineralisation confined within the oxide weathering zone.

The Company has planned further geotechnical, geological, engineering and metallurgical studies at Shillington and Wirraminna to further delineate gold mineralisation and ascertain the viability of mining at these deposits.

Road Ahead

According to Middle Island, a few further drill holes must be completed under the ongoing Phase 2 campaign to validate two small areas at Shillington, which are still categorised as Inferred Resources. These areas are likely to fall within the optimum FS pit.

Moreover, both Shillington and Wirraminna deposits will be re-optimised to identify the in-pit Mineral Resources that are expected to contribute to the feasibility study.

The Company is also in the process of updating the key Two Mile Hill open pit Mineral Resource and intends to report the resource estimates of all remaining deposits as soon as Phase 2 drilling campaign results are received and compiled.

As at 12:49 PM AEST, MDI is trading at $0.022.