Highlights

- Barton Gold begins key water monitoring at Tunkillia project

- Tunkillia scoping study shows robust financial metrics

- Stage 1 development to unlock low-risk production pathway

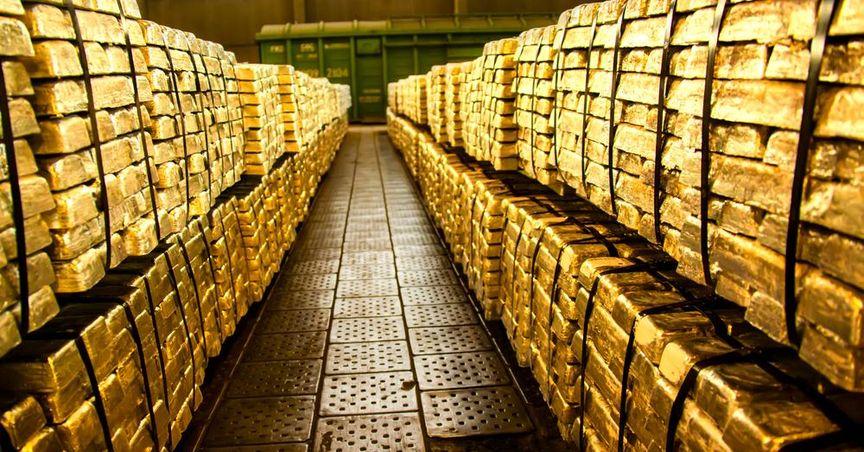

Barton Gold (ASX:BGD) has officially launched a comprehensive baseline water monitoring program at its flagship Tunkillia gold project in South Australia. This initiative marks a crucial step in the project’s long-term development strategy, paving the way for the anticipated mining lease application by the end of next year.

The two-year monitoring program aims to gather essential environmental data needed to support regulatory approvals and future production activities. This baseline data will also be benchmarked against historical figures to ensure a comprehensive understanding of the site's water profile.

This move follows the recent release of an optimised scoping study for Tunkillia in May, which highlighted the project's strong financials. The study projected $2.7 billion in operating free cash flow, a $1.4 billion net present value (NPV), and an impressive internal rate of return of 73%. With a rapid payback period estimated at just 13 months from the start of operations, the study has reaffirmed the project's commercial appeal.

The new development phase has also extended the project’s overall life to 10 years—up from the previously estimated eight—while accelerating higher-grade mill feed across an eight-year life-of-mine. Barton Gold anticipates processing approximately 30.7 million tonnes of ore to yield 833,000 ounces of gold and 1.9 million ounces of silver throughout the mine’s lifecycle.

The early-stage development, including a proposed starter pit, is expected to generate about 206,000 ounces of gold, contributing $825 million in operating free cash flow in just over a year. Barton is concurrently finalising Stage 1 development studies, aiming to leverage the historic Central Gawler Mill facility. This strategy would facilitate early production while minimising capital costs and dilution, positioning the company to transition into a gold producer within the coming year.

Tunkillia, alongside Barton’s Tarcoola project, forms the core of the company’s dual-asset development approach. This strategic positioning is helping lead the resurgence of gold mining activity in South Australia.

While Barton Gold is not currently listed among the ASX200 stocks, its progress at Tunkillia highlights the growing momentum within Australia’s gold exploration and development landscape—an area that continues to attract attention as commodity prices remain elevated.

As the company works through its staged development plan, Barton’s systematic execution and promising economics may continue to draw interest from investors tracking emerging names in the gold sector.