Highlights

- Raiden Resources has received approval for a comprehensive resource definition and exploration drilling campaign at Mt Sholl.

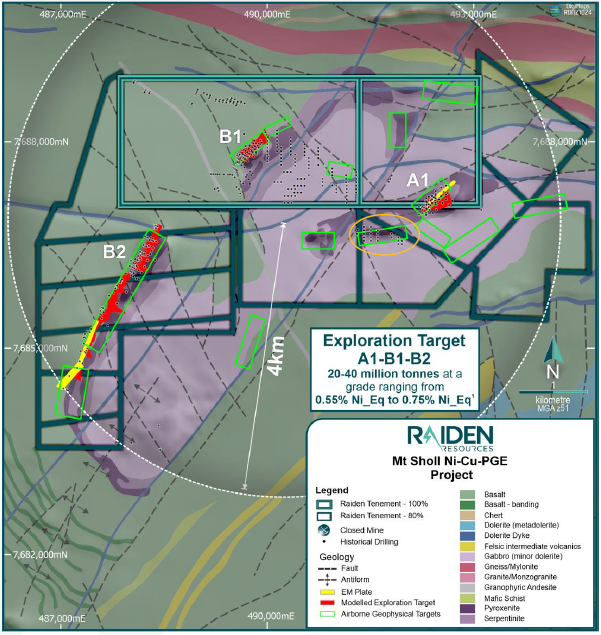

- RDN is planning to define resources across the A1, B1 and B2 deposits and drill test geophysical targets across the tenement area, where ~80,000m of historical drilling has been undertaken.

- The Mt Sholl Project may have the potential for a significant outcropping sulphide deposit, and the ground geophysical survey defines extensions in mineralisation across three deposits.

Setting its growth plan in motion on the Mt Sholl Nickel Project, Raiden Resources Limited (ASX:RDN|DAX:YM4) has secured key approvals to commence its proposed resource definition and exploration drilling campaign.

Bourses welcomed the significant update with RDN’s shares surging 8.33% to AU$0.013 on 30 March 2022.

Good read: Raiden Resources (ASX:RDN) all set to write a new nickel story in Pilbara region

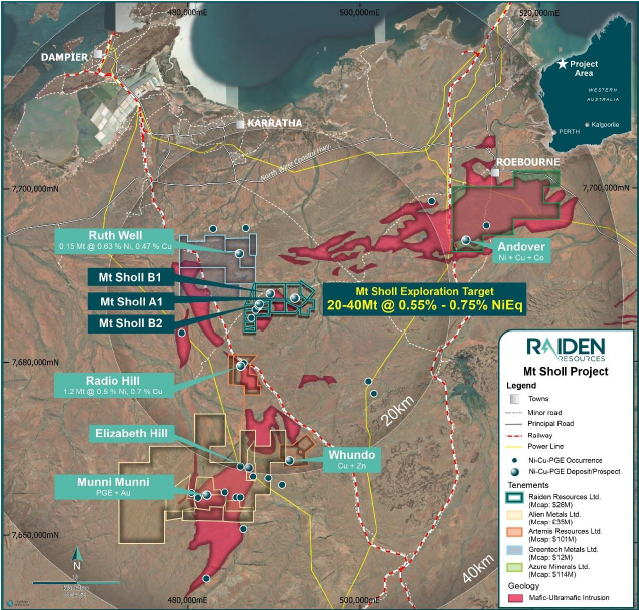

The Western Australian Department of Mines, Industry Regulation and Safety (DMIRS), has given its go-ahead to the development plan at the flagship Mt Sholl Ni-Co-Cu-PGE Project. The project has an exploration target of 20 to 40 Mt of 0.55%-0.75% of nickel equivalent over the A1, B1 and B2 deposits, where ~80,000m of historical drilling has been undertaken. These three deposits will be targeted in the upcoming drilling program being scheduled during the second quarter of 2022.

Location map of Mt Sholl Project with respect to other key projects in the region (Image source: Company update, 30 March 2022)

Raiden will focus its drill program on the exploration target along with areas that have shown significant potential for massive nickel sulphide mineralisation in the recent remodelling of geophysical airborne and ground electromagnetic data.

Related read: Raiden Resources (ASX:RDN) intercepts anomalous gold at Arrow; drilling at Mt Sholl Ni-Cu-Co-PGE project on the cards

RDN is designing the diamond drill program to test the validity of the exploration target, which could lead to a more robust understanding of the potential of the deposit. Nearly 80,000m of drilling has been done on the tenement by past explorers between 1970 to 2007. The upcoming drilling program will test the viability of data provided by historical drilling.

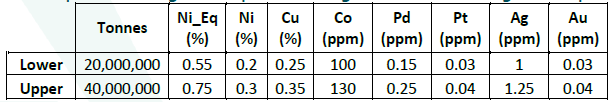

Data source: Company update, 30 March 2022

Exploration potential

Raiden had secured services of Terra Resources for the re-interpretation of historical data from the existing exploration target. The re-interpretation work delineated several targets across the project area that RDN may consider in its near-term drill targets. These targets include potential direct depth extensions of mineralisation at the A1 and B1 deposits, along with multiple new targets outside current exploration model areas.

Related read: Raiden Resources (ASX:RDN) sitting on goldmine of opportunities in Pilbara region

Historical drilling has also defined a drill-ready target, Kudos, located southwest of the A1 deposit. Kudos remains open along strike in both directions and to depth.

Mt Sholl Project with exploration targets. Kudos prospect highlighted in orange (Image source: Company update, 30 March 2022)

Previous explorers drilled 677 holes across the tenure. The drilling data forms the basis for geological modelling that was used to evaluate the exploration target. Raiden feels that more drilling is required to convert the exploration target to a resource and test extensions of known mineralisation as well as evaluate untested targets.

The exploration target of 20-40Mt in grades ranging between 0.55% to 0.75% of Ni Eq is deduced from the historical data, geochemistry data, geophysical data combined with remodelled EM targets.

Exploration target Ni-Eq tonnes and grade with all-metal grades (Image source: Company update, 30 March 2022)

Related read: Raiden Resources (ASX:RDN) reports a supercharged December quarter

Raiden plans to commence the drilling operation in Q2 of 2022 and expects to complete it by the last quarter of 2022. Timelines are dependent on rig availability and the completion of an aboriginal heritage survey prior to the drilling campaign.