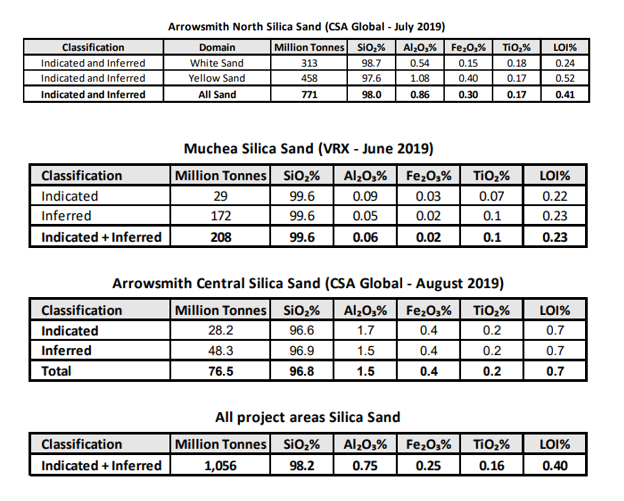

Amidst the growing demand for silica sand across the world, Australia-based silica sand explorer, VRX Silica Limited (ASX: VRX) is engaged in meeting this rising demand via its significant projects in Western Australia. The company possesses a robust project portfolio, which includes Arrowsmith, Muchea, Warrawanda, Biranup and Boyatup projects. The Arrowsmith and Muchea silica sand projects are the most advanced ones, with a total JORC compliant Indicated and Inferred silica sand Resources of 1,056 Mt at an average grade of 98.2% SiO2.

VRX Silica, listed more than eight years ago on ASX, has been under the investorsâ radar for its attractive stock returns. The companyâs stock has delivered an exceptional return of 162.13 per cent in the last five years. Over last six months, the stock has soared up by 110.14%. Considering this, let us discuss some of the key attributes of VRX Silica that make it an attractive investment opportunity:

Emerging Australian Strategic Silica Sand Producer

The developing silica sand producer has attained significant progress in line with its encompassing strategy, which involves the following components:

The company has recognised that the broader silica sand mining industry is an evolving industry in Western Australia with less established practices and fewer depth of expertise than is usual in other segments of the mining industry. Consequently, the company created a strong portfolio of silica sand projects in Western Australia as discussed below:

- Arrowsmith Silica Sand Project - 270km to North of Perth, Comprises Five Granted Exploration Licences and Two Mining Lease Applications Pending

- Muchea Silica Sand Project - 50km to North of Perth, Comprises One Granted Exploration Licence, with One Mining Lease Application Pending

- Boyatup Silica Sand Project - 100km to East of Esperance, Comprises Two Adjacent Granted Exploration Licences

The remaining two projects of the company that are prospective for other minerals are:

- Warrawanda Project: 40km to the south of Newman; Prospective for High Purity Quartz and Nickel Sulphides

- Biranup Project: Adjacent to the Tropicana Gold Mine in WAâs Goldfields; Prospective for Gold and Base Metals

Outstanding Project Economics and Logistics

The companyâs Arrowsmith and Muchea projects are the most developed ones amongst all its five projects with excellent project economics and logistics, that are discussed below:

Arrowsmith Silica Sand Project

The Arrowsmith project has been classified as an industrial mineral Inferred/Indicated Mineral Resource due to its favourable logistics and location. The project has a rail connection to Geraldton Port and is located adjacent to the Brand Highway. The rail connection to the Geraldton Port passes via Narngulu, which is the route previously used by the Eneabba mineral sands operations.

As per the company, the rail is rated at 19 tonnes per axle and is a Tier 1 railway line. The rail line between Eneabba and Geraldton offers a direct access to the Geraldton Portâs ship-loading facilities and provides a unique logistics solution.

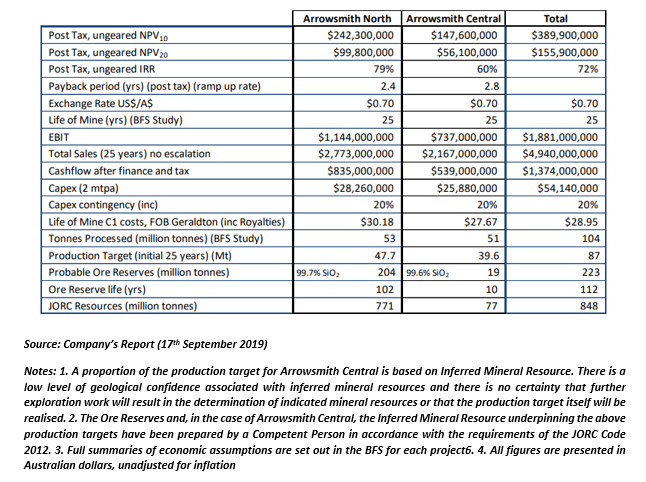

The companyâs Arrowsmith North and Central projects have demonstrated excellent project economics in their recently released Bankable Feasibility Studies (BFS). The key BFS outcomes for both the projects are highlighted in the below table:

Muchea Silica Sand Project

The companyâs Muchea Silica Sand Project is strategically situated close to Brand Highway and has a rail link to Kwinana port, suitable for large handling. The Kwinana port facility is likely to offer easy transportation and shipment of products post the commencement of production at Muchea project.

Ideally Placed to Capitalise on Robust Market Outlook and Demand

The market for silica sand is growing rapidly amid the mounting demand for high quality silica sand across the word. From 2009 to 2016, the silica sand sales experienced a CAGR of about 8.7 per cent with a market value of US$6.3 billion. The company expects the worldwide consumption of industrial silica sand to increase by 3.2 per cent per year over 2022. The largest regional consumer of industrial sand, the Asia-Pacific region, is likely to surpass the global consumption of industrial silica sand, by growing at 5-6 per cent per year.

VRX Silica holds significant potential to supply the rising demand for silica sand across the globe. The company has been receiving strong interest from Asian customers for its potential products. In April this year, the company received enquiries for silica sand products from its Arrowsmith and Muchea project from manufacturers and purchasing agents in China, Japan, Philippines, Korea, Malaysia, Thailand, India and Taiwan.

Recently, it has also tied up with CSG Holding Co Ltd, largest architectural glass manufacturer in Peoplesâ Republic of China (PRC), to explore:

VRX Silica is in a unique position to produce numerous silica sand products from its projects and if required, modify the plant to manufacture the products required by the largest buyers.

Potential Large Sand Resources and Production

VRX Silicaâs total Inferred and Indicated resources are currently in excess of 1 billion tonnes at its three silica sand projects â Arrowsmith North Silica Sand, Muchea Silica Sand and Arrowsmith Central Silica Sand (see figure below).

Source: Companyâs Report (15th August 2019)

Recently, the company has also reported probable ore reserves of 223 Mt @ 99.7% SiO2 for Arrowsmith North and 18.9 Mt @ 99.6% SiO2 for Arrowsmith Central project.

VRX Silica is ideally placed to become a major global silica sand supplier, backed by its strong fundamental attributes, that are likely to offer a rapid pathway to financing and production in the future. The company is vigorously evaluating additional silica sand projects in Western Australia.

Stock Performance: VRX is currently trading at $0.140 on 9 October 2019 (as at 3:40 PM AEST).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.