Two stocks BOT and PM1 are on trading halts, pending their upcoming announcements on ASX. Let us have an overview of the recent developments and the performance of the stocks for these companies.

Botanix Pharmaceuticals Limited

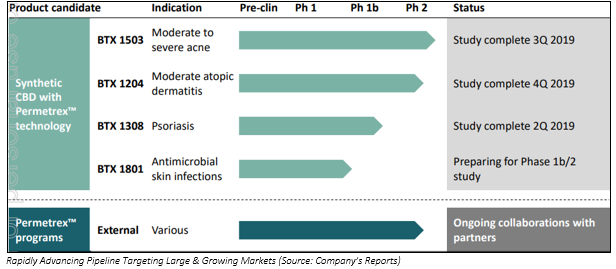

Strong Development Pipeline: Headquartered at North Perth, Western Australia, Botanix Pharmaceuticals Limited (ASX: BOT) is a pharmaceutical company which is into the health care segment. The mission of the company is to improve the lives of patients suffering from acute skin diseases including acne, psoriasis and atopic dermatitis using a novel therapeutic and advanced transdermal drug delivery system.

According to a company announcement on 18 June 2019, its securities will be in a trading halt till it makes a statement related to the results of BTX 1308 psoriasis Phase 1b study or start of normal trading on 20 June 2019, whichever is earlier.

The company, on 14 June 2019, released a presentation made to its Advisory Board. The presentation was focused on the dynamics of the psoriasis market and opportunity for Botanixâs BTX 1308 product. The advisory meeting was held with the companyâs key opinion leaders in Milan, Italy, in conjunction with Botanixâs attendance at the 24th World Congress of Dermatology.

The Founder and Executive Director of Botanix, Matt Callahan, said that a compelling rationale for the significant potential of BTX 1308 was provided by the updated view on the global psoriasis market, given it is significantly larger than the combined markets of acne and atopic dermatitis. The development pipeline of the company is strong, on the back of upcoming results from the Phase 1b BTX 1308 mechanism of action study in 2Q CY2019 and results from the BTX 1503 (acne) and BTX 1204 (atopic dermatitis) Phase 2 studies later 2019.

Psoriasis is a chronic, inflammatory disease which leads to red patches and plaques with silvery scales on the skin. The disease affects approximately six million to eight million people in the United States. ~90% have mild to moderate disease. Centers for Disease Control and Prevention (CDC) surveys suggest only 2 million patients are actively treated.

There has been lack of innovation in topical therapies for decades. Most used pharmacologic treatments are topical corticosteroids (TCSs) which suffer from limitations on use. Biologics are costly and limited to use in more severe disease, although it is highly effective. More than 30% of patients exclusively use topical agents, but as many as 72% are non-adherent.

The stock of Botanix Pharmaceuticals Limited last traded on 17 June 2019 at $0.135, with a market capitalisation of $104.37 million. The stock yielded a YTD return of 84.93% and exhibited returns of 92.86%, 20.0% and 17.39% over the past six months, three months and one-month period, respectively. Its 52-week high price stands at $0.140.

Pure Minerals Limited

Robust Investment Highlights: Pure Minerals Limited (ASX: PM1) is a mineral explorer, based in West Perth, Western Australia. The company is engaged in the exploration and development of battery metals such as manganese, lithium, and tantalum. The company operates majorly in the areas of Gascoyne Region of Western Australia.

PM1 securities will be in a trading halt till the commencement of normal trading on 20 June 2019 or when the announcement related to the finalisation of a material capital raising, is released to the market, whichever is earlier.

As per the latest energy mines and money presentation on 13 June 2019, the key investment highlights include positive scoping study, high-grade ore supply, near term production, strong fundamentals for battery chemicals, Townsville location and experienced management of the company.

PM1 has secured high-grade Ni-Co ore supply agreement with two New Caledonia mining companies. It has low mining/exploration risks. The battery market is robust with factors including strong fundamentals for battery chemicals (Ni Sulphate / Co Sulphate), Nickel resurgence and majority of worldâs cobalt coming from DRC â QPM offers supply from a stable jurisdiction.

QPM or Queensland Pacific Minerals Pty Ltd is a wholly owned subsidiary of Pure Minerals Limited. QPMâs ore supply partners are Societe des Mines de la Tontouta and Societe Miniere Georges Montagnat S.A.R.L. It holds 20% of the tenure in New Caledonia that comprises nickel projects, with well-established mining companies that have been operating for decades. It has an initial annual supply of 600,000 tonnes, which can be boosted in the future.

Townsville remains as an ideal location. Over 50 million wet tonnes in New Caledonia Ni-Co feed has been imported and processed in Townsville over 30 years. Moreover, it has a robust infrastructure with port, road, rail, power and water. Moreover, it has the availability of skilled labour workforce.

New Caledonia hosts the best quality limonite within the Asia-Pacific region. Townsville lies ~2,100 km from New Caledonia and is well positioned to process ore. Australia is a long term, approved trading partner with New Caledonia. It hosts the worldâs largest laterite. Ore reserves have been estimated to contain 700kt of Cobalt, 7Mt of Nickel, 140 Mt of Iron and 15Mt of Magnesia.

Queensland Pacific Minerals Pty Ltd, PM1 subsidiary, in the recent past appointed Lycopodium Minerals Pty Ltd, a wholly owned subsidiary of ASX listed Lycopodium Ltd, as Lead Engineer for the Pre-Feasibility Study for the Townsville Energy Chemicals Hub project.

On the back of shareholderâs approval for the acquisition of QPM, and in the process of being finalised, the company is eager to launch its planned battery materials refinery as the Townsville Energy Chemicals Hub. The battery materials refinery will have a capacity of 600ktpa, producing nearly 25,000tpa of nickel sulphate and 3,000tpa of cobalt sulphate in addition to other co-products.

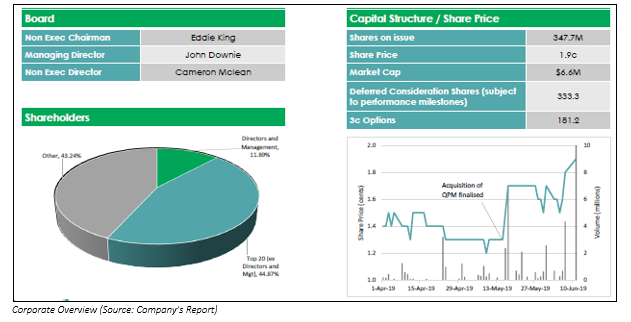

Turning on to the stock performance, the Pure Minerals Limited stock last traded on 17 June 2019 at $0.020, with a market capitalisation of $6.95 million. The YTD return for the stock stood at 33.33% and exhibited returns of 42.86% and 17.65% over the past three months and one-month period, respectively. Its 52-week high price stands at $0.022.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.