Pure Minerals Limited (ASX: PM1) is an ASX listed exploration company based in West Perth, Australia. The company is focused on exploration and development of metals which are used in batteries like manganese, lithium and tantalum.

Acquisition of QPM

On 15th May 2019, the company provided updates regarding the acquisition of Queensland Pacific Metals Pty Ltd (QPM). The company released a statement, quoting that it has completed the acquisition of QPM and now owns the company to the extent of 100%.

Appointment of Managing Director

The company also made a new addition to its top management, which is related to the acquisition of QPM. The Director of QPM, John Downie has now been appointed as Managing Director of Pure Minerals. He is a mechanical engineer by qualification with 30 years of experience in the mining industry.

Previously, he had been the Director of Mines for Valeâs Goro operations, Director of Projects at Queensland Nickel and CEO of Gladstone Pacific Nickel with senior roles in several other companies.

According to the employment agreement, the initial salary of John Downie has been decided at $120,000 per annum (excluding superannuation). The appointment was effective 13th May 2019 and has a three-month notice period.

In conjunction with John Downieâs appointment, resignation has been given by Lincoln Ho who was the non-executive director of Pure Minerals. His contribution from the relisting of Pure Minerals in 2017 to the QPM acquisition process has been recognised by the board.

General Meeting

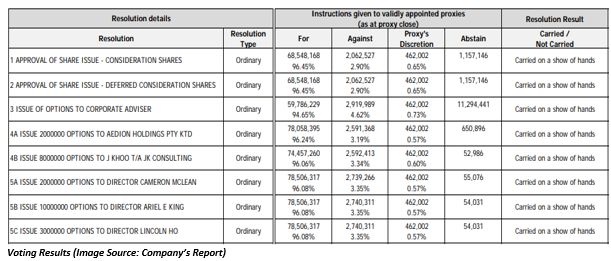

The company announced the result of its general meeting which was held on 1st May 2019.

All the proposed resolutions listed above were duly passed by the shareholders with a majority.

March 2019 Quarterly report

Operational update

In the quarterly activities result ending on 31 March 2019, the company announced about its binding option agreement with QPM. According to the agreement, the company exercised its option on 25th February 2019 to acquire QPM on the back of the positive scoping study results and strong outlook. In order to receive shareholdersâ approval, the shareholders made some variations to the original term sheet and approved the revised term sheet. Some of the variations in the term sheet were as follows:

- A reduction in the number of initial consideration shares from 66.6 million to 33.3 million.

- An increase in the number of deferred consideration shares of 33,300,000 for the first tranche.

After positive scoping study results, the company is committing to undertake a Pre-Feasibility Study (PFS) to assess the project in greater detail.

Cashflow report

The company used total cash of A$215,000 in the operating activities, the highest cost being incurred towards administration and corporate costs. No activity has been performed under the investing and financing activities for the quarter. At the end of the reporting period, the company was left with net cash of A$1.77 million.

The estimated cash flow for the next quarter is expected at A$752,000 with the highest estimated cost of A$509,000 to be incurred on exploration and evaluation.

On 9th April 2019, the company announced about QPMâs application for the grant under the CRC-P scheme.

Stock Performance

The company has a market capitalisation of A$314.38 million. The stock has a 52-week high of the stock is A$0.019. The stock last traded at A$0.013, as on 13th May 2019. The last one-year return of the stock is negative 18.7%, and the YTD return stands at negative 13.3%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.