Summary

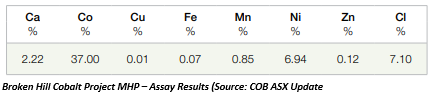

- Cobalt Blue achieved significant testwork outcome, with samples from BHCP delivering 37% Co and 7% Ni in the MHP intermediate product.

- Pilot plant equipment arrived on site, with commissioning subject to the impacts of COVID-19.

- During the June quarter, work continued on an updated ore reserve statement, released during mid-July 2020.

- Testwork success at Millennium Project, with excellent metal recoveries, including 93% cobalt and 93% copper.

Cobalt Blue Holdings Limited (ASX:COB), a green energy exploration company focused on advancing its flagship Broken Hill Cobalt Project (BHCP), has released quarterly activities report for the period ended 30 June 2020.

BHCP Samples Comply with World-Class Specifications

Cobalt Blue conducted laboratory testwork at ALS Metallurgy to proceed with the planned pilot plant trials. In 2019, 45 tonnes of ores from BHCP were used to produce 7.7 tonnes of concentrate samples. A 200kg sub-sample of the concentrate was taken for the laboratory testwork for the process development program. The Company has been focussing on optimising the beneficiation method to further reduce iron, copper, zinc, manganese and calcium in the cobalt-nickel hydroxide intermediate precipitate.

In addition, the present specifications of the hydroxide intermediate product, which would be further processed to produce high-purity cobalt sulphate, are as follows-

The hydroxide precipitate was filtered from the chloride mother liquor leaving the remaining moisture of 10-15%. Hydroxide intermediates make up to ~75% of the global cobalt trade. The Democratic Republic of Congo (DRC) holds the lion’s share in the hydroxide intermediate market and this share is anticipated to grow further in the near term.

Hydroxide intermediates are sold off to specialised refiners on a pricing formula including 2 major components.

- Floating component – Associated to the cobalt metal price

- Cobalt Content – A higher content may draw a higher price irrespective of the total volume of the intermediate

Fastmarkets quotes prices for cobalt intermediate hydroxide with 30% minimum content, with typical content from the DRC at 25-40%. Additional strong anticipated nickel credits would increase the payable metal for COB’s MHP product. The MHP intermediate includes little levels of impurities and are considered attractive.

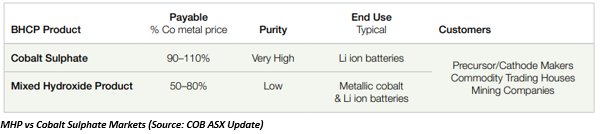

Cobalt Blue at BHCP envisions a flexible production strategy for a commercial intermediate product to suit the varying market conditions of pricing of MHP (50-80% cobalt payable) vs cobalt sulphate (90-110% cobalt payable) products.

The BHCP refinery is planned to produce the following commercial products-

- An MHP intermediate product with 37% Co and 7% Ni. High Co/Ni ratio is expected to attract a premium pricing.

- A premium cobalt sulphate product expected upon further refinement of the MHP intermediate. The specification of >20.5% Co in the sulphate crystals is targeted for commercial operations, making it suitable for the manufacturing of cathode.

Over 7.5 tonnes of sample concentrates from the Broken Hill project was prepared for calcine (furnace) testwork. After the thermal decomposition, calcination residues would be sent for testing at COB’s pilot plant at Broken Hill. The calcined samples will be further leached and sent for metallurgical recovery trials while ~1 tonne of elemental sulphur would be assessed by Mitsubishi Corporation.

Post the quarter completion, extensive testwork achieved >20.8% cobalt sulphate heptahydrate and >99.3% elemental sulphur purity.

To know more, do read Major Breakthrough: Cobalt Blue Announces BHCP Testwork Achieving Battery Grade Cobalt Product

Pilot Plant Equipment Received, Commissioning Subject to COVID-19 Impacts

During the quarter, the Company updated about expected commissioning of the pilot plant in the last quarter of 2020, with equipment arriving on site; however, its commissioning is subject to COVID-19 impacts.

COB is developing the plant, which would be scaled from an initial pilot plant operation to a larger scale fully integrated demonstration plant. The centre will be beneficial for the engineering design process and in the estimation of expenses for the BHCP Feasibility Study. The facility will have a final production capacity of 1-2 tonnes of cobalt sulphate by processing up to 2,000 tonnes of ore.

Updated Ore Reserve - BHCP

Cobalt Blue advanced on the updated ore reserve statement during the June quarter, and the upgraded ore reserves update was announced during mid-July 2020, as part of the Project Update 2020, which also identified key optimisation opportunities.

For Project Update 2020, please read Cobalt Blue’s BHCP Update Highlights Increased Ore Reserve, Longer Operating Life and Lower Costs

Strong Corporate Partnerships to Lead Way Towards Commercial Operations

The mixed hydroxide and cobalt sulphate samples are being evaluated for technical and market assessments under the cobalt product sample program.

Cobalt Blue plans to emerge as the cathode materials supplier to top-tier companies and anticipates sharing its samples with over 10 sampling partners including battery precursor manufacturers and cobalt trading firms.

During the quarter, Sojitz Corporation, the Japanese behemoth, was added as a sampling partner under the cobalt product program.

Must Read: Cobalt Blue Supported by Industry Majors: LG and Mitsubishi, Many More to Follow

Proprietary Technology Testing

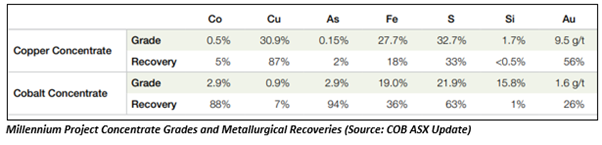

Cobalt Blue conducted testwork at GEMC’s Millennium Project, producing separate copper and cobalt concentrates through a COB developed floatation scheme.

The cobalt concentrate was further processed utilising the proprietary COB process involving –

- Thermal decomposition of pyrites, converting then to pyrrhotite (Fe7S8).

- Leaching the calcined pyrrhotite product to extract cobalt and copper.

The leaching process extracted over 90% of the cobalt and 95% of the copper. Additionally, 10% of the gold was leached mostly from the formation of gold-chloride complexes. The leach residues were further washed on to recover additional gold from the cobalt concentrate at the total metallurgical recovery of 90% (80% from the cyanide leach residues and 10% in the cyanide leach solution).

OZ Minerals Limited (ASX:OZL) has also partnered with COB to test its process on a pyrite concentrate. The testing is under progress and is anticipated to be completed in the upcoming four-month period.

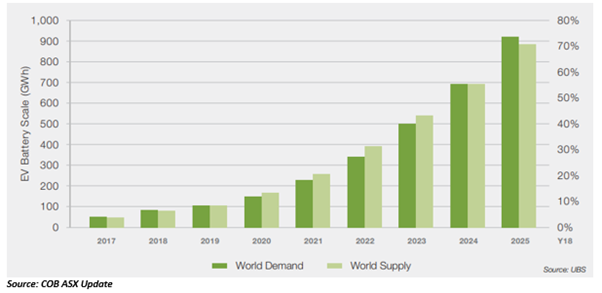

Incentive Push to Drive EV Market

Cobalt Blue noted a recent UBS study, highlighting that a consumer poll within the top seven automobile markets unveiled that for the first time ever, consumers chose Battery Electric Vehicles (BEVs) over Internal Combustion Engine (ICE) vehicles, subject to BEV specifications such as-

- At least 300-mile (~480km) range

- Comparable costs

UBS has estimated that the EV market share would register strong growth.

Furthermore, there has been a strong push from European economies to introduce or extend incentives to encourage electric vehicle adoption rate.

Read our article on Cobalt Blue Foresees Strong Cobalt Market with Government EV Incentive Push.

Cobalt Blue had a cash balance of $2.057 million as on 30 June 2020, and received a R&D tax incentive rebate, government security deposit refund and a CRCP grant payment totalling ~$1.36 million during the quarter. The Company has already implemented strategies to minimise the risk of COVID-19 to employees, contractors and the business. Moreover, a cost preservation measure including a hold on any non-essential expenditure is already in place.

Stock Performance - COB stock closed the day’s trade at $0.125 a share with a market capitalisation of $21.59 million on 28 July 2020. The last three-month return of the stock was noted at 28.57%.

(Note: All currency in AUD unless specified otherwise)