Highlights

- Renegade Exploration shares have gained more than 37% in the past 3 days and trading at 52-week high on the ASX.

- RNX is engaged in developing copper assets across the world-class Mt Isa region.

- The company is banking on exceptional copper fundamentals and a strong gold outlook.

- RNX is planning a 2,000m RC drilling program over North Isa Project.

Shares of ASX listed mineral explorer Renegade Exploration Limited (ASX:RNX) have been on a tear in the past 3 days with gains of over 37%. The copper and gold explorer closed the first quarter of 2022 at AU$0.011, a new 52- week high.

Related read: Renegade Resources (ASX:RNX) Board approves RC drilling post promising exploration results at Lady Agnes

On 23-24 March 2022 Renegade participated in the Brisbane Mining, Energy and Minerals conference. The company took the opportunity to highlight its operational activities and demonstrate the resource potential of its assets.

RNX is engaged in the development of highly prospective copper and gold projects in the world-class mining jurisdiction of Mt Isa mineral province. The company is planning to invest AU$500,000 over the next four years as per the terms of the earn-in agreement.

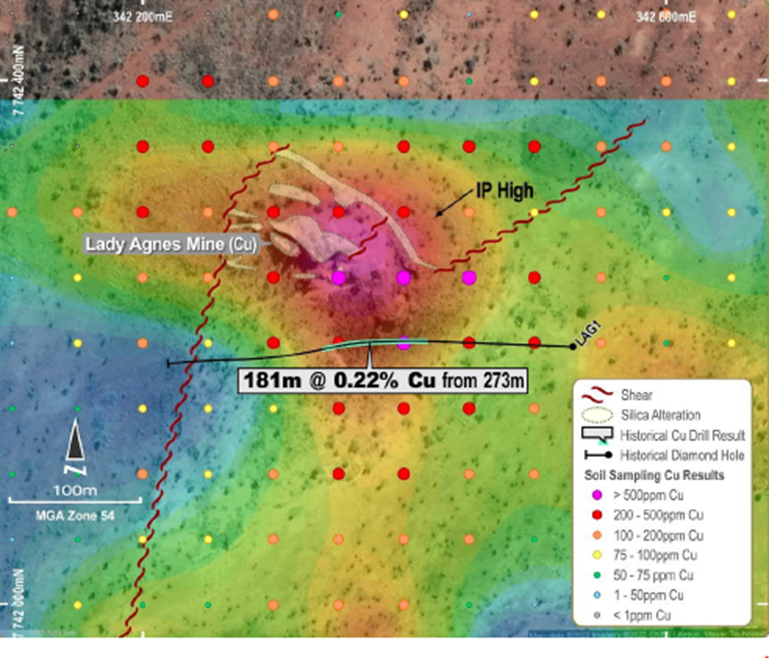

The initial exploration operations have delineated three high-potential prospects – Lady Agnes Mine, Pipeline and Tulloch on the project tenement package. The company undertook soil sampling and mapping operations on the project area, which delineated targets for follow up operations.

Recent update: With focus on copper assets, Renegade Resources (ASX:RNX) wraps up action packed 1HFY22

Renegade recently announced that its Board approved a 2,000m drilling campaign over the Lady Agnes prospect. RNX is the first explorer on the project that holds all historical data.

Lady Agnes target on North Isa Project (Image source: Company Presentation, 23 March 2022)

The access agreements are being finalised on Lady Agnes, and preparations are underway for the upcoming drilling operation.

Carpentaria JV Project

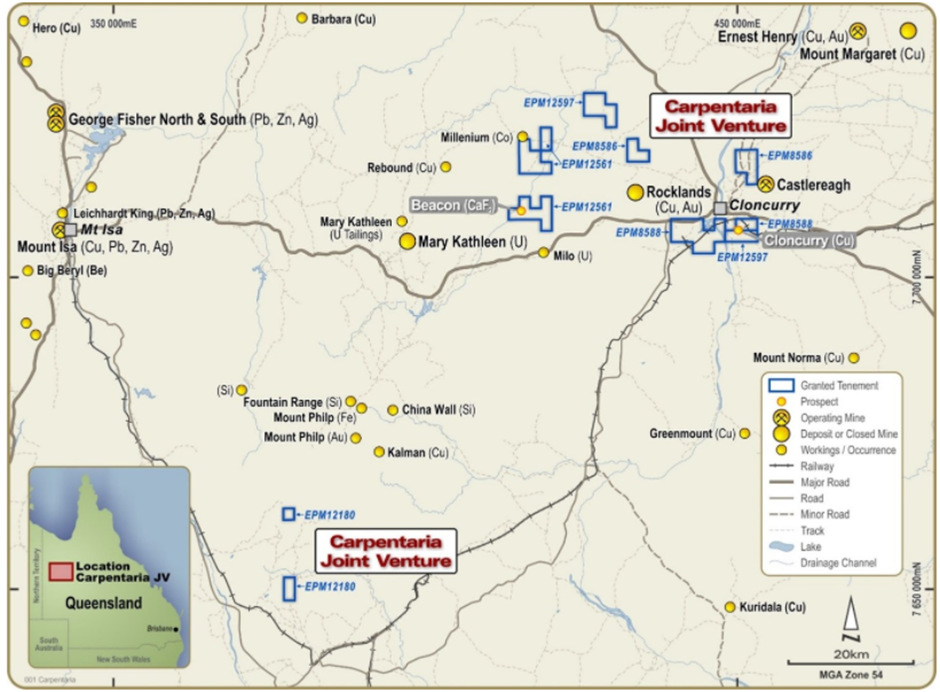

To increase its copper footprint, RNX acquired a 23% interest in Carpentaria Joint Venture Project. The project is operated by a subsidiary of Glencore and is located in a prime copper-producing region with excellent exploration potential.

RNX spent AU$350k for its 23% interest in the project. The JV partners are planning to pursue large targets in the Duchess and Cloncurry area during 2022. At Duchess, a drilling campaign is being planned for the third quarter.

Related read: Renegade Resources (ASX:RNX) eyes dominant role in copper market through North Isa Project

Location map of Carpentaria JV Project (Image source: Company website

Why is Renegade betting high on copper and gold?

Few market participants are of the view that the burgeoning EV demand and the accelerated pace of transition into the new electric age would translate to strong demand for copper in the near to long-term. New investments in copper exploration are becoming scarce, and no significant discovery has been made in the recent past.

Gold continues to maintain its shine and trading in the range of US$1,900-2,000/oz. The ongoing geopolitical uncertainty and inflation are causing economic uncertainty, pushing investors to flock to gold as it provides a hedge against inflation and considered as a ‘safe haven’ asset.

Related read: Renegade Exploration (ASX:RNX) soars 7% on appointment of new non-executive director

The company opportunistically manages its portfolio to create value for its shareholders. RNX sold the Yandal Project to Strickland Metals (ASX:STK) for AU$800,000 cash consideration and 40M shares of STK. Renegade also maintains 0.5% net smelter royalty (NSR) and continues to maintain exposure to the Yandal Project through Strickland’s share and NSR.

Renegade received a considerable amount on the selling Yukon base Metal located in Canada. The asset sales have put the company in a a strong cash position for new businesses, which can reduce future dilution to shareholders.