Highlights

- Platina Resources’ (ASX:PGM) June quarter report outlines substantial developments at its scandium and gold projects.

- The company progressed earthworks at the Xanadu gold project for upcoming RC drilling.

- PGM completed aircore drilling at the Challa Gold project.

- The company also progressed master alloy development and permitting programs for its Platina Scandium Project.

Australian explorer Platina Resources Limited (ASX:PGM) actively progressed with top-notch development activities across its extensive project portfolio during the June 2022 quarter.

The period saw PGM undertaking an array of developments focused on planning and advancing further activities on its Xanadu and Challa gold projects. Meanwhile, the company made serious strides to unlock the value of its Platina Scandium Project.

At the quarter-end, PGM held AU$1.2 million in cash and AU$4.2 million in investments.

Let us look at the company’s progress during the last quarter ended 30 June 2022.

PGM gears up for drilling at Xanadu Gold Project

PGM secured all statutory approvals for drilling at its Xanadu Gold Project. The company looks to soon conclude a cultural heritage survey of the proposed reverse circulation drill pad sites. This further enables the company to initiate drilling in late August 2022.

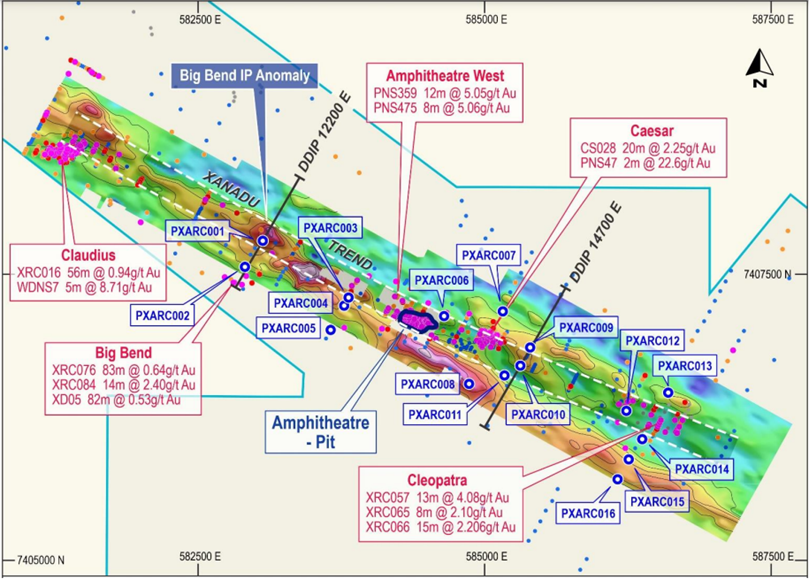

The company plans to undertake a 4,000m Phase 1 RC drilling program to follow-up on results from the 2021 geophysics program, which identified multiple anomalies for drill testing.

Multiple chargeable anomalies were identified along the target area that represents sulphides with associated gold mineralisation. Further details have also been provided confirming the chargeable targets along this linear zone through the follow-up dipole–dipole IP surveying.

Source: PGM Announcement 29/07/2022

PGM has also wrapped up a reprocessing of airborne electromagnetics (AEM) data over the wider project area.

Moreover, the company has enhanced understanding of the structures and host rocks that offer confidence to identify drill targets with potential for gold – sulphide mineralisation at depth.

AC drilling at Challa Gold Project

The quarter saw PGM securing all statutory approvals and concluding a cultural heritage survey at the Challa Gold Project.

The company wrapped up maiden 2,398m AC drilling after the June quarter, aimed to test some of the targets identified through the extensive soil testing program. The assay results are expected in September 2022.

PGM has planned additional drilling to test other soil anomalies.

Source: PGM

Unlocking value at Platina Scandium Project

In light of the recent trends to minimise the western world’s reliance on China for scandium minerals, there has been a notable interest in the advancement of scandium projects. In response to these developments, several significant global mining industry players are advancing new scandium production facilities.

During the quarter, PGM undertook initiatives to unravel the value of its world-class Platina Scandium Project. These initiatives included progressing the master alloy development program at Swinburne University as well as advancing key aspects of the permitting activities needed to secure a Mining Licence.

Source: PGM

The quarter saw testwork for developing an aluminium scandium master alloy production process. PGM believes that the results will support optimising the process conditions.

Notably, the company has attained scandia conversion of up to 100%. Moreover, the scale of experiments has been increased ten times. The scaling up increased process consistency and confidence for a commercial process.

PGM plans to kick off a new phase of testwork during the first quarter of FY2023, which, if successful, could help in reducing the total cost of producing a master alloy.

The company intends to produce a premium value-added product directly saleable to the market by developing an exclusive process for comparatively low capital and operating cost operation.

PGM is also continuing a stakeholder engagement program that was initiated during the June quarter. This program forms part of the company’s renewed focus on securing operating permits at both Condobolin and the Red Heart Mine site.

Exploration licence application for Mt Narryer South

PGM is committed to securing an exploration licence (EL), E 09/2423, at Mt Narryer South. The company reduced the size of the tenement application during the quarter to exclude a small part covering the state forest.

Moreover, PGM has applied for a new EL, E09/2704, overlapping and expanding the area of the initial application to cover the potential rejection of the application.

PGM shares traded at AU$0.032 on 29 July 2022.