Highlights

- Platina Resources Limited (ASX:PGM) is making serious strides to position itself as a significant gold player.

- The consumption of bullion is anticipated to rise ~6.1% in 2022 due to robust investment demand.

- The company has kicked off aircore drilling at the Challa Project to test soil anomalies.

Platina Resources Limited (ASX:PGM) is going full steam ahead across its Challa Gold Project amid increasing demand for the yellow metal as an inflation-hedge asset due to the ongoing turmoil between Russia and Ukraine.

As per the June 2022 edition of the Australian government’s Resources and Energy Quarterly, worldwide demand for gold accelerated 34% year-on-year to 1,234 tonnes in the March 2022 quarter. Moreover, gold consumption is expected to grow 6.1% globally to 4,265 tonnes in 2022, largely driven by stronger investment demand.

With the demand for the precious metal to trend up in the near term, Platina Resources is making significant moves to position itself as a major gold player in the tier 1 mining jurisdiction of Western Australia.

Currently, the miner holds two gold projects in its strong portfolio – the Xanadu gold project, which is located in the Ashburton Basin, and the Challa Gold Project, which sits within the gold districts of Mt Magnet and Sandstone.

Challa Project offers significant opportunities

Platina acquired 100% interest in the highly prospective Challa Gold Project in 2020. The project covers an area of nearly 293 sq. km and is located 500km northeast of Perth.

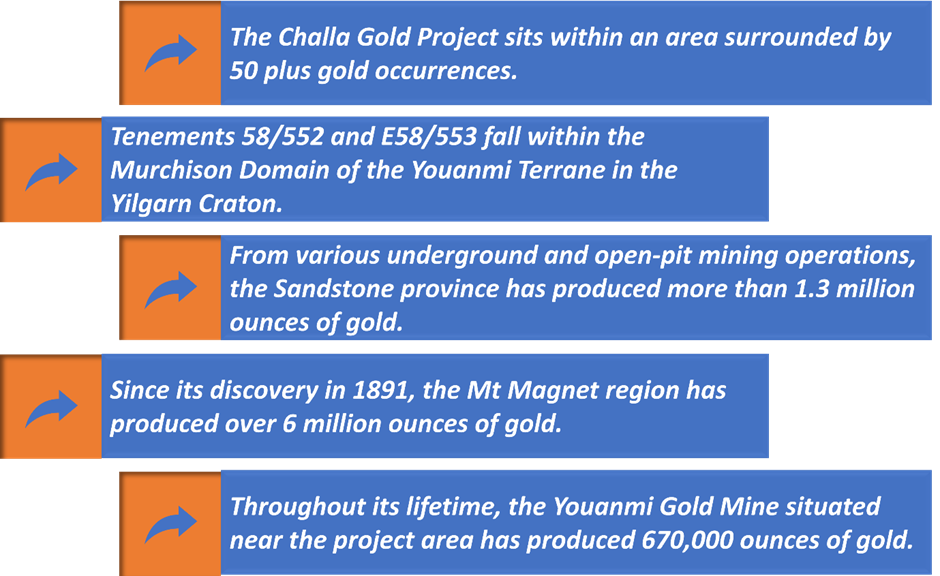

Rich history of gold production (Source: company updates)

Evolution of Challa Project

In June 2020, PGM entered into a conditional agreement to acquire a 100% interest in the Challa Gold Project. The project lies in between two prolific gold districts, including Mt Magnet and Sandstone.

- Following the successful completion of the project acquisition in August 2020, PGM decided to commence exploration activities at the project location. To define and test primary targets, the company planned soil geochemistry and a low-cost Rotary Air Blast drilling program.

- In the last quarter of 2020, Platina completed its first reconnaissance field trip to the project, which revealed a broad zone of low-level gold anomalism in transported soils surrounding mineralised outcropping veins. The program resulted in gold grades of 1.62g/t and 5.89 g/t in rock chip samples.

- The company also assessed logical requirements for the next major phase of exploration, including further soil sampling and aircore drilling.

- Later in 2020, the company updated that a major soil sampling program at the project indicated that future exploration may be potentially less costly than first budgeted. This program targeted broader areas around mineralised outcropping veins previously identified in the October reconnaissance program.

Platina kicks off maiden drilling at Challa

In July 2022, PGM kicked off an aircore drilling program, comprising around 60 holes for 3,500 metres in total, at the project. The company looks to identify targets below ubiquitous-transported sheet wash soils covering most of the tenements.

PGM remains optimistic to identify drill targets under its latest exploration strategy as the project is located within a prolific gold-producing region, including proximal gold projects at Mt Magnet, Sandstone and Youanmi. The company sees the project as a significant opportunity.

Platina Resources’ shares were trading at AU$0.026 midday on 15 July 2022.