Highlights

- Invictus Energy Limited (ASX:IVZ) has granted Cluff Energy Africa’s (CEA) request to extend its farm-in option expiry for the Cabora Bassa Project.

- The latest agreed expiry for CEA to exercise its option has been extended to 30 April 2022, from 31 March.

- The additional time will allow CEA to assess the extended SG 4571 area and finalise additional funding requirements related to the upcoming drilling campaign.

Invictus Energy Limited (ASX:IVZ) continues progressing the development of its 80% owned and operated Cabora Bassa Project in Zimbabwe. The Company has granted the extension of farm-in process for a 2-well exploration drilling campaign in the Cabora Bassa Project to Cluff Energy Africa’s (CEA).

Upon the release of this market update on the ASX, IVZ was trading up by over 1% at AU$0.18, mid-day on 31 March 2022.

Notably, in December 2021, Invictus executed the farm in option agreement with CEA, as per which CEA would fund 33.33% costs for a 25% interest in the Project and Invictus will remain its operator.

Farm-in option expiry extension

Granting CEA the request to extend the farm-in option expiry and submit an updated binding offer, Invictus seems to have taken a strategic decision.

©2022 Kalkine Media®

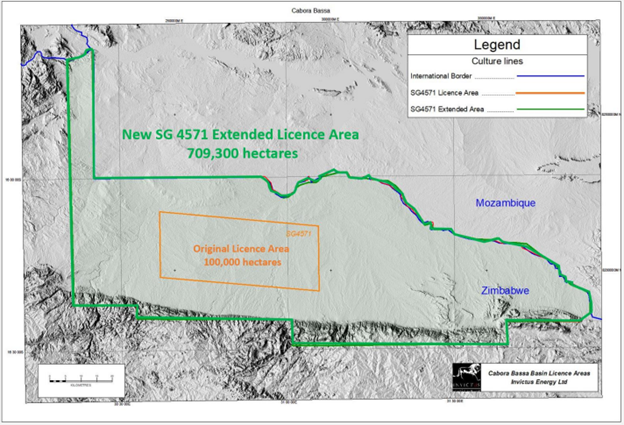

Now, the expiry for CEA to exercise its option has been furthered from 31 March 2022 to 30 April 2022. This extension follows the recent agreement with the Republic of Zimbabwe and Sovereign Wealth Fund of Zimbabwe (SWFZ) to increase the SG 4571 licence area from 100,000 to 709,300 hectares. Besides, it also coincides with the revised mobilisation date for Exalo’s Rig 202 from Tanzania. The rig is now likely to arrive at the Project in mid-June (previous estimates at the time of CEA option agreement were of early May).

Notably, the additional time will allow CEA to-

- Assess the extended SG 4571 area

- Finalise additional funding requirements associated with the drilling campaign and past costs.

SG 4571 expanded licence area map, Source- Company announcement, March 2022

MUST READ- Invictus Energy’s action-packed half-year report is here!

What next?

Invictus continues to progress the farm-in process and is in active discussions with multiple parties. Meanwhile, planning is underway to commence a 2-well drilling program in June. The Muzarabani-1 well is targeting 8.2 trillion cubic feet and 247 million barrels of conventional gas-condensate. The Muzarabani Prospect is an 8.2 TCF and liquids rich conventional gas-condensate target, believed to be potentially the largest, undrilled seismically defined structure onshore Africa.

Besides, the Company is also considering maturing additional prospectivity to drill a second well in the basin margin play. If successful, this could be transformational for Invictus and for the Republic of Zimbabwe.

In the days to come, Invictus and its local partner One Gas Resources (Pvt) Ltd are expected to amend the Invictus and One Gas Shareholders’ Agreement and terms of the One-Gas carried interest in the expanded SG 4571 licence.

Additionally, the proposed Petroleum Product Sharing Agreement (PPSA), that takes effect following commencement of the production phase of the Project, has undergone independent review, and is expected to be finalised and executed shortly.

All in all, the awaited maiden drilling program to test the world-class Muzarabani prospect seems to be coming together very well. The Cabora Bassa Project can prove to be a potential game changer for Zimbabwe.