Index Rebalancing

Index Rebalancing includes a thorough evaluation of the underlying stocks in the Index. Indices have methodologies that are required to be maintained. Sometimes, stocks can be included to index excluding the quarterly rebalance/periodical rebalancing, and this may be due to corporate action like a merger, delisting etc.

Index rebalancing allow the operator to add potential stocks to the index, that are eligible and remove the existing stocks that are not satisfying the methodology of the index. Besides, there could be several other reasons for the addition & removal of the constituents of the index.

More importantly, these stocks would have increased allocation from the asset management companies, which are running index funds benchmarking to ASX/S&P Indices.

On 6 September 2019, S&P Dow Jones Indices announced quarterly rebalancing, which would come into effect from 23 September 2019. Below are the stocks that are included in the major indices:

nib holdings limited (ASX: NHF)

nib holdings provide health insurance, medical insurance, and life insurance services in Australia. In addition, the group is also engaged in sales & distribution of travel insurance globally through its travel business.

On 6 September 2019, the stock of the group was added to the S&P/ASX 100 Index. Besides, NHF is a component of several indices, including S&P/ASX 200, All Ordinaries, S&P/ASX 200 Financials (Sector), S&P/ASX 300 Index and more.

Over the year-to-date period, the stock has delivered a return of +40.66%. Recently, during the last month period, the insurance group released full year results for the period ended 30 June 2019.

Reportedly, the revenue was up 9% to $2,461.2 million in FY2019 compared to the revenue of $2,267.7 million in FY2018. Net profit after tax was up 13% to $149.8 million for the period compared to a profit of $132.4 million in FY2018.

Meanwhile, nib holdings announced a fully franked dividend of 13 cents per share was announced payable on 30 September 2019. Subject to franking credit availability, the company is in a position to maintain a pay out ratio of 60% to 70% of earnings in future ordinary dividends, along with further capacity to pay special dividends as part of future capital management.

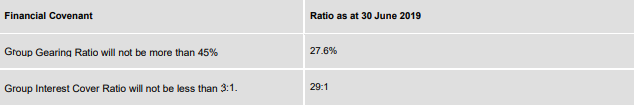

At year end, the balance sheet of the company was carrying retained profits of $498.9 million compared to $445.5 million at the previous year end. Besides, the company has maintained very healthy financial covenants with respect to existing secured credit.

More importantly, two of the secured credit facilities would mature in the next calendar year/FY2021, which include AUD $80.5 million variable rate loans with NAB maturing 31 October 2020, and NZD $70.0 million variable rate term loan facility with ANZ with a maturity date of 18 December 2020.

Financial Covenants (Source: nib Annual Report 2019)

On 6 September 2019, NHFâs stock last traded at A$7.18, down by 0.692% from the previous close.

Collins Foods Limited (ASX: CKF)

Restaurant Operator, Collins Foods operates, manages, and administers restaurants in Australia, Europe and Asia. It operates brands like KFC, Taco Bell and Sizzler in countries, including Germany, Netherlands, Thailand, China, Japan & Australia.

Starting on 23 September 2019, the stock of the company would be a part of S&P/ASX200. Currently, it constitutes to S&P/ASX 300, S&P/ASX All Australian 200, All Ordinaries, and S&P/ASX Small Ordinaries.

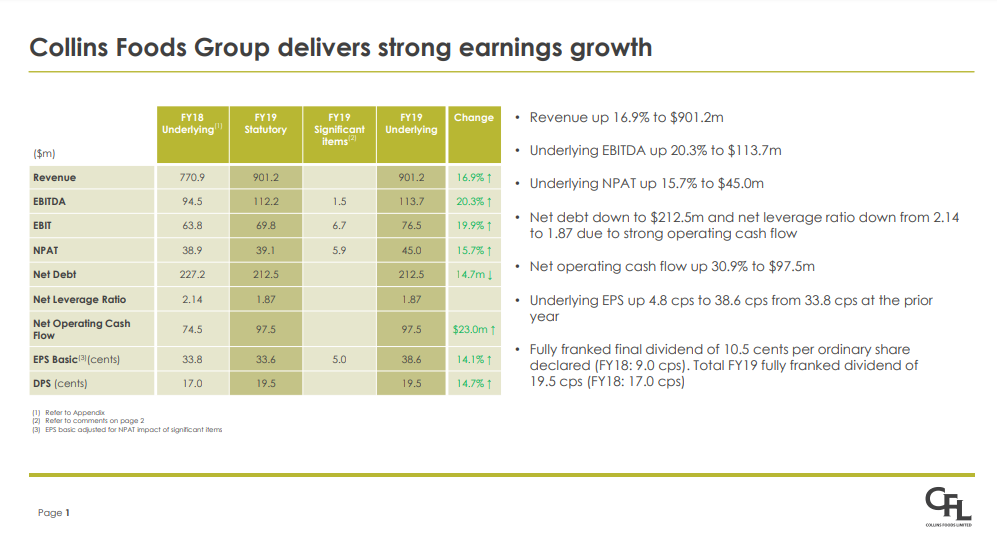

FY2019 Highlights (Source: CKF Results Presentation, June 2019)

In FY2019 report ended 28 April 2019, the company recorded revenue of $901.2 million compared to revenue of $770.9 million in the previous year. EBITDA for the period was at $112.2 million compared to $89.6 million. Meanwhile, NPAT for the period was $39.1 million in FY2019 compared to $32.5 million in FY2018.

On 6 September 2019, CKFâs stock last traded at A$8.58, down by 0.694% from the previous close. In the last one year, the stock has returned +51.85%, and its year-to-date stands at +43.76%.

Gold Road Resources Limited (ASX: GOR)

On 06 September 2019, S&P Dow Jones Indices announced that Gold Road Resources will be added to S&P/ASX200 starting from 23 September 2019.

Concurrently, the company released interim year results for the period ended 30 June 2019. Accordingly, the company has recorded a loss after tax of $16.9 million compared to restated loss of $7.7 million in HY 2018.

Meanwhile, the company had total current assets of $78 million at the end of half- year against total current assets of $58.8 million in the previous corresponding period. Besides, the company incurred capitalised expenditure of $15.6 million in mineral exploration and evaluation at the half-year end.

Upcoming Gold Producer (Source: GORâs Diggers & Dealers Presentation)

Further, the company is yet to generate revenue, and is progressing for commercial sales. Among all the expense incurred during the half-year period, Gold Road Resource incurred $9.4 million in fair value loss on derivatives. However, income tax benefit of $6.74 million helped to offset losses.

On 6 September 2019, GORâs stock last traded at A$1.36, down by 0.366% from the previous close. Over the year-to-date period, the stock has returned +105.26%.

Jumbo Interactive Limited (ASX: JIN)

Lotteries & Gaming Provider, Jumbo Interactive was also added to S&P/ASX200 index. Besides, the stock of the company is a constituent of S&P/ASX 300, All Ordinaries, and S&P/ASX Small Ordinaries.

In its full-year results ended 30 June 2019, the company has posted revenue of $65.21 million, up 64% from $39.77 million in FY2018. Besides, NPAT for the period was up 117.9% to $26.42 million against $12.12 million in the previous year.

Meanwhile, the company almost doubled the dividend payment in FY2019 with 36.5 cents of total dividend declared against 18.5 cents in the previous year. This includes the final fully franked dividend of 21.5 cents per share payable on 20 September 2019.

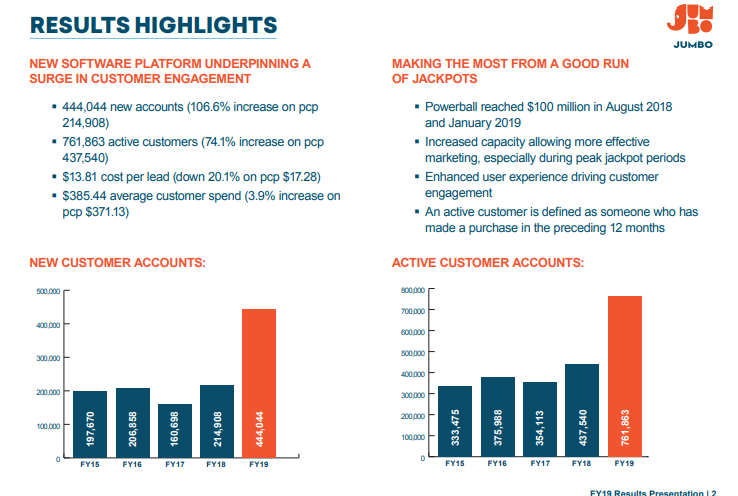

Highlights (Source: JIN Full Year Results Presentation)

In FY2019, the company had focused customer delivery backed by the new software platform and increased large jackpot activity help to achieve resilient performance during the year. Between the reported twelve-months, new online accounts increased 106% to ~444k, and active customers increased 74% to ~761k.

On 6 September 2019, JINâs stock last traded at A$24.99, up by 6.795% from the previous close. Over the year-to-date period, the stock has returned +221.23%.

Netwealth Group Limited (ASX: NWL)

Platform Provider, Netwealth Group provides a range of financial services to financial intermediaries, including managed funds, portfolio services, superannuation master fund, separately managed accounts, and self-managed superannuation administration services.

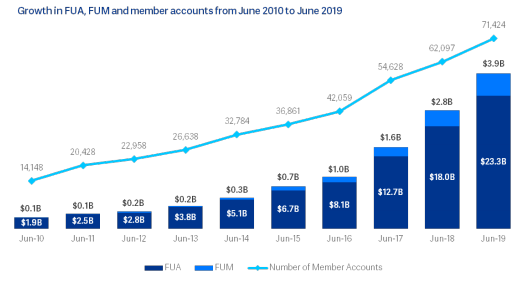

On 6 September 2019, Netwealth was also in the list of the stocks to be added to S&P/ASX 200 index. Recently, in August this year, the company released full-year results for the period ended 30 June 2019. The revenue was $98.77 million, up 18.6% over the revenue of $83.26 million in the previous year.

Reportedly, the net profit after tax was up 64.7% at $34.29 million during the period compared to a profit of $20.81 million in FY2019. In FY2019, the company continued its investment in platform technology and functionality, and this was attributed to several enhancements.

(Source: NWLâs 2019 Annual Report)

Besides, Netwealth introduced a new web portal for clients and advisors, added to annuities to the platform coupled with reporting suite improvements. Meanwhile, the company has a dedicated Legal, Risk and Compliance division to maintain highest standard.

On 6 September 2019, NWL was trading at A$8.235, up by 3.585% from the previous close.

PolyNovo Limited (ASX: PNV)

Medical Device Developer, PolyNovo uses proprietary medical grade polymers that are utilised to manufacture medical devices. Its flagship device NovoSorb is covered by 47 patents, all under the name of PolyNovo.

PolyNovo is the only company from Health Care sector in this quarterly rebalancing, which will be part of S&P/ASX200 starting from 23 September 2019.

In FY 2019 (ended 30 June 2019), the total revenue of the company was $13.68 million compared to revenue of $5.98 million in the previous year.

FY20 Strategy (Source: PNVâs Full Year Presentation

Reportedly, the company narrowed its losses to $3.19 million for the period compared to a loss of $5.97 million in FY2018. The company was carrying no debt in the balance sheet at the year end and is targeting a potential breakeven in FY20.

On 6 September 2019, PNVâs stock last traded at A$2.16, down by 3.139% from the previous close. In terms of returns, the stock has recorded a return of +271.67% over the year-to-date period.

Silver Lake Resources Limited (ASX: SLR)

Gold Copper Developer, Silver Lake Resource is engaged in the exploration, evaluation, development, production and sales of gold & copper in Australia.

Stock of Silver Lake will be admitted to S&P/ASX 200 index, starting from 23 September 2019. Besides, it is a component of S&P/ASX Emerging Companies Index, S&P/ASX All Australian 200, S&P/ASX All Ordinaries Gold (Sub Industry), S&P/ASX 300 Metals and Mining (Industry) and more.

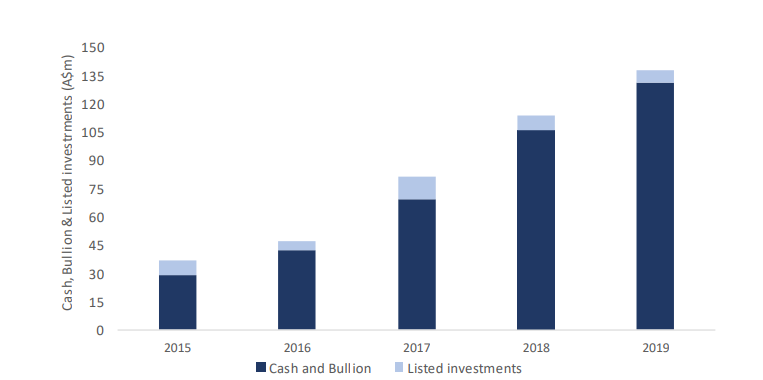

Cash & Bullion Growth (Source: SLRâs Full Year Announcement)

Recently, Silver Lake had disclosed full-year results for the period ended 30 June 2019. Accordingly, the revenue of the company was up 18% to $301.51 million compared to a revenue of $255.57 million. During FY 2019 period, SLR merged with Doray Minerals Limited (ASX:DRM), which resulted in 5 mines and 2 processing facilities.

Reportedly, the average realised gold sale price of the period was A$1,754/oz compared to an average realised sale price of A$1,684/oz.

The net profit after tax for the period was $6.5 million compared to $16.2 million in the previous year. The fall in net profit was primarily due to acquisition-related costs of $8.675 million.

On 6 September 2019, SLRâs stock last traded at A$1.05, down by 1.869% from the previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.