Highlights

- Wisr recorded a 2.07% YoY increase in revenue, reaching AUD 93.80 million in FY24, driven by improved yield metrics.

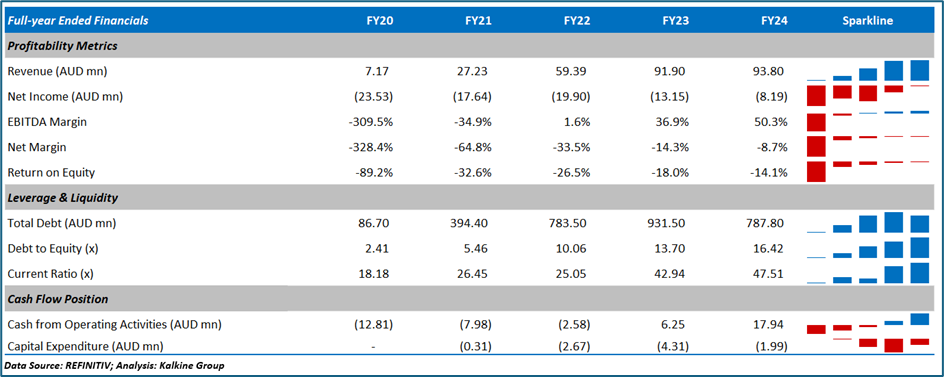

- Cash from operating activities rose from AUD 12.81 million in FY20 to AUD 17.94 million in FY24.

- The company aims for 75% loan origination growth and plans to enhance its technology platform and customer acquisition strategies.

Wisr Limited (ASX:WZR) is a neo-lender within Australia’s financial landscape, offering personal loans and securing vehicle loans for three, five and seven-year maturities. These loans are funded through the warehousing funding structures.

In the financial year 2024 (FY24), the company recorded 2.07% YoY rise in revenue to AUD 93.80 million, driven by improved yield metrics, partially offset by a decrease in the loan books.

The company reported noteworthy financial progress over the five years. Revenue increased from AUD 7.17 million in FY20 to AUD 93.80 million in FY24, and net loss decreased from AUD 23.53 million in FY20 to AUD 8.19 million in FY24.

In FY24, the company implemented strategic cost management which resulted in 19% YoY drop in opex and taking cost-to-income ratio to 28% from 36% in FY23.

Outlook

In FY25, the company intends to focus on sustainable growth, supported by the continuous expansion of its loan book and enhancements in profitability. The company is expected to deliver annual loan origination growth of 75% in FY25.

To increase market share, WZR intends to further improve its technology platform and customer acquisition strategies.

Share performance of WZR

WZR shares closed at AUD 0.029 apiece on 15 October 2024. In the last nine months, WZR’s share price has dropped by almost 29.27%, and in the past one month, it has increased by almost 7.41%.

52-week high of WZR is AUD 0.051, recorded on 5 January 2024, while 52-week low is AUD 0.019, recorded on 5 December 2023.

WZR Daily Technical Chart, Source: REFINITIV

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 15 October 2024. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.