Highlights

- Wisr is an ASX-listed neo-lender that mainly caters to Australian customers.

- In FY23, the company reported a 55% YoY rise in operating revenue and 19% YoY growth in loan book.

- The company is focused on NIM expansion and maintaining a strong balance sheet.

Wisr Limited (ASX:WZR) is an Australia-based neo-lender which offers a collection of financial services and products. Its prime operations include writing personal loans, securing vehicle loans for different maturities and funding these loans via a warehouse funding structure. The company has a Financial Wellness Platform, the Wisr App.

In the financial year 2023 (FY23), the company registered a 55% YoY jump in operating revenue to AUD 91.9 million, underpinned by 19% growth in loan book in a year and improved yield on new loan originations. The period also saw improvement in operational leverage as its loss before income tax decreased by 34% YoY to AUD 13.15 million.

Financing costs increased by 146% YoY in FY23 due to increased funding costs and loan book growth.

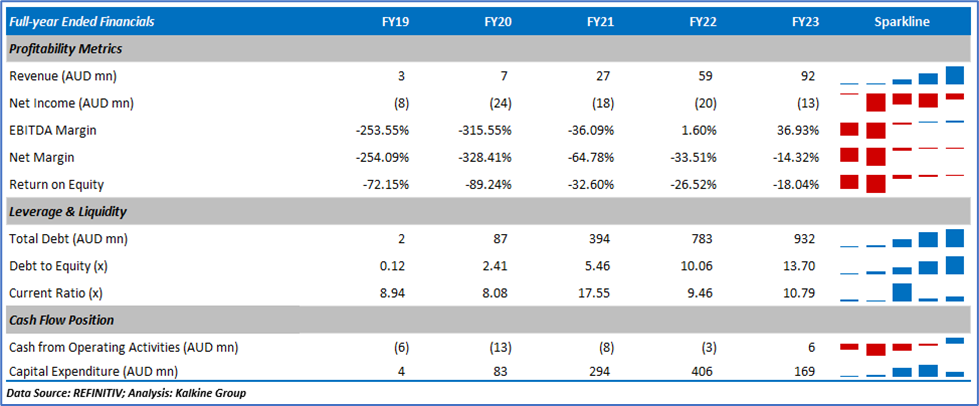

Here’s the historical financial trend of WZR.

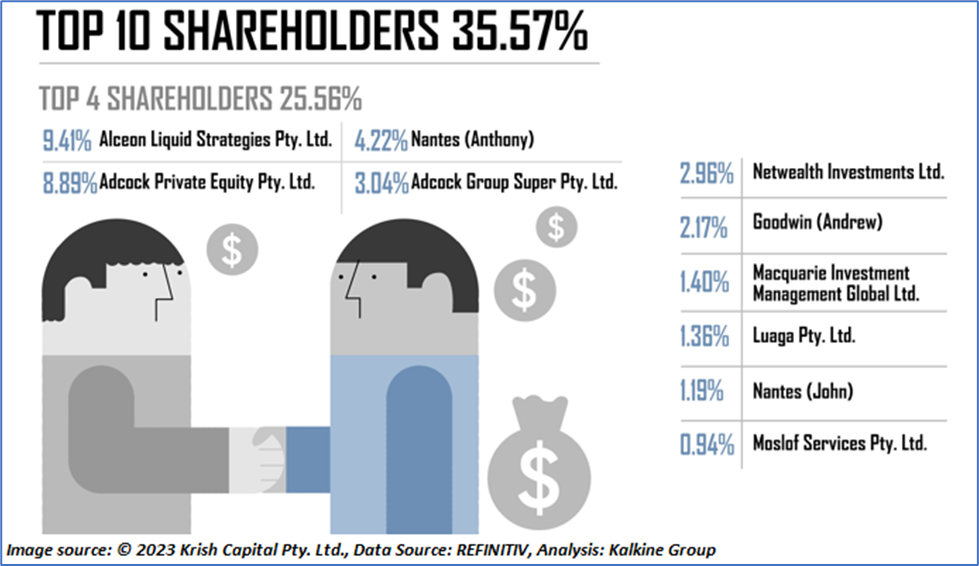

Top 10 shareholders of WZR

The top 10 shareholders of WZR have almost 35.57% shareholding in the company, while the top four have 25.56% shareholding. Alceon Liquid Strategies Pty. Ltd. and Adcock Private Equity Pty. Ltd. Have the highest stake in the firm, with a shareholding of ~9.41% and ~8.89%, respectively.

Recent business update

Through an ASX update dated 13 September 2023, the company informed that Matthew Brown, its director, has increased his stake in the firm as it bought over 1.18 million shares for the consideration of AUD 39,634 on 7 September 2023.

Outlook

The company is committed to maintaining a strong balance sheet and focusing on NIM expansion to deliver profitability.

WZR believes that its capital management strategy will assist in managing the present macroeconomic environment, and the business has measures in place to scale its loan origination volume with the improvement in macroeconomic conditions.

Share performance of WZR

WZR shares closed 3.03% down at AUD 0.032 apiece on 19 September 2023. With this, the share price has recorded a fall of 51.51% in the last nine months and a fall of 8.57% in the last one week.

The 52-week high of WZR is AUD 0.081 apiece, recorded on 17 November 2022, which is almost 60.49% lower than today’s closing price. While the 52-week low is AUD 0.028 apiece, recorded on 24 August 2023.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 19 September 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.

_09_22_2023_05_08_17_513673.png)