Highlights

- Stanmore Resources is an ASX-listed metallurgical coal producer

- In FY23, the company witnessed 7% YoY rise in its revenue and 23.8% YoY fall in the underlying EBITDA

- Golden Energy and Resources Ltd has the highest stake in the firm with a shareholding of nearly 59.01%

Stanmore Resources Limited (ASX: SMR) is an Australia based resource company with operations and exploration assets located in the Bowen and Surat basins. The company manages and oversees the Isaac Plains Complex, South Walker Creek, and Poitrel metallurgical coal mines, along with the undeveloped Wards Well, Isaac Plains underground, and Isaac Plains South projects, all situated in Queensland's prominent Bowen Basin area.

In the financial year ended 31 December 2023 (FY23), revenue of SMR increased by 4% YoY to USD 2,807 million, backed by increase in sales volume. The period saw a 23.8% YoY drop in the underlying EBITDA to USD 1,110 million and cash flow from operations decreased by 35.1% YoY to USD 472 million. Lower EBITDA in FY23 was driven by increased operating costs in 1QFY23 due to adverse weather events.

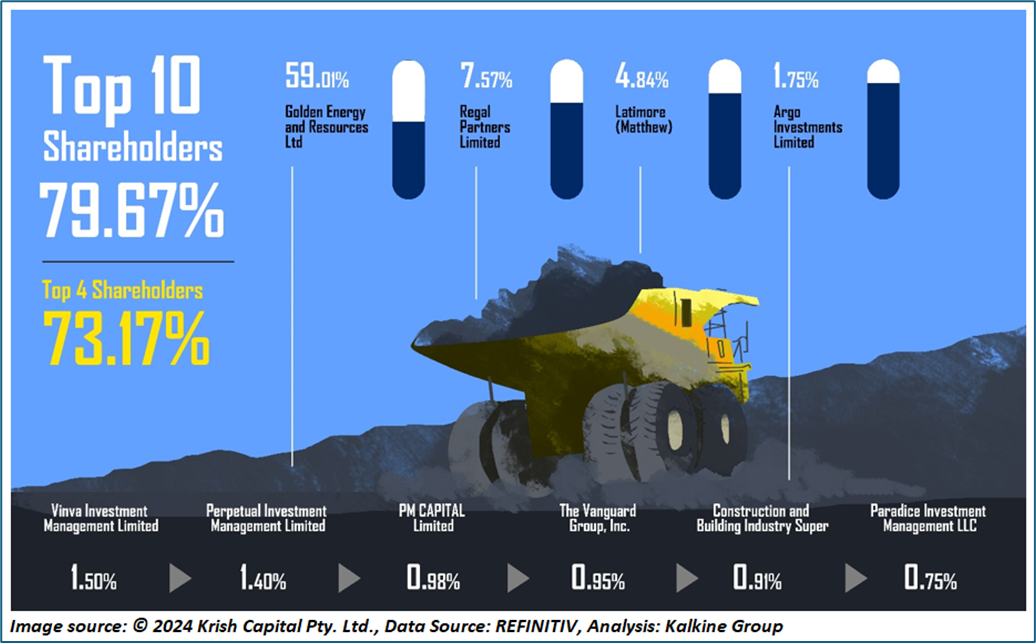

Top 10 shareholders of SMR

The top 10 shareholders of SMR have ~79.67% shareholding in the firm, while the top four have 73.17%shareholding. Golden Energy and Resources Ltd and Regal Partners Limited hold maximum stake in the company with a shareholding of ~59.01% and ~7.57%, respectively.

Recent business update

On 23 April 2024, the company released quarterly results for the quarter ended 31 March 2024. During the three months period, the run of mine production was 4.6mt, saleable production stood at 3.3Mt and total coal sales were 3.4Mt, meeting the annual guidance range.

As of 31 March 2024, consolidated cash holding stood at USD 313 million and net cash holding stood at USD 86 million.

The firm inked a binding agreement to buy a 50% stake in the Eagle Downs Metallurgical Coal Joint Venture Project and 100% interest of Eagle Downs Coal Management Pty Ltd from ASX-listed company South32.

Outlook

With the acquisition of Eagle Downs project, the firm expects to enhance its infrastructure, logistics portfolio and technical capabilities, to unlock asset value to full potential.

In FY24, SMR expects its saleable coal production to fall in the range of 12.8 – 13.6Mt across all its projects, while FOB cost is anticipated in the range of USD 99-100/tonne sold.

Revised capital expenditure of USD 165-185 million is expected in FY24 due to FX movement and inclusion of the Millenium Complex capital expenditure.

Share performance of SMR

SMR shares closed 2.140% higher at AUD 3.340 apiece on 30 April 2024 with a market cap of AUD 2.94 billion. In the last one year, SMR’s share price has increased by 10.73%, and in the last three months it has dropped by 15.44%.

The 52-week high of SMR is AUD 4.22, recorded on 22 January 2024, while the 52-week low is AUD 2.371, recorded on11 July 2023.

SMR Daily Technical Chart, Source: REFINITIV

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 30 April 2024. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.