Highlights

- Seven West Media operates in content production across publishing, digital, and television platforms

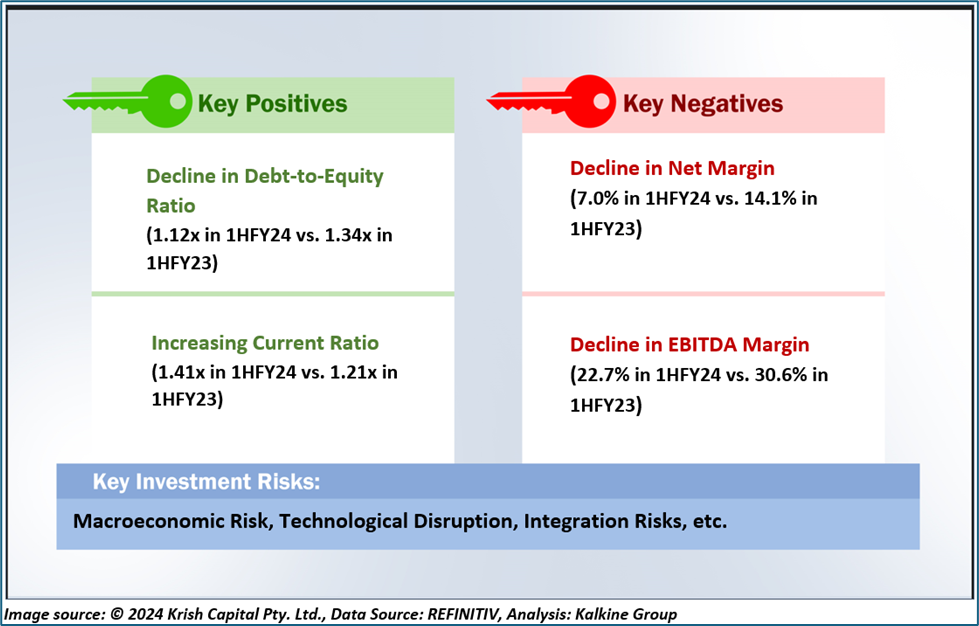

- In 1HFY24, SWM experienced a 5% YoY decline in total revenue, with profit after tax dropping by 53% YoY

- Seven Group Holdings Limited holds the largest stake in SWM, with a shareholding of 40.20%

Seven West Media Limited (ASX:SWM) is an Australian integrated media company with a presence in content production. Its media portfolio includes Seven Network and its associated channels.

The ASX-listed media company recorded a 5% YoY fall in revenue to AUD 775 million in the first half of the financial year 2024 (1HFY24) ended 31 December 2023. Meanwhile, profit after tax decreased by 53% YoY to AUD 54 million. During 1HFY24, the total TV market fell by 9% YoY, and in 2QFY24, the market demand was softer than expected. The revenue decline reflects a weaker advertising market, partly offset by a 1.7 percentage point increase in TV market share, reaching 41%.

As of 31 December 2023, net debt stood at AUD 257 million, compared to AUD 249 million as of 30 June 2023.

Top 10 shareholders of SWM

The top 10 shareholders collectively hold 65.09% of the company. The highest stake is held by Seven Group Holdings Limited with a shareholding of 40.20%.

Recent business update

In a company update dated 16 February 2024, SWM announced an investment of AUD 5.25 million in Mad Paws via a share placement, securing 10.8% stake.

Outlook

In FY24, SWM targets a revenue share exceeding 40%. The company anticipates an improvement in advertising market conditions in 3QFY24 compared to 1HFY24. Moreover, in 3Q, the BVOD (broadcaster video on demand) market is anticipated to maintain double-digit growth.

In the second half of FY24, costs are expected to decrease by nearly 4% over the previous corresponding period.

Share performance of SWM

SWM shares closed 2.702% higher at AUD 0.190 apiece on 5 April 2024 with a market capitalisation of AUD 284.74 million. Over the past year, SWM’s share price has declined by 54.76%, and in the last three months, it has fallen by 26.92%.

The 52-week high of SWM is AUD 0.430, recorded on 3 April 2023, while the 52-week low is AUD 0.18, recorded on 4 April 2024.

SWM Daily Technical Chart, Source: REFINITIV

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 05 April 2024. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.