Highlights

- ResMed offers cloud-connected medical devices and digital health technologies

- RMD intends to expand its geographical presence and undertake product development and innovation initiatives

- First Sentier Investors (Hong Kong) Limited have the highest stake in the firm with the shareholding of approximately 1.65%

ResMed Inc. (ASX:RMD) is a medical device manufacturing company that provides cloud-connected medical devices and digital health technologies. These medical device caters to the needs of people with chronic obstructive pulmonary disease, sleep apnea and other chronic diseases.

The sleep and related respiratory care market is underpenetrated globally, and therefore, RMD is focused on tapping opportunities and expanding its operations in this segment.

The company is present in 140 countries and is undertaking initiatives to boost its sales and marketing efforts while expanding its presence in other locations.

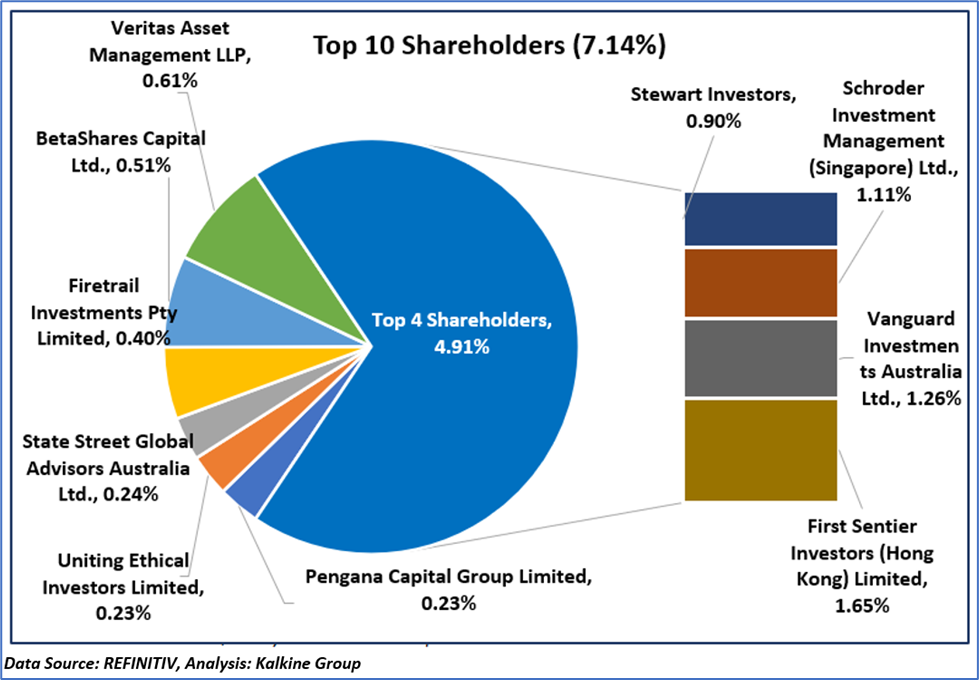

Top10 shareholders of RMD

The top 10 shareholders of RMD together have around 7.14% shareholding of the company, while the top 4 shareholders have nearly 4.91% stake. First Sentier Investors (Hong Kong) Limited and Vanguard Investments Australia Ltd. have the highest holding in the company, with stakes of ~1.65% and ~1.26%, respectively.

Recent business update

Through a significant recent update, dated 4 August 2023, the company announced quarterly results for the period ending on 30 June 2023. During the reported period, revenue increased by 23% on pcp (previous corresponding period), while income from operations surged by 8% on pcp. During the quarter, the company paid dividend of USD 64.7 million.

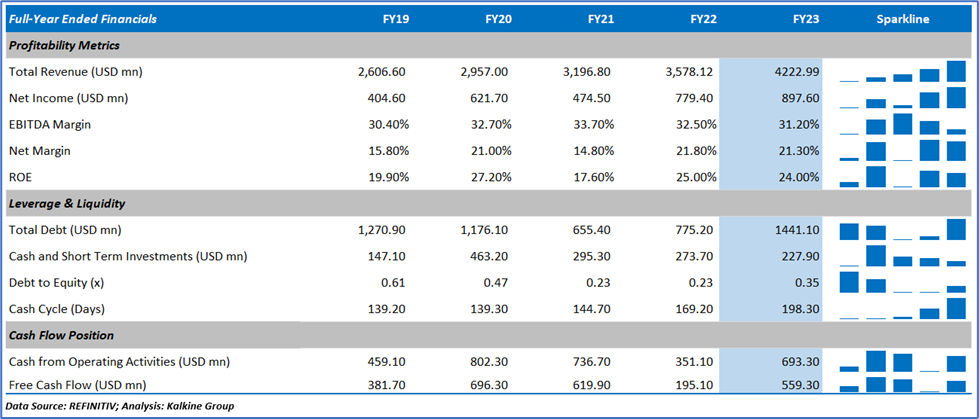

Financial insights

In the financial year 2023 (FY23), RMD registered double-digit growth in income and revenue, surging by 15.15% and 18.02% on pcp, respectively. The demand for cloud-connected flow generator devices and patient interface and software solutions underpinned the yearly revenue and income surge.

The period saw investment in product enhancement and research and development.

Here’s the historical financial trend of RMD.

Outlook

RMD is focused on expanding its geographical presence, new clinical applications, SaaS solutions in out-of-hospital care settings and cloud-based patient engagement and management platforms.

Also, the company intends to continuously take product development and innovation initiatives in sleep apnea and respiratory care products.

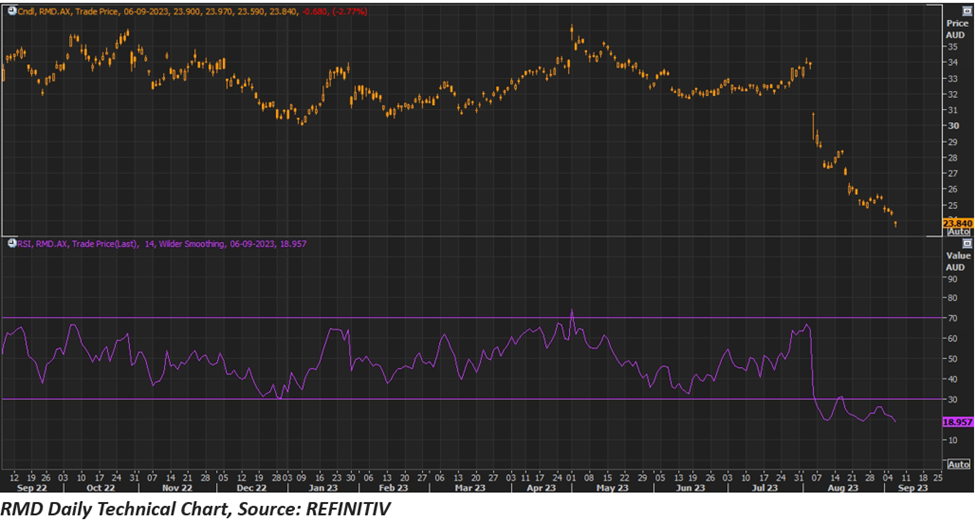

Share performance of RMD

Shares of ResMed closed 2.77% down at AUD 23.84 apiece on 6 September 2023. Including this, the RMD share price dropped by 28.28% in the last three months, and on a year-to-date basis, it has declined by almost 23%.

The 52-week high of RMD is AUD 36.37 apiece, recorded on 1 May 2023, and the 52-week low is AUD 24.36 apiece, recorded on 5 September 2023. Worth mentioning here is that the existing share price is 34.45% lower than its 52-week high.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 6 September 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.