Highlights

- Mesoblast posted a 6.85% YoY revenue decline to USD 3.16 million in 1HFY25 and a significantly widened net loss to USD 47.93 million.

- Despite a sharp YoY drop in cash reserves to USD 38.03 million, the company ended the March 2025 quarter with USD 182 million in cash after raising AUD 260 million through a global private placement.

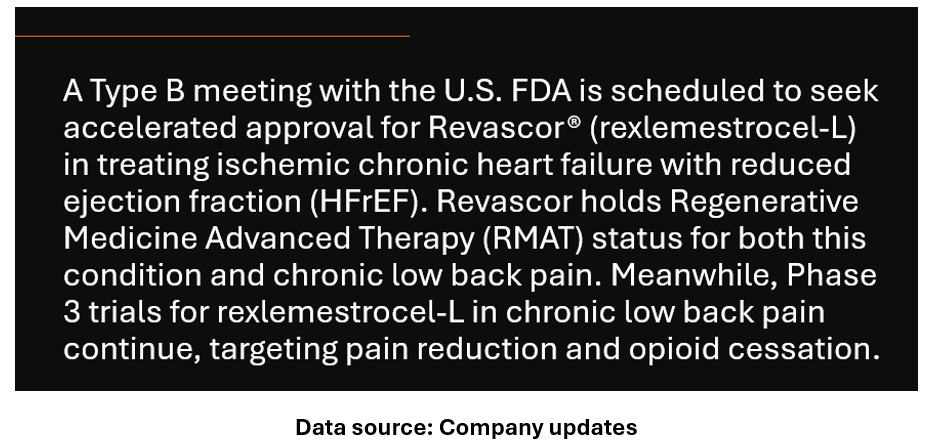

- Mesoblast launched RYONCIL® in the U.S. for pediatric aGVHD in March 2025 and is actively seeking FDA accelerated approval for Revascor®.

Global biotechnology company Mesoblast Limited (ASX:MSB; NASDAQ:MESO) is a pioneer in allogeneic (off-the-shelf) cellular medicines and continues to make strides in the treatment of severe and life-threatening inflammatory diseases despite facing financial headwinds.

Financial Performance

For the half-year ended 31 December 2024 (1HFY25), Mesoblast reported a 6.85% YoY drop in revenue to USD 3.16 million from USD 3.39 million in the prior corresponding period.

The company posted a net loss after tax of USD 47.93 million in 1HFY25, widening a loss of USD 32.54 million in the previous corresponding period. This was largely driven by non-cash share-based expenses, impairments linked to RYONCIL approval, and accounting adjustments related to a previously settled shareholder class action—costs fully covered by insurance.

Cash and cash equivalents declined sharply by 51% YoY to USD 38.03 million, down from USD 77.55 million a year earlier.

Business Update

In its latest quarterly update (as of 30 April 2025), Mesoblast disclosed a net cash outflow of USD 12.7 million, ending the March quarter with USD 182 million in cash. This improved position came after the company successfully raised AUD 260 million (USD 161 million) via a global private placement.

A significant commercial milestone was achieved with the U.S. launch of RYONCIL®, a treatment for acute graft-versus-host disease (aGVHD) in children. The therapy became commercially available in the U.S. on 28 March 2025 and is now covered by Federal Medicaid, improving accessibility to life-saving care.

Outlook

Share performance of MSB

MSB shares closed 2.18% lower at AUD 1.795 per share on 30 April 2025. Over the past one year, MSB’s share price has jumped almost 81.31% and has recorded a drop of 41.15% in the last three months.

52-week high of MSB is AUD 3.37, recorded on 2 January 2025 and 52-week low is AUD 0.88, recorded on 6 August 2024.

Support and Resistance Summary

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 30 April 2025. The reference data in this report has been partly sourced from REFINITIV.

Technical Indicators Defined:

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.