Highlights

- In FY24, revenue of MDR stood at AUD 122.10 million, up from AUD 98 million in FY23

- As of 20 September 2024, cash on hand was AUD 12.3 million, up 25.5% YoY

- Perennial Value Management Limited increased its stake in MDR to 11.91% as of 20 November 2024

MedAdvisor Limited (ASX:MDR) focuses on pharmacy-led patient engagement, offering tailored solutions to enhance medication management and health outcomes. The company supports over 33,500 pharmacies in the US and over 95% of Australian pharmacies.

In the financial year 2024 (FY24), the company recorded total revenue of AUD 122.10 million, compared to AUD 98 million in FY23, supported by higher sales across regions.

In the first quarter of FY25, revenue increased by 3.54% YoY to AUD 26.30 million, driven by growth in the Australia/New Zealand and United States markets. As of 20 September 2024, MDR’s cash on hand stood at AUD 12.3 million, reflecting a rise of 25.5% YoY.

Outlook

The second quarter of FY25 is expected to be supported by a pipeline of opportunities especially during the key selling season in the US, with a focus on the rollout of new initiatives and vaccine programs.

In FY25, the company expects to make significant advancements with Transformation 360 and to execute its growth strategy, as mentioned at the close of FY24.

Rise in shareholders’ interest in MDR

Through an ASX update, the company notified that Perennial Value Management Limited has increased holdings in the company to 11.91% from 10.40% as of 20 November 2024.

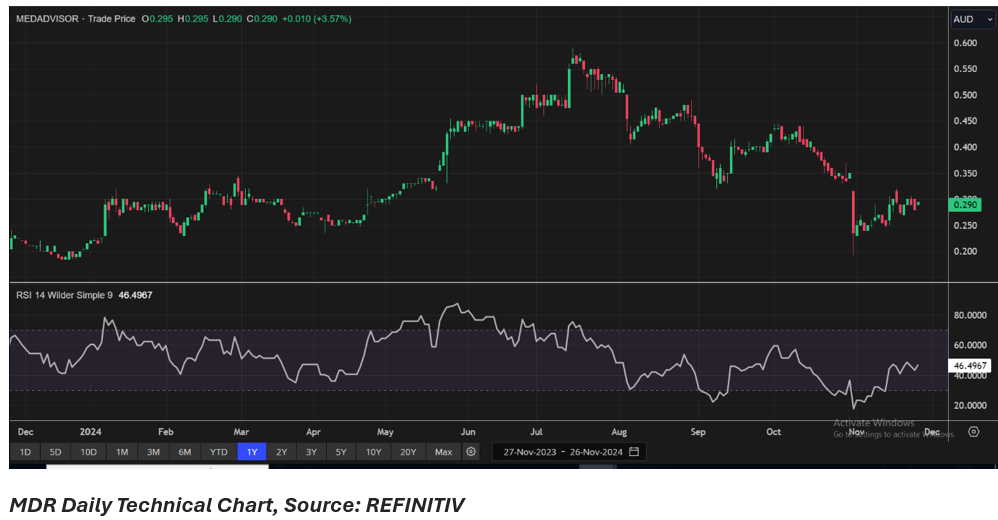

Share Performance of MDR

MDR shares closed 3.57% higher at AUD 0.29 apiece on 26 November 2024. In the past one year, MDR’s share price has recorded a gain of 28.89% and in three months, the share price has dropped by 39.58%.

52-week high of MDR is AUD 0.59, recorded on 15 July 2024 and 52-week low is AUD 0.185, recorded on 22 December 2023.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 26 November 2024. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.