Highlights

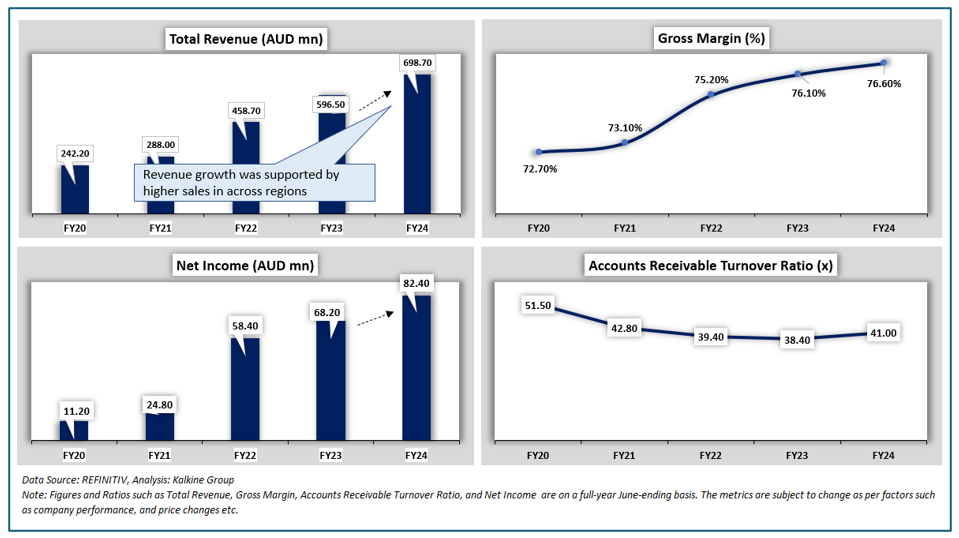

- In FY24, LOV’s revenue rose 17.14% YoY to AUD 698.66 million, with strong sales across global regions.

- Net profit attributable to owners in FY24 increased by 20.90% YoY to AUD 82.41 million.

- Pinnacle Investment Management raised its stake in Lovisa to 6.11% as on 21 October 2024.

Lovisa Holdings Limited (ASX:LOV) is an ASX-listed retailer primarily engaged in fast fashion jewellery and accessories for women. In the financial year 2024 (FY24), the company recorded a 17.14% YoY increase in revenue to AUD 698.66 million, driven by higher sales across Asia, Australia/New Zealand, Africa/Middle East, Americas, and Europe regions. Meanwhile, profit attributable to owners of the company increased by 20.90% YoY to AUD 82.41 million. Gross profit grew by 18.7% YoY to AUD 565.79 million.

Over the last five years, LOV’s revenue has increased from AUD 242.20 million in FY20 to AUD 698.70 million in FY24. Net income grew from AUD 11.20 million in FY20 to AUD 82.40 million.

Increasing Interest of Shareholders

In an ASX update dated 24 October 2024, the company announced that Pinnacle Investment Management Group Limited and its associated entities had increased their shareholding in the firm from 5.01% to 6.11% as on 21 October 2024.

Outlook

The focus is on expanding digital and physical store networks. The company informed that effective structures are in place to drive growth in current and new markets and store rollouts is anticipated to continue.

Share Performance of LOV

LOV shares closed 0.69% lower at AUD 27.16 apiece on 20 November 2024. Over the past year, LOV's share price has increased by 48.74%, while in the last three months, it has declined by nearly 25.32%.

LOV's 52-week high is AUD 38.29, recorded on 26 August 2024, while its 52-week low is AUD 17.31, recorded on 22 November 2023.

LOV Daily Technical Chart, Source: REFINITIV

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 20 November 2024. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.