Highlights

- JHX’s Q3FY25 net income was down 15% YoY to USD 153.6 million.

- Strategic acquisition of AZEK expected to deliver USD 350 million in annual EBITDA synergies.

- Stock price of JHX dropped ~5.6% in the past month and ~28.8% over six months.

James Hardie Industries PLC (ASX:JHX) is a global supplier of fiber cement and fiber gypsum building materials. In the third quarter of fiscal year 2025 (3QFY25), James Hardie reported a 3% YoY drop in net sales to USD 953.3 million. This decline was largely attributed to reduced volumes in a weak multifamily segment. EBIT declined 9% YoY to USD 206.1 million, while adjusted net income fell sharply by 15% YoY to USD 153.6 million. Despite the decline, the company noted that share gains in single-family construction and remodeling, as well as price increases implemented in early 2024, helped soften the blow.

Recent business update

On 24 March 2025, JHX announced that it entered into a definitive agreement to acquire The AZEK company in a deal valued at USD 8.75 billion, inclusive of debt. Under the terms of the agreement, AZEK shareholders will receive USD 26.45 in cash and 1.0340 JHX shares per AZEK share, valuing the offer at USD 56.88—representing a 26% premium to AZEK’s 30-day volume-weighted average price (VWAP). Post-merger, James Hardie will own approximately 74% and AZEK shareholders will own 26% of the combined company.

Management anticipates the deal will generate at least USD 350 million in annual adjusted EBITDA synergies once fully realised.

Outlook

Looking ahead, the company remains cautiously optimistic. For FY25, North American volumes are expected to reach at least 2.95 billion standard feet, with an EBIT margin projected at no less than 29.3%. Adjusted net income is expected to exceed USD 635 million. Additionally, the company narrowed its capital expenditure forecast for the year to approximately USD 420 million, down slightly from the previous guidance range of USD 420 – USD 440 million.

The company is scheduled to release its fourth-quarter fiscal 2025 results before the Australian market opens on Wednesday, 21 May 2025.

Share performance of JHX

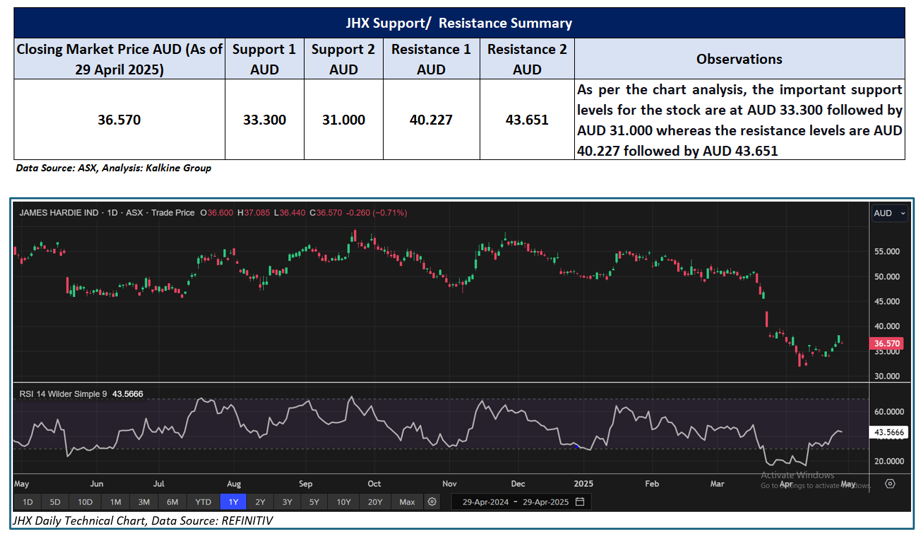

JHX shares closed 0.71% lower at AUD 36.57 per share on 29 April 2025. The stock is down ~5.6% in the past month and has plunged nearly 29% over the last six months. Currently trading below the midpoint of its 52-week range of AUD 31.86 to AUD 59.53.

Support and Resistance Summary

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 29 April 2025. The reference data in this report has been partly sourced from REFINITIV.

Technical Indicators Defined:

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.