Highlights

- Capitol Health offers medical imaging and related services in Australia.

- The company will distribute a dividend of AUD 0.005 per share on 20 October 2023.

- The key priority of CAJ is to implement the company’s initiative of a unified clinic operating system software.

Capitol Health Limited (ASX:CAJ) is an ASX-listed healthcare equipment and service company which offers community-based medical imaging and related services. The company offers its services through its 66 clinics across the country.

Soon, the company is going to distribute a fully franked final dividend of AUD 0.005 apiece. The dividend ex-date is 21 September 2023, and the pay date is 20 October 2023.

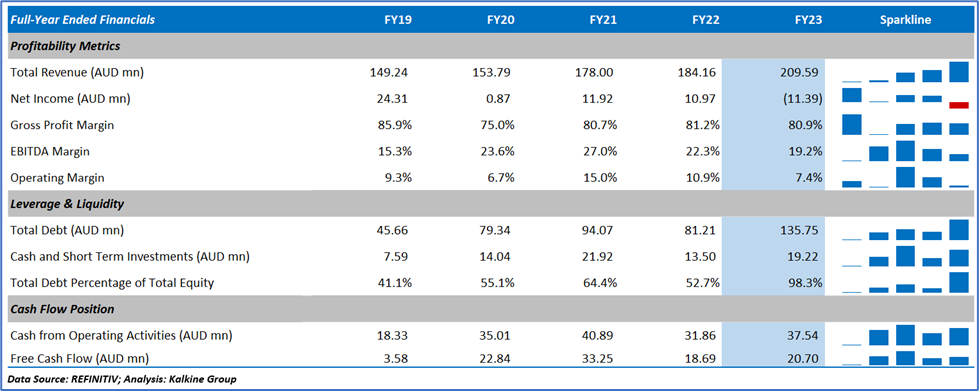

In the financial year 2023 (FY23), the company registered revenue growth of 13.81% y-o-y to AUD 209.59 million, backed by the expansion of service offerings in current clinics and the acquisition of Future Medical Imaging Group (FMIG). In November 2022, FMIG was acquired and contributed AUD 16.8 million to the total revenue.

During the period, the company reported a 2.27% fall in operating EBITDA to AUD 40.19 million, while cash and cash equivalent increased by 42.84% to AUD 19.11 million.

Here’s the historical financial trend of CAJ.

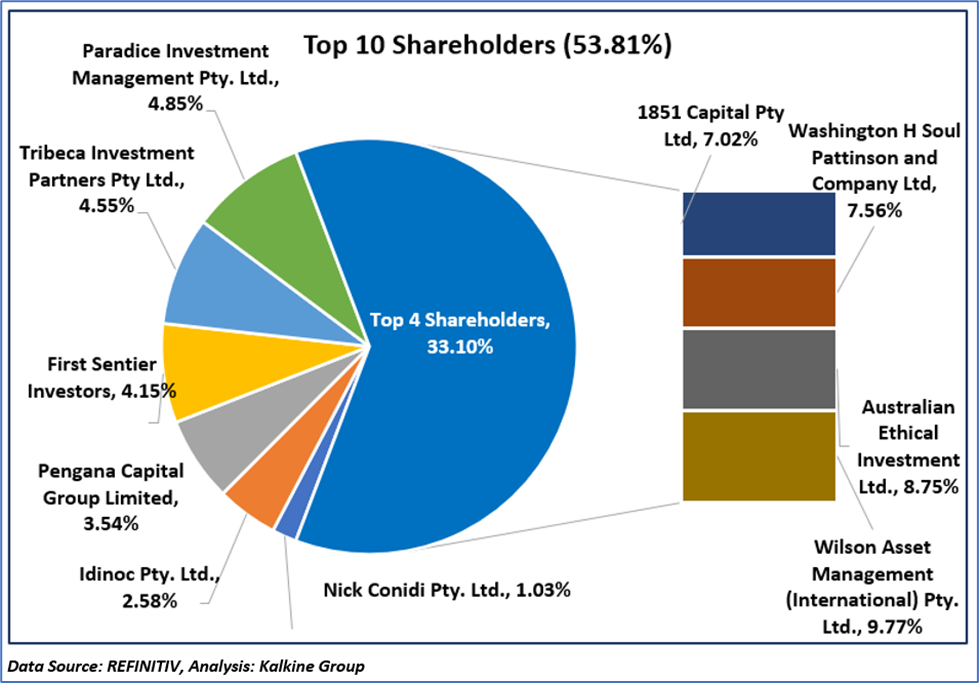

Top 10 shareholders of CAJ

The top 10 shareholders of CAJ hold nearly 53.81% stake in the firm, while the top four have around 33.10% shareholding. Wilson Asset Management (International) Pty. Ltd. and Australian Ethical Investment Ltd. have the highest stake in the firm, with a shareholding of ~9.77% and ~8.75%, respectively.

Recent business update

Through a recent ASX update dated 31 August 2023, the company informed about an extension to the voluntary escrow concerning more than 2.3 million shares issued to the vendors of Direct Radiology. The voluntary escrow period has been extended beyond 31 August 2023. The escrow release date is yet to be confirmed.

Outlook

In August, the company reported a substantial rise in August’s year-to-date revenue position, excluding the contribution of FMIG.

The company is committed to continuing investment in equipment and enhancing its service offerings. In Australia, the company aims at opening new clinics and developing existing clinics in strategic locations across the network.

Present key priority is to implement the company’s initiative of a unified clinic operating system software, which is expected to deliver improvement in service quality, scalability for growth and operating efficiencies.

The company intends to tap market expansion opportunities through strategic business acquisition.

Share performance of CAJ

CAJ shares closed 2.439% up at AUD 0.210 apiece on 20 September 2023 with a market capitalization of AUD 218.49 million. Including today’s gain, CAJ shares declined by 37.31% in the last 12 months, and the share price dropped by 24.99% in the last three months.

The 52-week high of CAJ is AUD 0.335 apiece, recorded on 21 October 2022, which is 37.31% higher than today’s closing market price. While the 52-week low is AUD 0.203 apiece, recorded on 13 September 2023.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 20 September 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.