Health and medical industry of Australia focuses on the worldâs leading technology, advanced research, development and innovation. Over the years, the industry has registered strong growth in terms of both size and reputation.

Let us discuss four companies that are operating in the healthcare sector and listed on ASX.

SomnoMed Limited (ASX: SOM)

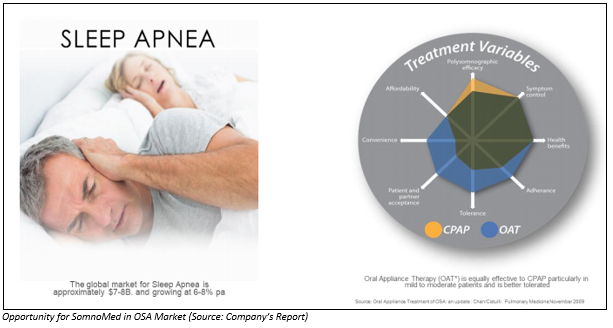

About the company: SomnoMed Limited (ASX: SOM) is a developer, manufacturer and marketer of innovative dental and medical products. The company focuses on solutions for sleep-related breathing disorders. Moreover, it caters its solutions towards bruxism, snoring and obstructive sleep apnea.

Latest update: On 8 July 2019, the company reported that more than 500,000 patients were treated with the SomnoDent® oral appliance therapy, globally, in the month of June 2019.

The company is engaged in the design, production, sales and distribution of the therapy under the banner COAT⢠(Continuous Open Airway Therapy) in 28 countries. SOM has secured approval from the US Food and Drug Administration as well as other required regulatory approvals for the treatment of obstructive sleep apnea (OSA), a serious medical condition, with its therapy.

Commenting on the development, Global CEO of SomnoMed, Neil Verdal-Austin, stated that the treatment of over 500,000 patients worldwide with this therapy was an important milestone for SOM, as it affirmed the companyâs position as the global leader in oral appliance therapy for the treatment of this serious medical condition. Neil Verdal-Austin further added that internal patient surveys gave high compliance rates, which confirmed that the SomnoDent® therapy resulted in a very effective medical outcome for the patients treated, who also experienced an improvement in the quality of their life.

Stock performance: The shares of SOM have given a negative YTD return of 16.30%. By the end of the trading session on 8 July 2019, the price of the shares of SOM was at A$1.550, up by 0.649% as compared to its previous close. The company holds a market capitalisation of A$96.72 million with approximately 62.8 million outstanding shares.

Anteo Diagnostics Limited (ASX: ADO)

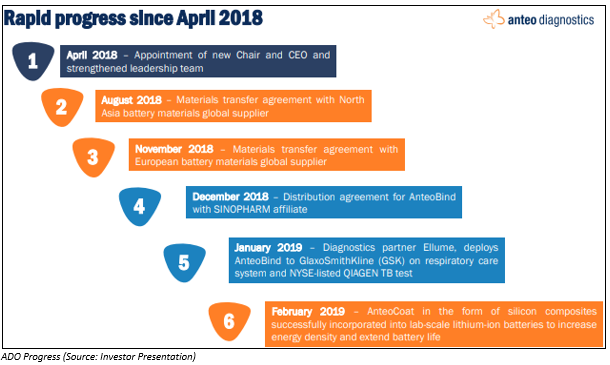

About the company: Listed on ASX in April 2000 and headquartered in Queensland, Anteo Diagnostics Limited (ASX: ADO) is engaged in the development and commercialisation of medical products, energy, and battery material composites. It holds Intellectual Property in AnteoCoatTM, AnteoBindTM and AnteoReleaseTM, the companyâs principal technology product groups. It serves customers in the markets of medical devices, diagnostics, energy and life sciences.

Latest update: ADO has signed an agreement with a well-known producer of battery anode on a global level, according to a companyâs announcement on 8 July 2019. Under the terms of the agreement for a joint development program, the two companies will share materials, test data and knowledge.

The agreement, which is majorly aimed at further developing Anteoâs silicon composites, will have two stages. The first stage will cover establishing project baseline, while as part of the second stage, the joint material development and evaluation, in addition to activities, will be undertaken, which is intended towards tailoring silicon composite properties to the needs of this partner.

This new agreement highlights how the interest level of the industry is growing in the companyâs surface chemistry and composite technology, which is directed towards lithium ion battery applications. Moreover, the two partners also share a common goal, aimed towards enhancing the energy density of future batteries, with applications in home and utility-scale energy storage systems, as well as electric vehicles and mobile devices.

Stock performance: The shares of ADO have given a negative YTD return of 24.42%%. By the end of the trading session on 8 July 2019, the price of the shares of ADO was at A$ 0.015, up by 15.385% as compared to its previous close. The company holds a market capitalisation of A$19.39 million with approximately 1.49 billion outstanding shares.

Volpara Health Technologies Limited (ASX: VHT)

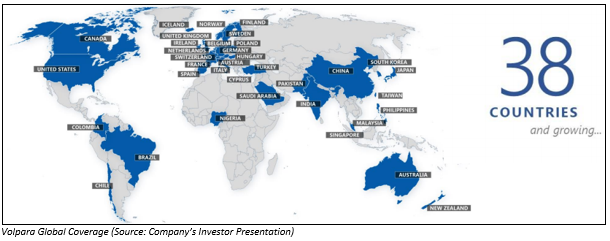

About the company: Founded in 2009, Volpara Health Technologies Limited (ASX:VHT) is a developer of digital health solutions. The company is focused on personalised breast cancer screening software applications. It holds certification to ISO27001 and ISO13485. Moreover, it is a US FDA-registered establishment. Additionally, the company holds the MDSAP 690110 certification for Japan, the United States, Australia and Canada.

Latest Update: In an ASX announcement on 8 July 2019, the company reported to have signed a distribution agreement with Dutch medical imaging company ScreenPoint Medical BV regarding the sale of the latterâs computer-aided detection software.

Under the five-year, non-exclusive contract, VHTâs established direct sales force will distribute Transparaâ¢, the AI solution of ScreenPoint targeted towards breast cancer detection. Transpara⢠is a next-generation computer-aided detection software, which marks specific areas of the breast image as likely being cancer or not, thereby enabling radiologists to read screening mammograms.

The software, which can deliver much more clinically useful information to radiologists, will be aimed towards breast imaging clinics in Australia, New Zealand, the United States, and parts of Asia. The contract also covers automatic renewal rights.

Meanwhile, ScreenPoint CEO Prof Karssemeijer stated that Volpara and ScreenPoint held the potential to help breast practices improve cancer detection and streamline mammography reading.

Stock performance: The shares of VHT have given a positive YTD return of 48.74%. By the end of the trading session on 8 July 2019, the price of the shares of VHT was at A$1.670, up by 2.769% as compared to its previous close. The company holds a market capitalisation of A$351.75 million with approximately 216.46 million outstanding shares.

Imugene Limited (ASX: IMU)

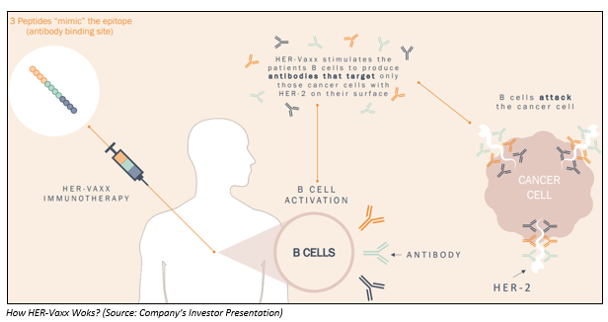

About the company: Clinical stage immuno-oncology company, Imugene Limited (ASX:IMU) is headquartered in Victoria, Australia. The company, with operations in America and Europe, is developing various new and novel immunotherapies. Its product pipeline includes several immunotherapy B-cell vaccine candidates, with its unique platform technology seeking to harness the bodyâs immune system to generate antibodies against tumours.

Latest Update: On 8 July 2019, the company announced positive data from the HER-Vaxx Phase 1b study. The clinical trial data of the metastatic gastric cancer vaccine demonstrated positive cancer fighting antibody and clinical response rates in the patients receiving the optimal biological dose of the vaccine.

According to the study data, patients have maintained strong and high levels of HER-2 targeting antibodies, highlighting the presence of a durable response with no resistance developed. In cohort, of the three patients receiving the optimal biological dose of the vaccine and selected Phase 2 dose, nearly 80% tumour reduction has been observed in one patient from baseline CT scan with one out of four of their lesions becoming unmeasurable by RESIST criteria at Day 266 visit.

The company has presented the data from the HER-Vaxx Phase 1b study at the European Society for Medical Oncology (ESMO) World Congress on Gastrointestinal Cancer in Barcelona, Spain.

The vaccine is being developed to treat tumours that over-express the HER-2/neu receptor, like breast, lung, gastric, ovarian, and pancreatic cancers.

The second phase of the study, which started patient enrolment in March 2019, is due for completion in 2020.

Stock performance: The shares of IMU have given a negative YTD return of 16.67%. By the end of the trading session, on 8 July 2019, the price of the shares of IMU was at A$0.016, up by 6.667% as compared to its previous close. The company holds a market capitalisation of A$54.15 million with approximately 3.61 billion outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.