Good returns, greater dividends and a lucrative trade environment are amongst the few criteria that attract investors to delve their thoughts and money into.

In this article, let us look at the three good performing stocks (in recent times) and understand their recent stock performances and company updates:

- Volpara Health Technologies Limited (ASX:VHT)

- ResMed Inc. (ASX:RMD)

- Bubs Australia Limited (ASX:BUB)

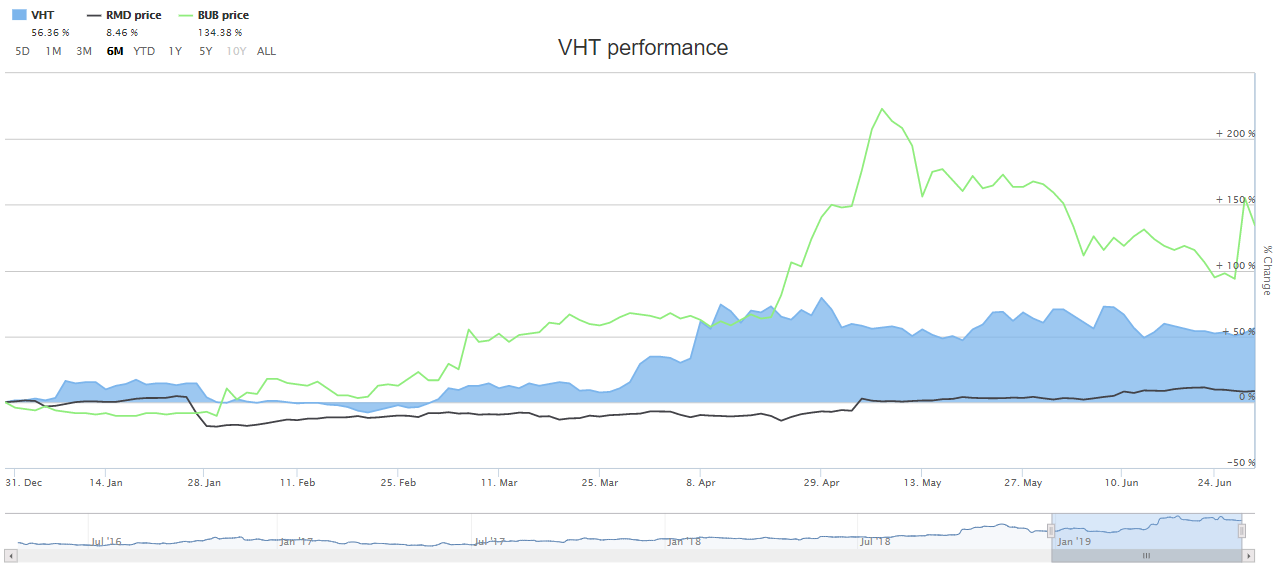

The below image depicts the past six-month returns of the three stocks under discussion. All the three stocks have an upward trend and are generating returns, capturing the interests of investors.

6-month return of VHT, RMD and BUB (Source: ASX)

6-month return of VHT, RMD and BUB (Source: ASX)

Volpara Health Technologies Limited (ASX: VHT)

Company Profile: A MedTech SaaS company, VHT offers technology and services in the field of health care. The company develops digital health solutions to enable personalised breast cancer screening software applications. The company is AI friendly, and it has an enterprise-wide software called VolparaEnterprise that provides role-specific dashboards and analytics to aid clinics in managing their works. Users of VHTâs technology and services are spread across 38 countries in the world. The company is based in Wellington, New Zealand and was listed on ASX in April 2016.

Stock Price Information: On 2 July 2019, the companyâs stock was trading at A$1.690 (at AEST 12:07 PM), down by 0.295 per cent. The stock has touched a 52-week high of A$1.932 and a low of A$0.745. With a market cap of A$361.45 million, the stockâs EPS value is a negative A$0.064. It has generated a return of 16.89 per cent and 55.15 per cent in the last three and six months, respectively. The stockâs YTD return is 55.15 per cent as well.

Entitlement Offer: On 1 July 2019, the company announced that it completed its fully underwritten pro rata accelerated non-renounceable entitlement offer of the new shares on 26 June 2019. As per the offer, retail stakeholders could subscribe for one new share for every 27 existing Volpara shares that they held on the date. The applications totalled 2,901,914 new shares at A$1.50 per new share, and the placement was successful to raise almost A$4.35 million. Along with the proceeds of the institutional part of the offer, the raise was A$9.52 million.

As per an agreement, Bell Potter Securities Limited would procure subscriptions for or subscribe 315,115 new shares. The total raise of the company, post placement to institutional investors on 3 June 2019, amounted to A$55 million and was used to fund the purchase price to acquire US-based MRS Systems, Inc. and towards the companyâs organic growth.

ResMed Inc. (ASX: RMD)

Company Profile: A player operating in the health care sector, RMD is focused on the manufacturing of medical devices. It was listed on ASX in 1999 and has its registered office in San Diego, United States. The company is a market leader in the management of sleep apnea and COPD. It has been recognised for its innovative devices and masks and has software solutions that enable cloud connection for devices. The company trades both on ASX and NASDAQ.

RMDâs AirMiniTM, the worldâs smallest auto CPAP device (Source: Company Website)

RMDâs AirMiniTM, the worldâs smallest auto CPAP device (Source: Company Website)

Stock Price Information: On 2 July 2019, the companyâs stock was trading at A$17.630 (at AEST 12:08PM), up by 0.685 per cent. The stock has touched a 52-week high of A$17.750 and a low of A$12.650. With a market cap of A$25.01 billion, the stockâs EPS value is A$0.442. It has generated a return of 19.15 per cent and 8.46 per cent in the last three and six months, respectively. The stockâs YTD return is 7.04 per cent.

Board Updates: On 16 May 2019, the company announced the appointment of Jan De Witte on its board.

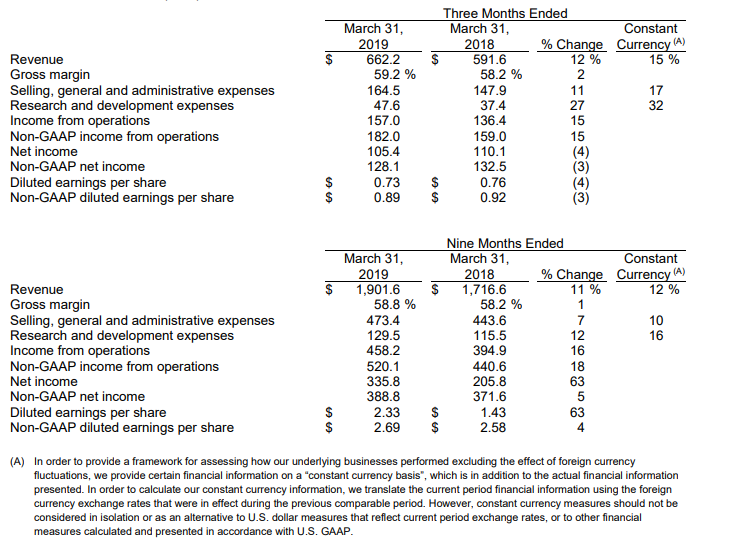

Third Quarter of Fiscal Year 2019: The company announced its third quarter results of FY19 and stated that its revenue was up by 12 per cent to $662.2 million. The gross margin had expanded 100bps to 59.2 per cent, while its net operating profit as well as the non-GAAP operating profit increased by 15 per cent, respectively.

RMDâs Financial Performance (Source: Companyâs Report)

RMDâs Financial Performance (Source: Companyâs Report)

Bubs Australia Limited (ASX: BUB)

Company Profile: A mother of three, Kristy Carr launched the countryâs first range of organic pouch baby food to be sold in the Aussie supermarkets.BUB is the nationâs major manufacturer of products made from goatâs milk. BUB makes infant formula, organic infant food and cereal products pertaining to all age groups. The companyâs products are found in stores and on online platform.

BUB Products (Source: Company Website)

BUB Products (Source: Company Website)

Stock Price Information: On 2 July 2019, the companyâs stock was trading at A$1.180, (as at 12:03 PM) up by 0.422 per cent. The stock has touched a 52-week high of A$1.615 and a low of A$0.355. With a market cap of A$603.86 million, the stockâs EPS value is a negative A$0.208. It has generated a return of 49.06 per cent and 160.44 per cent in the last three and six months, respectively. The stockâs YTD return is 160.44 per cent as well.

Strategic Joint Venture: On 27 June 2019, the company announced the first significant project of Bubs Brand Management Shanghai Co. Ltd, with Kidswant, which has the largest market share of mother and baby retail in China. As per the JV terms, the companyâs food products would be ranged across 275 Kidswant stores across China.

New Product Launch: On 6 May 2019, the company notified that it would be the countryâs first player to provide Australian made certified organic grass-fed infant formula, after entering into an agreement with Fonterra Australia to produce a new range of infant formula and provide the company with organic milk powder. The product would be available in Chemist Warehouse pharmacies throughout Australia, and a China export situation would follow shortly.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.