Penny stocks are those stocks that trade at a meagre price usually less than A$1.00, and the company has a very low market capitalization, below A$300 million. These kinds of stocks are characterised by high volatility and thus are considered highly risky. Let us have a look at the recent updates on three penny stocks.

About Anteo Diagnostics Limited

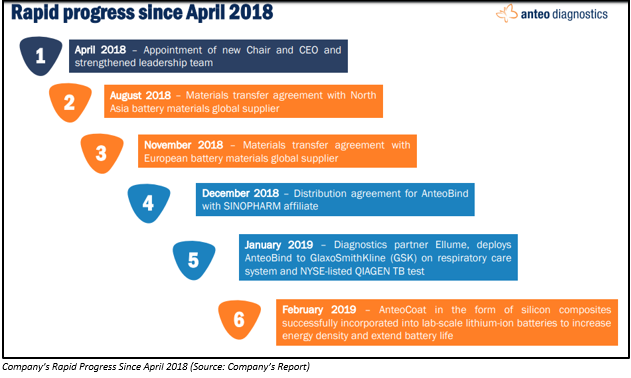

Anteo Diagnostics Limited (ASX: ADO is a company that belongs to the Health care sector and is known for developing and commercializing various products in life sciences domain, energy and medical devices markets, and in-vitro diagnostics.

As on 18 June 2019, ADO holds a market cap of A$20.88 million and the shares are trading flat at A$0.014 (as at AEST: 2:09 PM).

Recent Update:

On 17 June 2019, Anteo Diagnostics Limited announced that it has entered into a Collaboration Agreement with Lumos Diagnostics (Lumos), which is a California based Point-of-Care (POC) company and a spin out of medical technology firm Planet Innovation, a market leader in lateral flow assay development and reader design.

The Life Sciences division of the company along with Lumos will be integrating their expertise as well as their technology for developing a high sensitivity, lateral flow tests that would be used for the detection of very low concentrations of clinically important biomarkers.

Previously, the company had collaborated with Lumos on a Medical Counter Measures project that was led by the Defense Materials Technology Centre (DMTC) and Planet Innovation. This project was a great success, and it also won a National Innovation Award for the development of a field-deployable, handheld diagnostic device at the 2018 International Land Forces Exposition.

With this new collaboration agreement, the company believes that both the parties would be able to strengthen their collaborative relationship and will also provide other opportunities where the company would be able to access the performance advantages of AnteoBindTM, which it can deliver in the commercial development of lateral flow assays.

Further, the collaboration would focus on the development of a POC assay for detecting a novel biomarker at such a low concentration that it was not able to detect earlier in a conventional POC Lateral Flow setting. A biomarker is a naturally occurring molecule, gene, or characteristic that helps in identifying a particular pathological or physiological procedure, disease, etc.

Once the project gets completed successfully, it would be able to demonstrate the well-established and greater performance of the assay design as well as reader technology of the company. It would also demonstrate an essential role of AnteoBindTM in improving the development of the materials that are used to build the newest generation of ultra-high sensitive Lateral Flow POC tests.

Stock Performance: The stock has generated a decent return of 22.09% in the last 12 months.

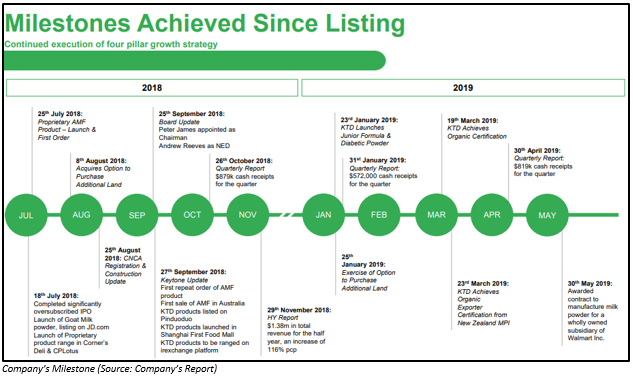

Keytone Dairy Corporation Limited

About Keytone Dairy Corporation Limited:

Keytone Dairy Corporation Limited (ASX: KTD) belongs to the Consumer Staples sector and is one of the premium dairy and nutritional production facilities in New Zealand situated in the heart of the South Island. The company operates in the dairy product segment of the FMCG industry. The products of the company are manufactured under the brand name KeyDairy® and KeyHealth® which comprises of premium milk and nutrition powders along with award-winning beauty products that are provided in a multiform packaging solutions which comprise of nutrition sachet and jar products.

The shares last traded on 14 June 2019 with the closing price of A$0.530. KTD has a market capitalization of A$79.4 million, thus qualifying as a penny stock.

Recent Update/s:

On 17 June 2019, the company announced that it has entered into a binding conditional agreement where it would be acquiring 100% of the shares in Omniblend Pty Ltd (âOmniblendâ) for $22.6 million along with an earn-out up to $30 million that depends on performance milestones. The acquisition depends on the satisfaction of conditions precedent, which includes the shareholder approvals.

Omniblend was founded in the year 2008 and is a profitable and leading Australian-based product developer as well as a contract manufacturer of high value, formulated, blended powder products along with long-life UHT drinks in the health care and the wellness sector.

Once the acquisition of Omniblend gets finalized, the company would be paying the shareholders of Omniblend a cash consideration of $8 million as well as issue 23.3 million shares to the shareholders of Omniblend in Keytone which is equivalent to $10.0 million of consideration at $0.43 per share. The company would also be settling $4.6 million debt of Omniblend.

Omniblend expects to realize revenues of $29.7 million and EBITDA of $2.244 million on a pro-forma basis. In case the Omniblend business is able to achieve certain financial milestones, its shareholders would also receive earn-out consideration.

Further, the completion of the share purchase agreement depends on the satisfaction of conditions such as:

- The company is able to raise at least $8 million under the share purchase plan and placement.

- KTDâs shareholders approve the issue of shares and performance shares to the Omniblend shareholders.

- Omniblend concludes a pre-sale corporate restructure to the satisfaction of Keytone Dairy Corporation Ltd.

- Parties have obtained necessary approvals as per the ASX Listing Rules.

The company would be funding the acquisition through the placement of up to $8.0 million to institutional and sophisticated investors and SPP up to $10.0 million for shareholders. The acquisition is expected to complete after the shareholder approval at the shareholdersâ meeting, which is expected to be held in the second half of July 2019.

Stock Performance: The stock has generated a decent YTD return of 37.66%. The shares of KTD are under trading halt pending for an announcement related to a material capital raising and acquisition.

The shares of KTD have been under a trading halt since June 17, 2019, and the same were indicated to be under the halt until the earlier of a relevant announcement being made or commencement of normal trading on 19 June 2019.

Family Zone Cyber Safety Ltd

About Family Zone Cyber Safety Ltd:

Family Zone Cyber Safety Ltd (ASX: FZO) is an ASX listed company that belongs to the IT sector and focuses on cyber safety. The company has developed a unique and innovative cloud-based solution which integrates innovation with foremost international technology to keep kids safe online as well as manage digital lifestyles.

FZO is trading at A$0.135, down by 3.571% as compared to its previous closing price. FZO holds a market cap of A$27.08 million and approximately 200.63 million outstanding shares. (as on 18 June 2019, AEST: 2:41 PM)

Recent Update/s:

On 17 June 2019, Family Zone Cyber Safety Ltd announced that it had joined hands with The Noel Leeming Group (Noel Leeming) to retail its Cyber Safe mobile, the FZONE.

Noel Leeming is the leading consumer electronics retailer in New Zealand and has 77 stores. The company announced that Noel Leeming has selected to showcase its exciting, innovative and world first cyber safe mobile phone, FZONE through online as well as in its flagship stores. FZONE is a mobile phone that is built in consultation with experts of retail and cyber safety that meets the requirement of parents, schools and children.

FZONE is selected to be the first child-friendly device in the product range of Noel Leeming. The selection of FZONE in the product range of Noel Leeming is a significant milestone for the company, and it also validates the product fit as well as the complex challenges it seeks to resolve in the tech-savvy market of New Zealand.

Noel Leeming, through its highly trained expert store staff, would assist parents in the buying process and would also be highlighting the unique FZONE embedded parental control capabilities.

Stock Performance: The shares of FZO have generated a return of 12% in the past five days.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.