Australian software and services company, K2fly Limited (ASX: K2F) released its 2019 Annual General Meeting Chairâs Address to the shareholders on 25 November 2019. K2flyâs Chair / Non-Executive Director Mr Jenny Cutri highlighted FY2019 to have been a positive year for the company whereby-

- Revenue continued to grow to a record level;

- RCubed software solution was acquired, followed by the immediate signing of a new client;

- Demand for the Infoscope solution also increased;

- Significant contract extensions were obtained, and new clients were onboarded for consultancy work and for the companyâs third-party software solutions;

- Key partnerships were established;

- An Employee Incentive Plan executed;

- Successful completion of 2 capital raisings (including a fully-underwritten rights issue and placement);

- Overall, the companyâs geographical footprint largely increased during the year.

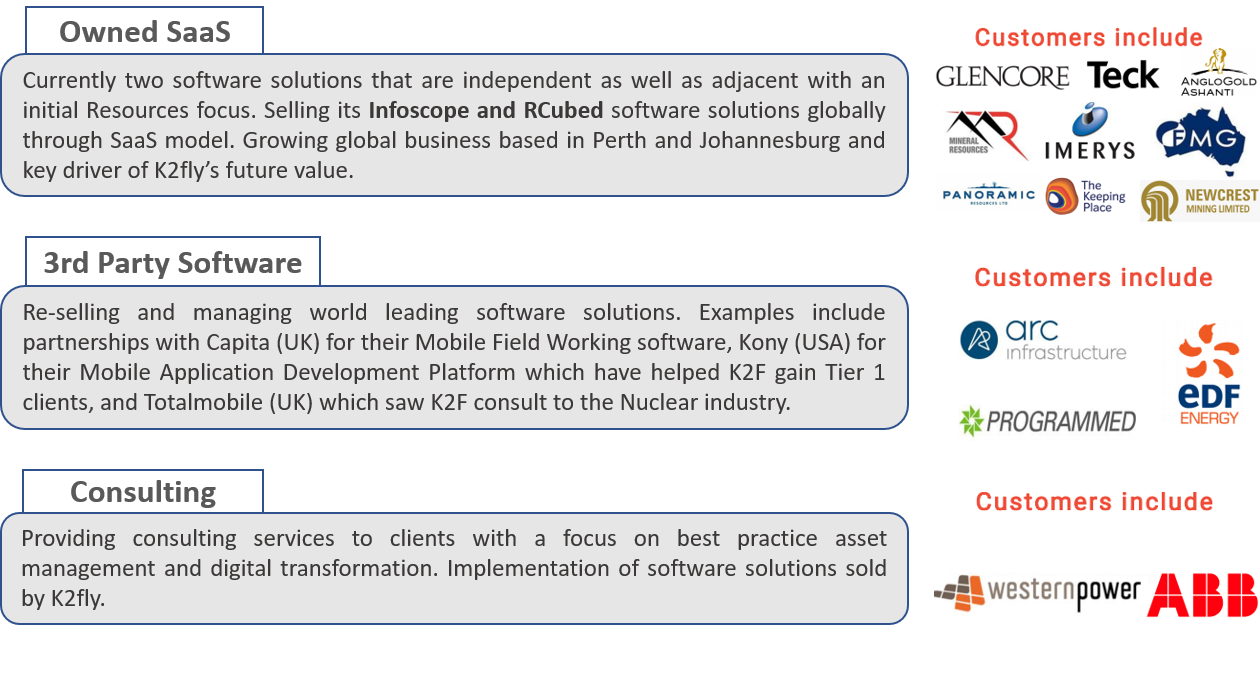

K2fly Business Segments

Around the end of the financial year 2018 (FY18), K2fly had made the strategic decision to no longer focus on owned software products including ADAM, Novin, Docman, Tagman, and the other acquired technology assets from K2 Technology Pty Ltd, as little demand / interest was being received for those products. As a result, K2fly targeted its focus on Infoscope, which was acquired earlier and already a part of its SaaS-based offering. Later in May 2019, the company completed the acquisition of RCubed Resources and Reserves Reporting software solution that has been extremely complementary to K2Fâs owned software solution, Infoscope.

The total revenue for FY2019 rose to $ 3.79 million, depicting an increase of 50% year-on-year compared to FY2018. Meanwhile, the companyâs quarter on quarter revenue demonstrated a consistent upward momentum through the year. In the most recent quarter ended 30 September 2019, K2fly raised invoices for approximately $ 1.43 million, depicting an improvement of 44% over the corresponding quarter in FY19.

With what appears to be the alignment of a perfect storm:

- Changes introduced by the US Securities and Exchange Commission to the reporting and disclosure requirements of mining companies operating in the US or listed on the New York Stock Exchange (NYSE); and

- The increasing demand for companies to be ESG (Environmental, Social and Governance) compliant.

Both these developments, in particular, have pushed up the demand for K2flyâs owned software offerings. Infoscope and RCubed that are now uniquely positioned to enable companies to comply with their reporting requirements and demonstrate their âsocial licenceâ to operate.

Thus, the companyâs own software solutions (RCubed and Infoscope) are proving to be transformative on a number of levels as K2fly now has-

- An office in Centurion, near Johannesburg, South Africa;

- Major mining houses as clients including- Fortescue Metals Group, Teck Resources Ltd, Anglo Gold Ashanti; Contracts signed in 2019 comprise Mineral Resources Ltd in February; Panoramic Resources Ltd in March, Imerys SA in June; Glencore Canada Corporation in August; Newcrest Mining Ltd in September; Nexa Resources in October; and most recently Rio Tinto in November.

- Increased Annual Recurring Revenues (ARR) from software subscriptions.

The testimony to RCubed software solution âbest in classâ nature is the contracts secured from mining companies of such a high calibre, including Tier 1 - Rio Tinto. In addition to existing clients, the company has also been working on consultancy assignments with a range of new clients including like EDF Energy, Queensland Urban Utilities, Stanwell Energy, South Australian Water and New Hope Group.

The Chairman pleasingly informed that K2flyâs ARR from software subscriptions is now approaching $ 1.5 million as on 25 November 2019.

FY2020 Vision

K2flyâs purpose includes providing solutions which contribute to a more transparent and sustainable world, so that:

- Customers benefit from improved and transparent relationships with their stakeholders.

- K2flyâs partners are assisted with thought leadership and innovative solutions for shared customers.

- The companyâs employees feel they are contributing in helping provide better communities, environment and governance for all.

- Lastly, the company aims to ensure that everyone feels valued and respected and grow personally and professionally together.

Stock Performance: On 25 November 2019, the stock of K2fly, with a market cap of ~AUD 16.75 million, closed the dayâs trade at AUD 0.215, up by 4.8% as compared to its previous closing price. K2F has generated positive returns of 57.69% YTD, 78.26% in the last six months and 28.13% in the last one month.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.