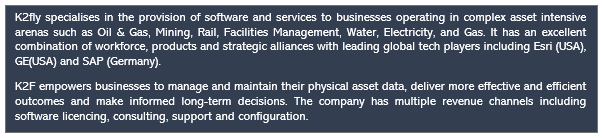

Australia-based software and services company, K2fly Limited (ASX: K2F) has announced yet another milestone with a five-year contract signed with leading global mining group Rio Tinto for the implementation of the RCubed Mineral Resource and Reserve solution across 20 sites globally. The total contract value is around AUD 1.45 million, which includes the initial cost of implementation (to begin immediately).

Rioâs existing inhouse systems will be replaced by RCubed, that would help the company to deliver mineral resources and ore reserves reporting and governance for its shareholders and regulators.

Brian Miller, CEO of K2fly commented, âThis is a significant deal with one of the worldâs most successful miners. We are delighted to collaborate with Rio Tinto to implement a âbest-in-classâ solution which will provide a highly auditable system for the production of resource and reserve numbers.â

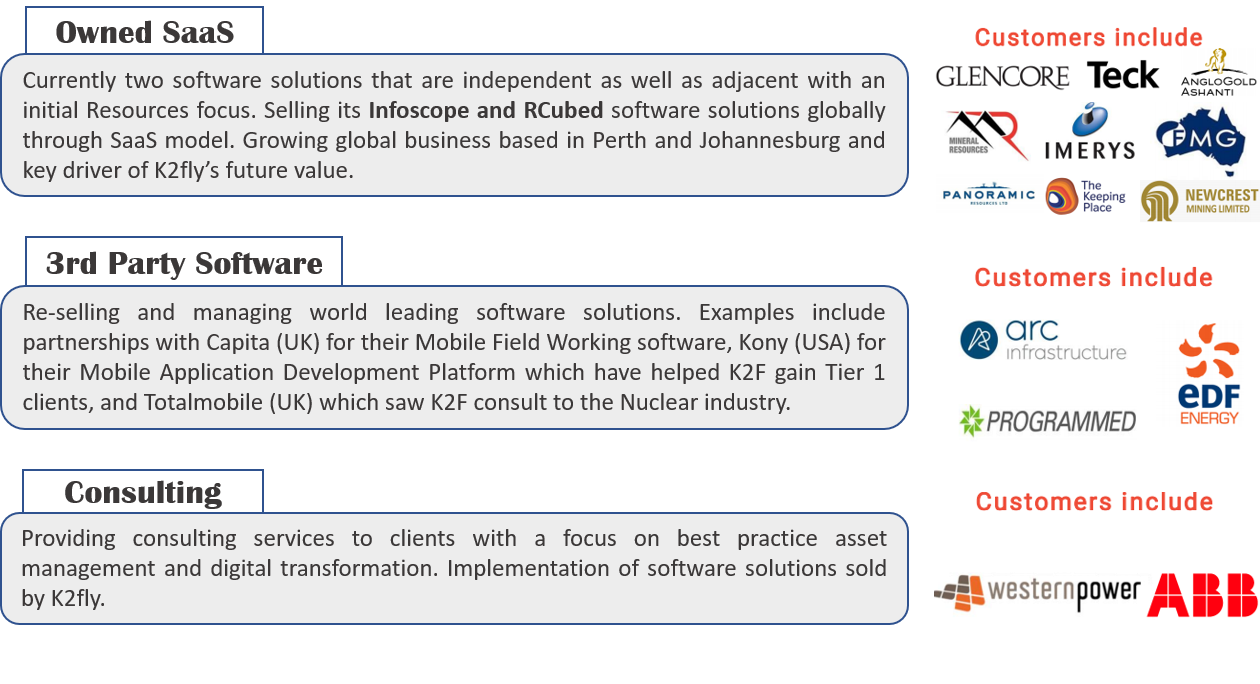

Business Segments

The Rio Tinto contract further supplements the strong growth in ARR (Annual Recurring Revenue) that K2flyâs SaaS business is experiencing of 150% CAGR over the last 4 quarters which includes 27% growth from Q4 FY19 to Q1 FY20.

The Rio Tinto contract further supplements the strong growth in ARR (Annual Recurring Revenue) that K2flyâs SaaS business is experiencing of 150% CAGR over the last 4 quarters which includes 27% growth from Q4 FY19 to Q1 FY20.

It is a shot in the arm for the company while it consistently works to accrue larger revenue on the back of high-margin sales of its SaaS-based offerings - Infoscope and RCubed.

For the energy and resources sector companies, ESG (Environment, Social and Governance) reporting has increasingly become a point of differentiation, as industry stakeholders demand higher standards of governance and transparency from the companies that they work for or invest in. In addition, the existing inhouse systems used by Tier 1 and Tier 2 Miners globally are becoming dated owing to dynamic changes sweeping across the regulatory (increased compliance) and technology (improved reporting) landscape.

Most importantly, the major driver of the accelerated demand for K2flyâs RCubed solution is the revamp in the disclosure requirements for the mining company issuers introduced by the stock market regulator Securities and Exchange Commission (SEC) in the United States in October 2018.

Over the years, SaaS has carved out for itself a foothold in software spending and as per various market experts, the global SaaS market for business applications is estimated to rise above $ 100 billion in the near future.

Strong Business Momentum with RCubed

In a short span of time, K2fly has achieved major headways with respect to RCubed Resources and Reserve Reporting software since its acquisition in May 2019. Major clients like AngloGold Ashanti (ASX: AGG), Teck Resources and Impala Platinum were added to its customer base. Thereafter,

- French multinational and Paris Stock Exchange-listed, Imerys SA signed on board in June 2019.

- An AUD 250,000 SaaS-based software contract agreement signed with Glencore Canada Corporation in August 2019.

- Very recently, ASX-listed gold producer Newcrest Mining Limited (ASX: NCM) and Brazilian mining and smelting company Nexa Resources also signed on board in September and October respectively for implementation of RCubed.

Read here: Getting Acquainted with K2flyâs 2019 Client Base

Stock Performance: K2F has a market capitalisation of around AUD 15.11 million with ~ 81.69 million shares outstanding. On 19 November 2019, the K2F stock price climbed up 21.62% by AUD 0.040 midday. K2F has also delivered impressive positive returns of 48% in the last six months, 42.31% Year-to-date, and 12.12% in the last three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.