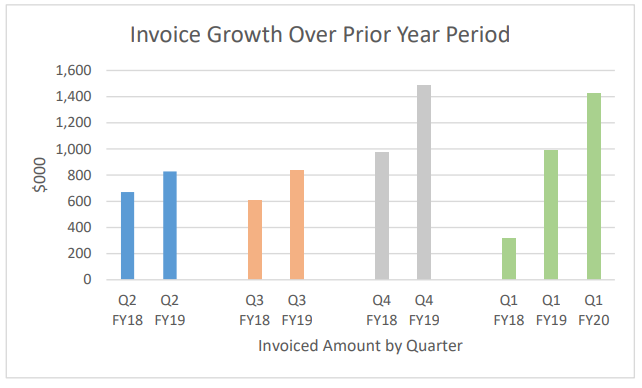

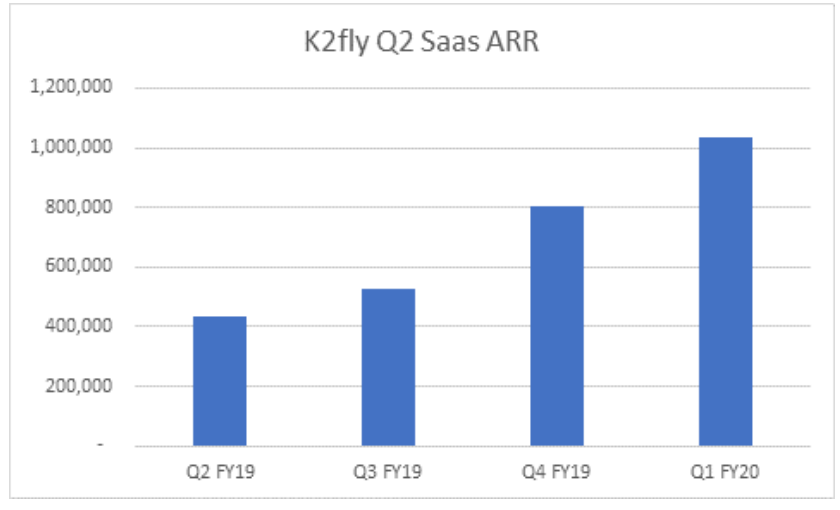

Australia-based technology company, K2fly Limited (ASX: K2F) released its Operations Update for the quarter ended 30 September 2019 (Q1 FY20), posting a significant improvement of 44% in the invoices raised to $ 1.43 million from 991k in Q1 FY19. After delivering a dynamic financial year (FY19) to 30 June 2019, K2fly continued to focus on building high margin SaaS revenue.

Increased adoption of K2flyâs SaaS-based solutions

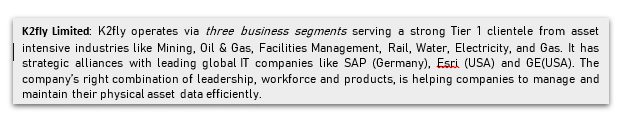

In this quarter K2fly experienced unprecedented demand for the RCubed solution. Glencore Canada Corporation, a subsidiary of the Swiss multinational Glencore plc, contracted the company for implementation of its RCubed Resource Governance SaaS solution across 56 sites (Zinc operations) in 7 countries (as announced on 15 August 2019). Subsequently on 2 September 2019, Newcrest Mining Limited (ASX: NCM) signed an agreement with K2fly to deploy the RCubed solution across its global gold operations in Australia, Indonesia and Papua New Guinea.

Read Here: K2flyâs bonanza through RCubed Software Solution: Glencore Canada on board

The key reason behind unprecedented demand for the RCubed solution has been a combination of regulatory changes in the United States (US) coupled with the retirement of certain in-house systems used by Tier 1 and Tier 2 miners globally.

Last year in October 2018, the Securities and Exchange Commission (SEC) in the US overhauled its disclosure requirements for mining company issuers, depicting the first significant change in ~ 30 years since the adoption of Industry Guide 7. This brought the US into line with countries such as Australia, Canada and South Africa that are already following CRIRSCO reporting codes. As per the new guidelines, companies operating in the US or listed on the NYSE would be required to adhere to the same from the first fiscal year beginning on or after 1 January 2021.

Many major mining houses would be affected by the new rules including BHP Group Limited (ASX: BHP), Rio Tinto Limited (ASX: RIO), Vale, Newmont Goldcorp, Anglo Gold Ashanti Limited (ASX: AGG) and Goldfields amongst more than 50 large mining companies listed on the NYSE.

The momentum for RCubed continued post the quarter end, on 25 October 2019, Nexa Resources from Brazil joined the league of RCubed users when it signed to deploy the solution across 12 sites in Brazil and Peru.

RCubed and Infoscope, have been deployed or are in the process of being deployed in over forty countries and across more than 200 sites internationally as of the quarter-end. In addition, K2fly is currently holding contractual negotiations with three (3) major mining companies, covering either Infoscope or RCubed, and relevant updates would be provided on the same as K2fly is quite optimistic about making further progress during Q2 FY20.

Read here: Vast Market Opportunity Awaits K2flyâs SaaS-based Solutions: Infoscope and RCubed

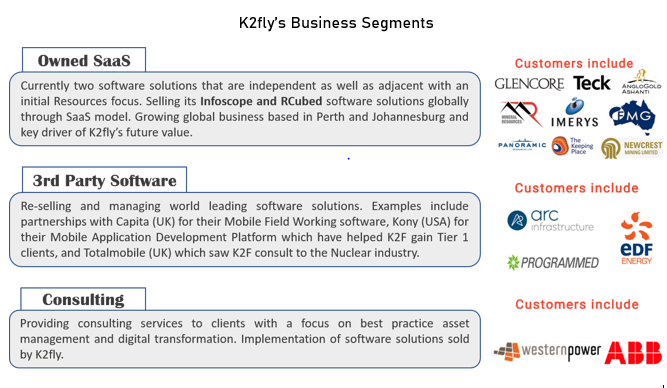

Expanding Annual Recurring Revenues

The companyâs Annual Recurring Revenues (ARR) from Software Subscriptions grew by 27% during the quarter, amounting to a Compound Annual Growth Rate (CAGR) of 150%.

Mobility

K2fly also informed that implementation of its Fieldreach enterprise mobility solution in Arc Infrastructure continues to go from strength to strength. In early October 2019, the Fieldreach solution was expanded to encompass Track Patrolling Management marking the first implementation in the world whereby Fieldreach was successfully integrated to Ellipse Inspection and full-cycle defect management.

Consultancy

During Q1 FY20, the company continued to undertake significant consultancy assignments across rail, water, mining and electricity clients including repeat business with existing clients in Western Australia and New South Wales. Some of these projects are scheduled to be completed till mid-2020.

In addition, with the onboarding of new SaaS clients, K2fly is looking to promote its consultancy services to these Tier 1 organisations and secure additional opportunities. Meanwhile, the company is engaged in contract negotiations around major consultancy opportunities in the United Kingdom and provide relevant updates in this regard.

Corporate Update

K2fly completed a placement of 6,250,000 fully paid ordinary shares at $0.16 each raising $1,000,000 (before costs) on 26 September 2019. The funds raised have been indicated to be directed towards the recently announced RCubed contracts, anticipated new contract wins and to deliver further sales growth for the company.

The issue price reflected a 12.6% discount on the VWAP over the 30 trading days prior to the date of the announcement of the Placement. K2fly also paid a placement fee of 6% to Canary on the funds raised pursuant to the Placement.

The cash balance stood at approximately $1.41 million as at 30 September 2019. In addition, there was nearly $955k in aged receivables from Tier 1 clients and Work in Progress worth $100k with existing clients which will be invoiced on delivery. The latest figures are a clear demonstration of K2flyâs steady progress towards achieving its goal of net positive cashflows as well as attaining Global Leadership in ESG (Environmental, Social and Governance), with rapid commercialisation and adoption of Infoscope and RCubed.

Stock Performance: On 31 October 2019, K2F was trading at AUD 0.160, climbing up 3.23% by AUD 0.005, with a market cap of AUD 12.66 million (AEST: 1:40 PM). The stock has delivered impressive returns of 29.0% in the last six months and 19.23% Year-to-date.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.