Consulting Systems Integrator, K2fly Limited (ASX: K2F), based in Australia, has had a momentous year to date. The company continued to derive revenue from multiple channels including software licencing, consulting, support and configuration with a focus on enabling the âessentialâ industries and delivering value through partnership.

Marking a sound start to 2019, January saw K2F becoming the sole Australian reseller of Totalmobile.

Marking a sound start to 2019, January saw K2F becoming the sole Australian reseller of Totalmobile.

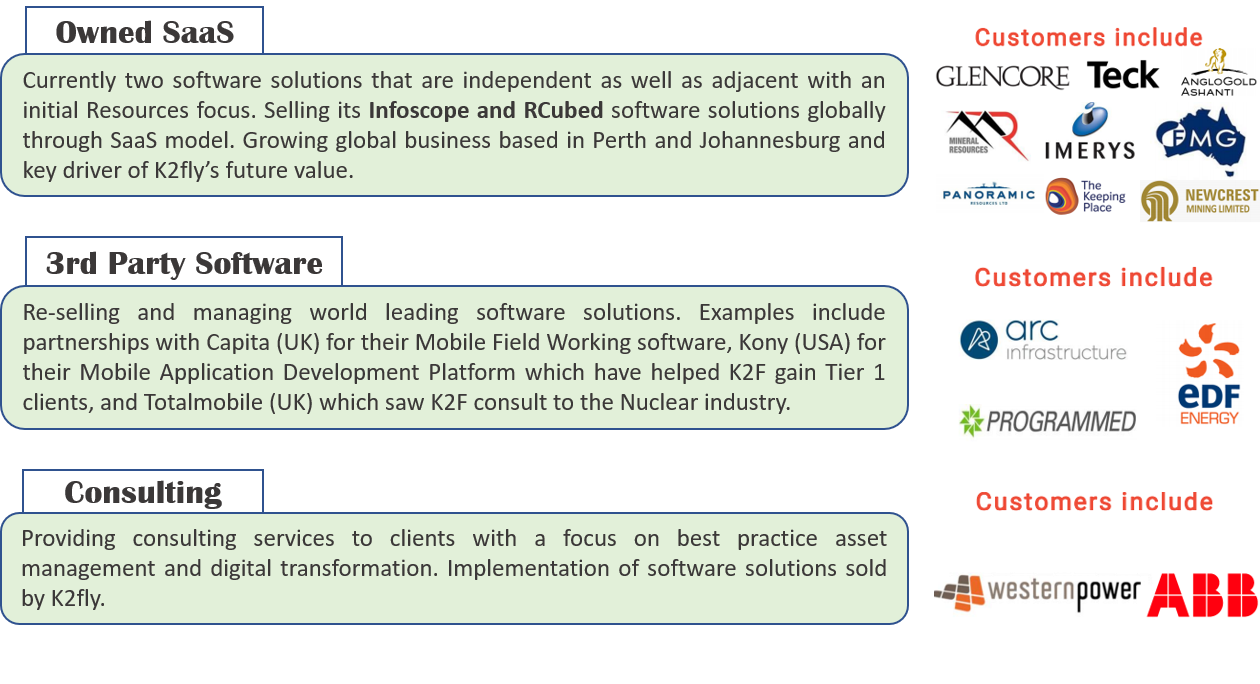

In February 2019, K2fly signed an annual software agreement with mining services provider, Mineral Resources Limited, to provide and implement the Infoscope Land Management System (LMS), which largely lowers operational risk whilst improving efficiency by enabling project operators to gather and share critical information with all stakeholders, including regulators.

Under its third-party/ Mobility solutions segment, K2fly was subcontracted in March 2019 to provide consultancy services to Totalmobile on a significant project in the UK with one of the worldâs largest power companies and a global leader in low-carbon energy â Electricité de France (EDF) that boast of ⬠68 billion in annual revenue and a global staff of 150,000. This was the first overseas consultancy contract and a testimonial to K2Fâs consultancy expertise being internationally-recognised. Later in the same month, WA based Panoramic Resources Limited, a base metal mining and exploration company, signed a contract to use Infoscope, demonstrating growing market acceptance for the solution.

Contract extensions worth over $ 250k were also executed with both Western Power and Arc Infrastructure for consultancy services.

May 2019 turned out to be extremely crucial for the company as it expanded on its SaaS based offering with the acquisition of South African company, Prodmark Pty Ltd and associated entities, relating to the RCubed Resources and Reserve Reporting software. It highly strengthened K2flyâs SaaS solutions, which initially comprised Infoscope, targeting the Resources sector. Major customers like Impala Platinum, Anglo Gold Ashanti and Teck Resources were added to K2fly client base through this acquisition.

Since then, the complementary SaaS-based Infoscope and RCubed software, have been a one-stop solution for businesses to fulfil their Environmental, Social and Governance (ESG) obligations, supporting their social licence to operate.

A strategic Reseller Agreement was also signed with Esri Australia Pty Ltd, the worldâs leading GIS technology provider and location-based analytics specialist, whereby Esri would work on distributing and positioning the Infoscope application within its ecosystem in addition to their own ArcGIS software.

During May, K2F commenced consulting assignments with two new clients in Queensland - New Hope Group and Stanwell Energy and won further contract extensions from existing clients including Westgold Resources, Fortescue Metals Group, Western Power, Arc Infrastructure and Programmed.

With the completion of the RCubed acquisition in June 2019, K2fly welcomed new client Imerys SA on board for the provision of RCubed Software solution for the companyâs mineral sand operations in 80 sites across 25 countries. French multinational Imerys SA, listed on the Paris Stock Exchange, boasts of revenues over ⬠4.5 billion per annum as it provides high value-added, functional solutions to multiple sectors including processing industries to consumer discretionary.

While negotiations continued with potential mining houses, K2fly hit a bonanza through RCubed Software Solution in August 2019 as Glencore Canada Corporation, a subsidiary of the Swiss multinational Glencore plc signed an AUD 250,000 worth of SaaS based software contract agreement for implementation of RCubed across Global zinc operations at 56 sites in 7 countries.

The business momentum with RCubed continued as K2fly signed new contracts with the largest ASX-listed gold producer Newcrest Mining Limited and Nexa Resources, a mining and smelting company from Brazil, in September and October respectively.

With major mining houses affected by changes (announced in October 2018) in the US Securities and Exchange Commissionâs (SEC) disclosure requirements for mining company issuers, the demand for RCubed solution has dramatically increased in the last few months and the trend is expected to continue. Companies operating in the US or listed on the NYSE would have to comply with the new rules from the financial year commencing on or after 1st January 2021.

K2flyâs is well-poised for rapid growth as the company continues to accrue higher margin SaaS revenue through Infoscope and RCubed and move towards achieving its goal of positive cashflow.

Stock Performance

K2fly has a market capitalisation of around $ 15.11 million and ~ 81.69 million shares outstanding. On 18 November 2019, the K2F stock was trading at $ 0.185, up 8.8% as compared to its previous closing price. The stock has also delivered positive returns of 30.77% on a YTD basis, and 54.17% in the last six months.

Read here: K2fly Annual Report FY19 Highlights

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.

_06_13_2025_06_30_45_136544.jpg)