K2fly Limited (ASX: K2F), based in Subiaco, Western Australia, is a technology company and consulting systems integrator helping businesses to transform digitally and achieve process improvement. The fusion of right people, products and strategic alliances enables the company to cater to clients mainly from the complex asset-intensive industries like mining, rail, oil & gas, water, electricity, and others.

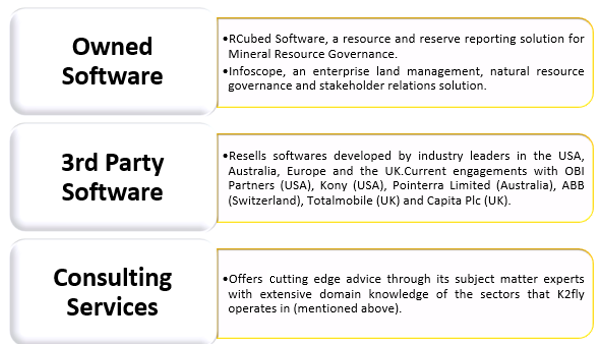

There are three primary sources of revenue generation for K2fly - Owned Software, Third Party Software and Consulting Services.

More on K2Fâs products can be READ here.

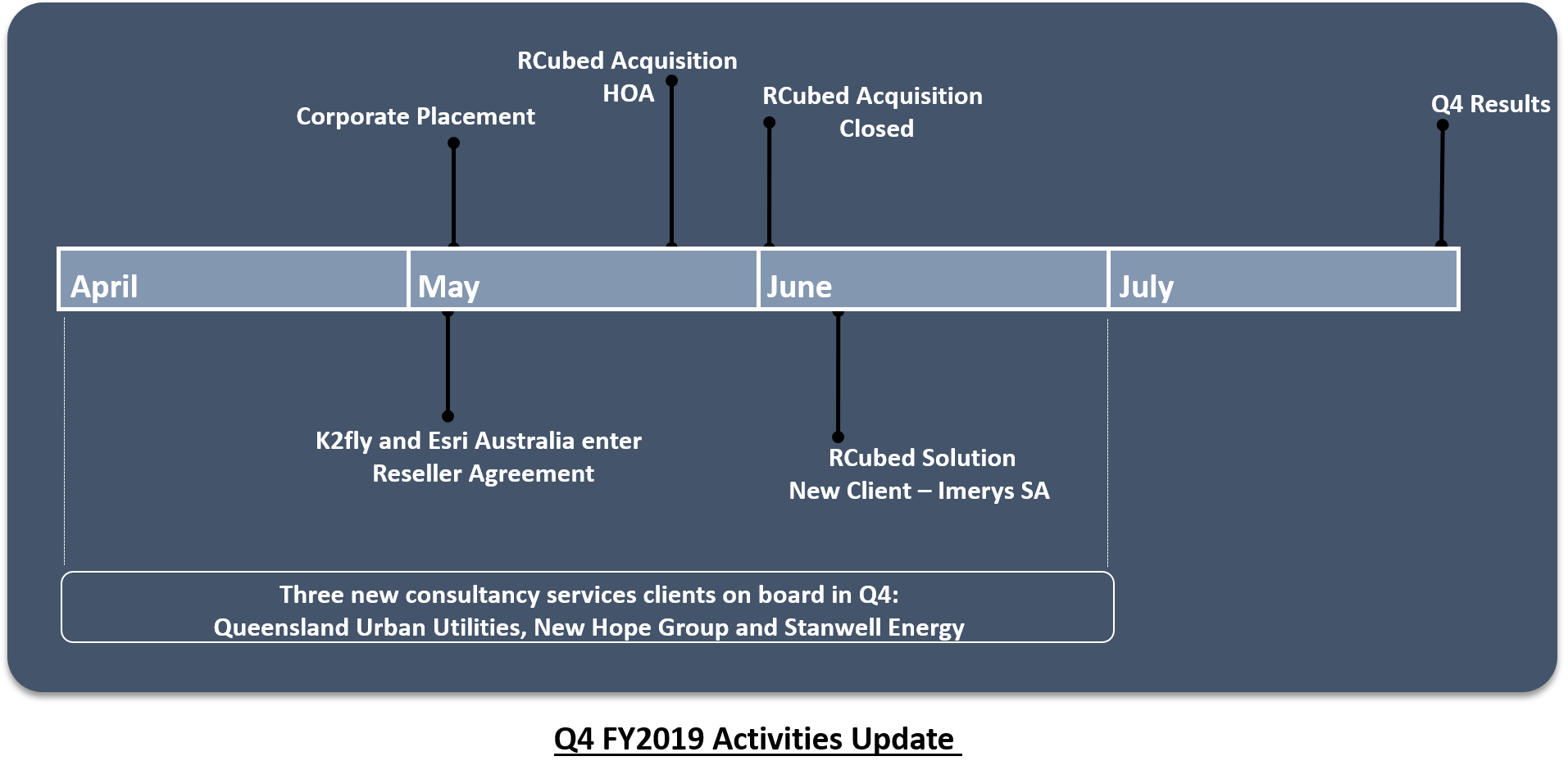

Fourth Quarter Activities Update

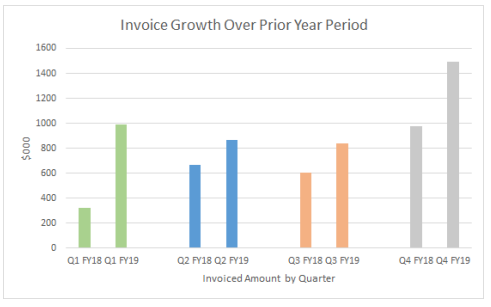

Billing and Cashflow- On 31 July 2019, K2fly disclosed its Quarterly Activities Report for the three months to 30 June 2019 (Q4 FY2019). The company informed that it raised invoices for $ 1.49 million, reflecting a growth of 52% over the same quarter in FY2018. As a result, the total invoices raised for FY19 amounted to $ 4,144,000, which is 61% higher than $ 2,574,000 reported in FY18.

For this quarter, the company reported net cash from operating activities of $ 62,000, net cash used in investing activities of $ 481,000 and a net cash flow from financing activities of $ 783,000. The company projects a total estimated cash outflows of $ 1,861,000 for the upcoming quarter.

K2fly had $ 1,060,000 of cash in hand available as at 30 June 2019 along with $ 850,000 in aged receivables from its Tier 1 clients. K2fly also informed that it currently has $ 50,000 worth of work in progress with existing clients (to be invoiced on delivery). The latest numbers are a clear reflection of the companyâs consistent progress as it aligns its operations towards steadily achieving net positive cashflows.

Source: Quarterly Activities Report June 2019

RCubed Acquisition and Sales Update- The RCubed solution, now added to K2flyâs proprietary offerings, was acquired in early June 2019 from South Africa-based Prodmark Pty Ltd through a binding heads of agreement signed in May 2019. RCubed supports reporting codes including NI43101, JORC and SAMREC across the five key global stock exchanges - ASX, LSE, NYSE, TSX and JSE.

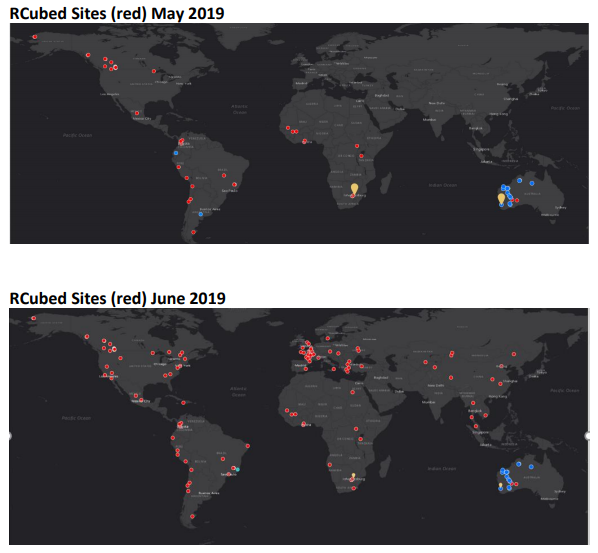

Following the strategic acquisition, K2fly onboarded a France-based client, Imerys SA, to provide RCubed Software solution for Imerysâ mineral sand operations spread across 85 locations in 25 countries, globally. Imerys SA, a Paris Stock Exchange-listed entity, is primarily engaged in the production and processing of industrial minerals and generates revenues of ~ EUR 4.5 billion per annum, backed by a team of over 18,000 employees.

The signing of the French client increased the number of K2fly RCubed sites by 2.3 times to 150. (impact demonstrated below in the picture).

(Image Source: Companyâs Report)

US Demand for RCubed â The disclosure requirements for the mining company issuers in the US were revamped last year (October 2018) as the Securities and Exchange Commission (SEC) implemented a new rule. This marked a major change for the US companies as they have been following the Industry Guide 7 for over 30 years but have been added to the category of countries like Australia, Canada and South Africa which are already following CRIRSCO (Committee for Mineral Reserves International Reporting Standards) reporting codes.

Accordingly, the mining companies operating in the US or listed on the NYSE (New York Stock Exchange) would have to be compliant with the new rules in their first fiscal year commencing on or after 1 January 2021.

Thus, regulatory changes, coupled with the retirement of certain in-house systems in the US, has reportedly generated extraordinary demand for the RCubed solution. As a result, K2fly is holding contractual negotiations with some large resource companies for the provision of RCubed. As per the company, although these contracts often take considerable time to be finalised because of the enterprise-wide impact and numbers of internal stakeholders involved, they are optimistic of being a preferred bidder in a handful of potential sales situations.

It has been a busy period for the company since the acquisition and various senior Perth-based personnel have visited the South African office to participate in meetings with significant prospective clients.

Other contracts â During the three months, K2fly also signed three new consultancy services clients: Queensland Urban Utilities, New Hope Group and Stanwell Energy.

In addition, the company also executed extension of contracts with existing clients (Western Power, Arc Infrastructure, Fortescue Metals Group (ASX: FMG), Programmed and Westgold Resources (ASX: WGX) for over $ 1 million, mainly concerning the Infoscope solution offering and for consulting services.

Consistent with Strategic Partnerships- K2fly believes its strategic partnerships are crucial to attaining long-term growth and sustainability of the business. Therefore, the company continued to jointly work with SAP and Esri to position its Infoscope software product suite to the existing and new clients, including prospective clients beyond the mining industry.

As reported by the company, the partnerships with 3rd party Mobile Software partners; Capita, Kony and Totalmobile are also faring well. Finally, the company is looking forward to building and establishing more consulting collaborations like the one with ABB, wherein K2fly is offering assistance on a key project.

Corporate Placement â In early May 2019, K2fly completed the placement of 8,000,000 fully paid ordinary shares at $ 0.10 each, raising ~ $ 800,000 (before costs), which were utilised for funding the RCubed acquisition while a placement fee of 6.375% was paid to Canary Capital Pty Ltd on the funds raised.

With consistent strides reported so far, K2fly is delivering on its strategy to achieve global leadership in environmental, social and governance (ESG) and help its resource industry clients to develop sustainability reports that reinforce their social license to operate on land.

Stock Performance

As of 2 August 2019, K2flyâs shares were trading at AUD 0.190, climbing up 2.778% by AUD 0.005 with ~ 59,288 shares traded (as at AEST: 2:26 PM). In addition, K2F has generated positive returns of 42.31% on YTD basis and 54.17% in the last three months.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.