K2fly Limited (ASX:K2F), based in Subiaco, Western Australia, operates a software-as-a-service (SaaS) business and provides an integrated software ecosystem for the management of assets (physical or data) in asset-intensive industries, serving clients worldwide.

In addition, the company offers cutting edge consulting services in areas including Rail, Gas, Electricity, Water, Mining, Oil & Gas, and Facilities Management. K2fly also re-sells softwares through establishing strategic partnerships and aligning with industry leaders in the USA, Australia, Europe and the UK .

The three distinct yet complementary revenue streams of the business include-

- Owned software- The company sells their Infoscope software solution through SaaS model which addresses Environmental, Social and Governance obligations. The strategic alliances with SAP (Germany) and Esri (USA) are expected to increase the sales opportunities for these services. The Group has Fortescue Metals Group Ltd (ASX: FMG), Mineral Resources Ltd (ASX:MRL), Westgold Resources Limited (ASX: WGX), and Panoramic Resources (ASX: PAN), among its key clients for this business.

- 3rd party software- The reselling and managing of software solutions comes under this segment and examples include partnerships with Capita (UK) for their Mobile Field Working software, Kony (USA) for their Mobile Application Development Platform which has provided access to Tier 1 clients, and Totalmobile (UK) that helped the company break into the Nuclear industry. Key clients for this business include Arc Infrastructure, Programmed, FMG and EDF Energy, among others.

- Consulting services- K2fly offers consulting services to clients with a focus on best practice asset management and digital transformation. Some of the Groupâs clients for this business include Western Power, Horizon Power, ABB, Snowy Hydro, EDF Energy and Public Transport Authority.

In 2017, K2fly completed the highly complementary, synergistic and value accretive acquisition of Infoscope, a land management and stakeholder relations solution for the energy and resources market. A number of synergies have been harvested through the acquisition and Infoscope quickly became the flagship product of the company. Infoscope engages stakeholders with spatial intelligence and is an advanced way to manage land and social license to operate.

Source: K2Fâs Investor Presentation

Among its many projects, K2F is engaged with The Keeping Place, which houses their indigenous heritage repatriation program sponsored by BHP Group Limited (ASX: BHP), Rio Tinto Limited (ASX: RIO) and Fortescue Metals Group Ltd (ASX: FMG). A new fit-for-purpose entity is being formed (previously, a part of the National Trust WA), and there are more than 20 Indigenous communities looking to join The Keeping Place and utilise the Infoscope solution.

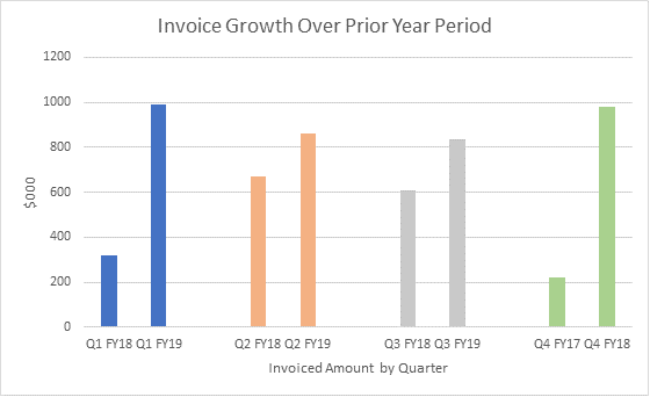

The company recently reported significant progress in the March 2019 quarter (Q3 FY2019), well in accord with its long-term strategy. During the period, K2fly raised invoices to the value of ~ $ 838k, an increase of 38% on $ 607k recorded in the equivalent quarter in FY2018.

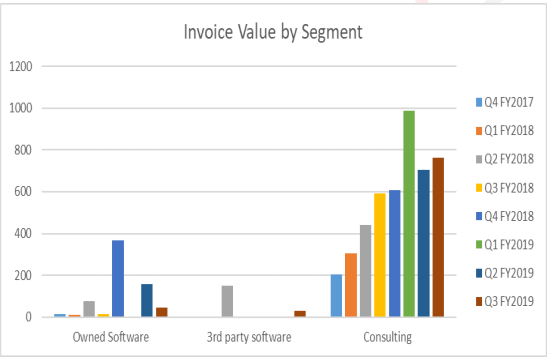

The invoices raised to date in FY2019 stand at ~ $ 2,692k which exceeds the entire total invoices raised in the FY2018. The quarter and segment wise invoice growth trends are illustrated as follows:

Quarter-wise Invoice Growth (Source: K2Fâs Investor Presentation)

Quarter-wise Invoice Growth (Source: K2Fâs Investor Presentation)

Segment-wise Invoice Growth (Source: K2Fâs Investor Presentation)

The company signed new Infoscope software license contracts with Western Australia-based mining companies Mineral Resources Limited (ASX: MIN) and Panoramic Resources Limited (ASX: PAN). In addition, it also signed two consulting services contracts. One with ABB which is estimated to generate ~ $ 1.5 million consulting revenue in 2019. The second contract was executed with Totalmobile for ~ $ 100k, to assist with the implementation of the Totalmobile product at EDF Energyâs nuclear business

The cash at hand was $ 705K as of 31st March 2019.

To support the consistently building revenue momentum, K2F aims to place the focus on growing the proportion of revenue from the prospective SaaS sales.

Following an eventful start of 2019, K2fly recently informed the market that it had executed a binding Heads of Agreement for its subsidiary, K2fly RCubed Pty Ltd, to acquire the assets of Prodmark Pty Ltd relating to the RCubed Resources and Reserve Reporting software. The cash consideration for the transaction is AUD 450,000, which was funded by a placement of 8,000,000 ordinary shares at 10 cents. The strategic move strengthens K2flyâs existing SaaS offerings targeting the resources sector and brings major customers like Teck Resource and Anglo Gold Ashanti to its business.

With ~ 75.35 million outstanding shares, the K2F stock is trading at $ 0.120 (As at 1:25 PM AEST, 20th May 2019).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.