Highlights

- Allup Silica is riding high on latest metallurgical test results of samples taken from its Sparkler project.

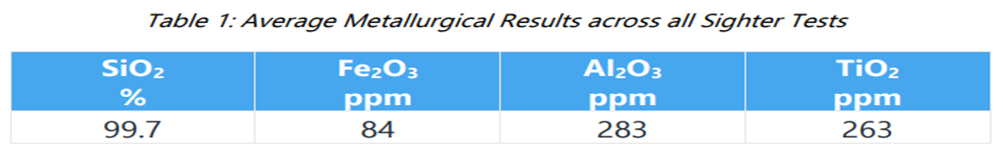

- The results delivered SiO2 grades of 99.7%-99.8% with Fe2O3 impurity falling to an average of 84 ppm.

- The company registered improvements in its process circuit design, as the results signify the mark of <100 ppm, a specification premium to the photovoltaic or solar panel industry.

- An impressive SiO2 recovery (yield) of 95%-97% has been obtained in all the sighter tests, subject to further optimisation.

Allup Silica Limited (ASX:APS) is thrilled with the findings of its most recent metallurgical tests, according to which the company has registered improvements in its process circuit design.

The samples, taken from Allup’s Sparkler Silica Exploration Project in Western Australia, have produced a consistently high-grade <100 ppm Fe2O3 silica sand product.

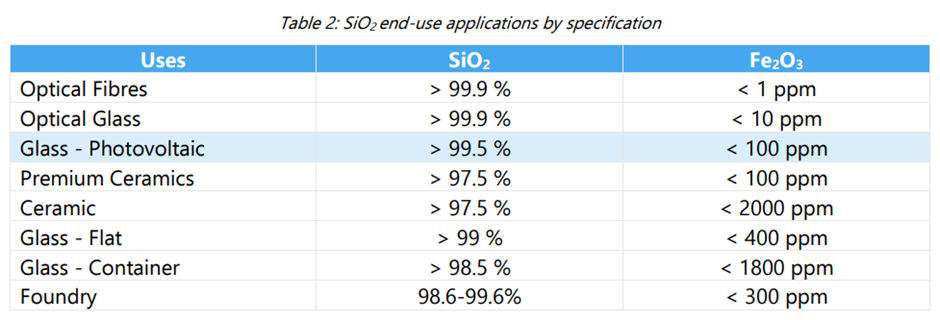

Noteworthily, grades of this purity are deemed appropriate for the photovoltaic industry, which also happens to be the primary target market for the company.

Source: Company update

How Fe2O3 impurities spell doom for silica sand products?

Silica sand as a raw material finds use in many applications like

- ceramics production

- optical fibre production

- refractory materials production and glassmaking, including the fabrication of specialty glass for photovoltaic and other high-tech applications like mobile telephone glass.

However, impurities, in particular Fe2O3, adversely affect silica sand products, by

- lessening transparency of glass

- discolouring ceramic products

- weakening optical fibre transmission, and

- lowering the melting point of refractory materials.

Silica sand with these impurities is usually less in value without any surprise.

Source: Company update

Where does achieving this grade position Allup?

The results associated with the recently enhanced process circuit design are

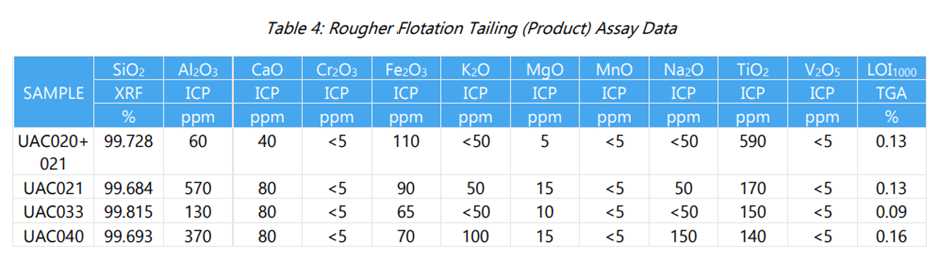

- Fe2O3 impurity dipped to an average of 84 ppm Fe2O3 (65 ppm to 110 ppm across 4 samples).

- SiO2 grades ranged between 99.7% (lowest) and 99.8% (highest).

- A phenomenal 95%-97% recovery (yield) of SiO2 was obtained across all the sighter tests, also setting the tune for further optimisation work.

In the company’s own words, their result on process circuit design is a positive step towards getting how to create a high-purity silica sand appropriate for use by the photovoltaic industry (specification >99.5% SiO2 and <100 ppm Fe2O3).

Furthermore, testwork is underway to improve the proposed process circuit methodology and hit the ultimate target of a consistent iron at sub-100 ppm across all the exploration projects of the company.

Sneak peek into the report

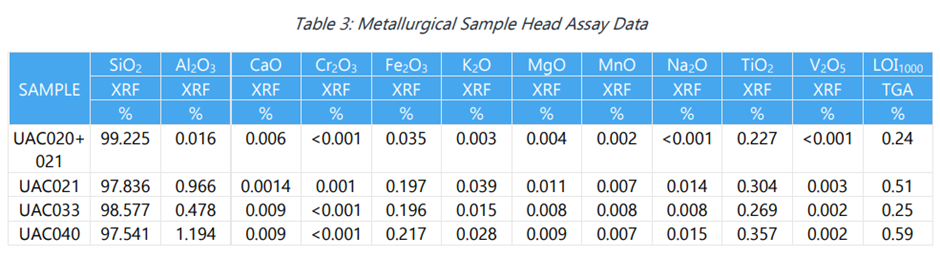

The testwork was performed on four samples from the Sparkler A Silica Exploration Project, as part of the current Inferred Mineral Resource Estimate. The metallurgical testwork was conducted at the Nagrom Mineral Processing facility in Perth. Thereafter, the results were forwarded to Battery Limits Metallurgical Consultants for review and preparing an Independent Metallurgical Report.

Source: Company update

The testwork covered a standard silica sand process circuit, including flotation. The summary data is mainly derived from the sighter flotation results.

The results show satisfactory recovery (>95%) of SiO2 to float tails (product), and a decrease in the grade of impurities in all the cases, with a dip in Fe2O3 of between 11% and 33% (Fe2O3) recovered to concentrate.

All in all, of the four sighter tests performed, there were variations in grades of SiO2, with 3 obtaining Fe2O3 grade with <100 ppm alongside considerable decrease in Al2O3 and TiO2.

Source: Company update

Allup is of the opinion that high-grade silica sand of this specification with low iron content will see high demand in the manufacture of premium ultra-clear cover glass, specifically for the growing photovoltaic manufacturing industry.

What lies next?

The next work program will serve multiple objectives:

- coming up with a more consistent, low-impurity (<100 ppm Fe2O3) product

- seeking the possibility to bring down operating and capex costs

- ensuring consistent Quality Assurance/Quality Control (QA/QC) in place, and

- inventing a methodology to support increase in the depth of sand to be viably mined, since this may increase estimated mineral reserves.

APS shares were trading at AU$0.099 midday on 12 October 2022, up 10% from the last close.