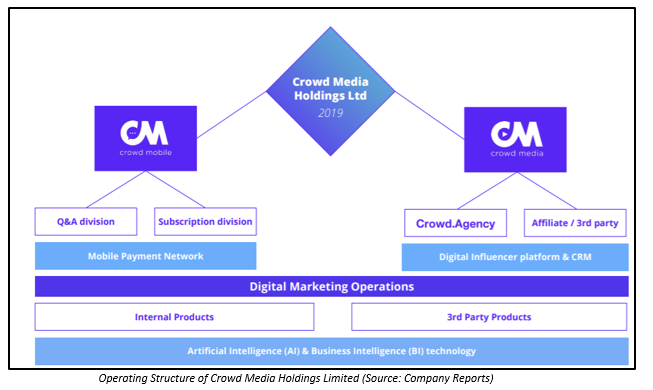

Crowd Media Holdings Limited (ASX: CM8) is a global media and marketing company with partnerships spanning across various fashion, beauty and lifestyle brands. The company mainly operates two divisions:

- Digital Marketing Division (Media) â This division works hand in hand with brands and digital influencers to deliver branded content to the massive and fast-growing millennial and Generation Z market.

- Mobile division- This division produces content like apps, games and music.

The company recently entered into a new financial year i.e., FY2020 with the expectations of moving back to profitability. On the financial front, FY19 was not a strong year for the company; however, it was a year of transition for Crowd Media, as the company was more focused on its rapidly growing media division. In order to better reflect its focus, the company even changed its name from Crowd Mobile Ltd to Crowd Media Holdings Ltd.

The rationale for the name change is:

- To focus more on the companyâs core strength in social media marketing;

- Clear positioning in a high growth area;

- Alignment across the group with Media, Subscription and Q&A.

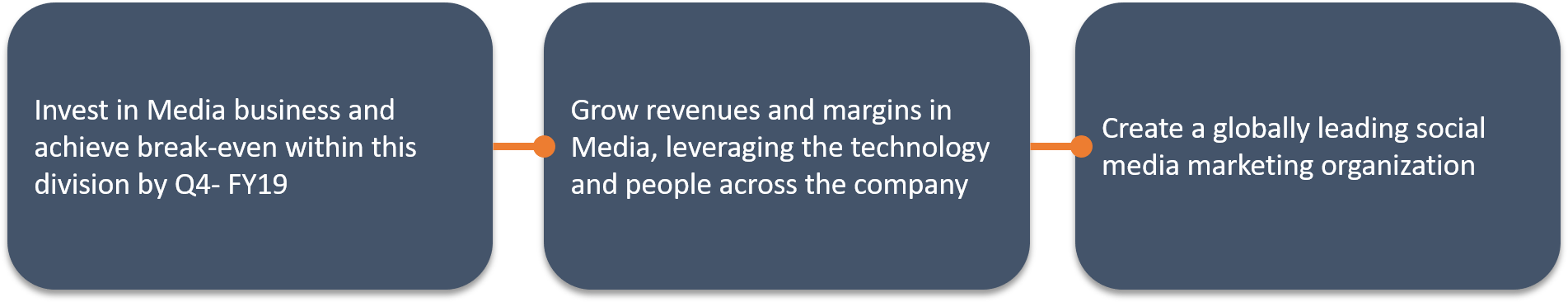

To accelerate growth in this division, the company followed the following strategies:

FY19 Results Forecast: The company has not yet published its FY19 results; however, it expects to register revenue of around $1.7 million from the media division, up 240% on FY18.

Overall, the company expects to report a group revenue of around $24.6 million in FY19 and an underlying FY19 EBITDA loss of $4 million. As compared to FY18, the forecast FY19 results are lower; however, in FY20, the company expects to be in a profitable state with positive cashflows.

Following a strategic review first announced to the market in mid-April 2019, the company recently implemented a range of aggressive cost-cutting measures, which are expected to result in estimated annualised cost savings of around $3.5 million, helping the company to move back to profitability.

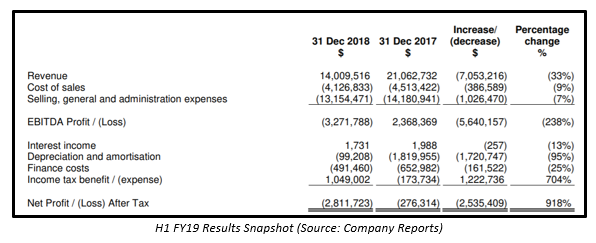

H1 FY19 Performance: For the first half of FY19, the company reported revenue of around $14 million which includes Q&A revenue of $9.04 million, Subscription revenue of $3.68 million and Media revenue of $1.28 million. During the half year period, the Q&A business experienced headwinds and thus reported softer than expected revenues. The company reported an EBITDA loss of $3.27 million and net loss after tax of $2.811 million. It is to be noted that the EBITDA and net loss included impairment of receivables of $1.72 million, a non-cash share-based payment charge of $12,375, restructuring costs of $130,364 and share issuance costs of $131,525.

In the half year period, the company witnessed a 25% decline in its selling, general, and administrative expenses, driven by a decrease in marketing and cost saving initiatives. The company expects to report a further decline in SG&A in line with the additional operational and employee costs savings that would materialise in the second half of FY19.

The Board is very much supportive of these cost cutting measures. In order to conserve cash, Crowd Mobileâs CEO agreed to accept 50% of his salary in Crowd Media shares in place of cash and likewise, the Chairman and Board also agreed to accept 25% of their fees in Crowd Media shares instead of cash.

As at 31 December 2018, the company had current assets of $7.268 million and current liabilities of $6.96 million, taking the total net assets to $2.76 million.

FY18 Performance: The year FY18 was a very challenging year for the company. Revenue, underlying EBITDA and operating cashflow for FY18 were around $38.6 million, $3.6 million and $2.6 million, respectively. During FY18, the companyâs Media division witnessed significant growth, while the Q&A division held steady and the Subscription division suffered a drop-in revenue.

The performance of the Q&A division in FY18 was broadly in line with FY17, with a revenue of $24.7 million. During the year, the number of billed messages increased 8%, reflecting the natural move to larger but lower unit pricing markets such as those in Latin America.

The companyâs subscription business in FY18 was impacted by major regulatory headwinds and the maturity of the Subscription model. As a result of that, it reported a 30% decline year on year with revenue of $13.3 million.

Outlook FY2020: With the implementation of various cost saving measures in FY19, CM8 expects to have a positive EBITDA and operational cashflow in FY2020. While keeping its focus on reducing the debt, the company will try to deliver globally competitive social media and digital influencer campaigns via its media division and will also try to stabilise and grow the revenues of its Mobile division.

Recent Updates:

- Executed new 3rd party agreements for digital marketing services including digital influencer marketing for multiple international brands;

- Executed a pilot agreement with Moneyfarm, one of the largest digital wealth companies in Europe, reflecting the shifting focus of Crowd Media to the large and growing digital influencer and social media marketing sector;

- The company entered into a Convertible Securities Agreement with Obsidian Global Partners, LLC (Investor);

- Launched a new media kit to reflect the shifting focus of Crowd Media to the large and growing digital influencer and social media marketing sector;

- Signed two initial Insertion Orders (Agreements) with cannabis hemp CBD oil company Elixinol to help Elixinol acquire new customers for its organic hemp oil products.

Stock Performance: On 19th August 2019, CM8âs stock closed the dayâs trade at a price of $0.019, up 5.556% intraday with a market capitalisation of circa $4.49 million.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.