Both seasoned and budding investors have a common trait- they are always on a hunt for new opportunities, to add a flavour to their respective investment portfolios. To satisfy their craving of tapping the most feasible investment, global stock exchanges provide an ocean of options, which require micro and macro-level research and analysis before proceeding with the investment process. One such attractive option in this hunt are small cap stocks, given the outburst of the small cap stock news of late.

ASX-listed small cap stocks have always been on an investorâs checklist for the many benefits that they offer. Before understanding these benefits, let us break down the concept of small cap stocks:

Small Cap Stocks

The companies classified on the basis of a small market capitalisation (the market value of its outstanding shares) constitute the small cap stocks. The concept has a different take amongst various industry experts, but ideally, a company which bears a market capitalisation of less than US$2 billion is regarded as a small cap company.

A majority of market experts believe that small cap stocks are better performers than the large cap stocks, but one should be aware of the dynamic market landscape, as this ideology varies with time in a change-prone broader economic climate.

Pros and Cons of Small Cap Stocks

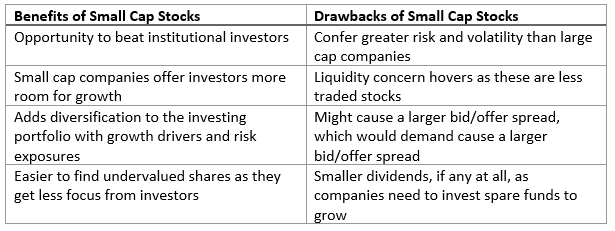

As is the case with every constituent of the share market, small cap stocks come with a set of advantages, which positively build the investors sentiment towards them, along with certain disadvantages, which makes one cautious before making investing decisions in the small cap stocks space. Let us understand both these cases:

How to tap small cap stocks?

Investors have always been tempted to invest in small caps at some point in their investing phase. The ones who have succeeded vigilantly found the right small-cap stocks for their respective portfolios, steering them in the right direction and filling in their pockets.

At this point, one should note- subject experts believe that several successful small-cap investments come from very basic business models. Even if the business model is simple, it is the investors who drive up stock prices.

Let us take a sneak peek at a few ways, which could be considered as guidelines when an investor wishes to try his luck with the small cap stocks:

- Pursue pattern shifts that are opening new opportunities- a vigilant search for small company suppliers, transition leaders and industry transitions.

- Invest only when the market opportunity is vast and measurable- small companies serving large markets bear the potential of enormous growth with even a small market share. The market size paves huge gains while reducing the risk profile.

- Invest in small stock companies before they come under investorsâ radar- this is when extensive research and vigilant market approach comes into practice. Before big investors are on board, one can tap lucrative stocks, as subsequent investment by investors would eventually drive up stock values.

- Tap stocks that offer growth as well as value- checking the companyâs market potential versus its total market capitalisation, its balance sheet (cash and debt) would aid in the decision-making process.

- Wary to the bear markets, market corrections and the fact that small caps are more volatile than large caps, an investor should expect larger swings in the stock prices and avoid catastrophic losses (stop loss level).

Where to Find small cap stocks asx?

Since we understand the things to bear in mind while investing in small caps, let us now acquaint ourselves to the ultimate destination to find these, which is the benchmark for small cap Australian shares. The S&P/ASX Small Ordinaries Index represents the small caps, those members of the Index S&P/ASX 300 that are outside the Index S&P/ASX 100.

However, the S&P/ASX Emerging Companies index has much smaller cap companies listed in its kitty, which are often referred to as âmicrocap stocksâ.

An investor can buy the small and emerging companies in the same way as he/she would buy other shares- via a fund or a broker. To ease the investorâs hunt, managed funds and exchange traded funds, which tracks an index of small cap shares can be tapped.

Small Cap Performance on ASX

Industry experts believe that due to the potential returns that are on offer at the small end of the share market, a little exposure to small caps is always a great option for an investing portfolio, if an investorâs risk profile allows for it. The current times are regarded as lucky and apt if one wishes to go the small cap route, as the Australian share market holds a good number of promising options presently.

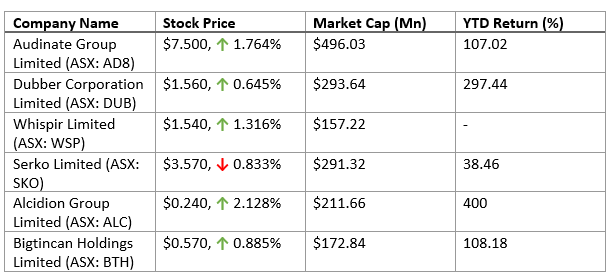

Below are a few small caps companies, with their stock performances and YTD returns, after the end of the trade session of the Australian Securities Exchange on 16 October 2019:

The S&P/ASX SMALL ORDINARIES (XSO), settled the dayâs trade at 2,892.0, up by 41.3 basis points or 1.43%. The S&P/ASX Emerging Companies Index (XEC), also settled the dayâs trade in green, at 1,575.8, up by 0.17% or 2.7 basis points.

Even though small-cap stocks are often overlooked by traders against their famous and large cap counterparts, they do offer an abundance of opportunities for traders and investors, if looked deeply at. Small-cap stocks have the capability to make one big deal, ink a lucrative deal, make a huge announcement, and surprise the market as these instances set the value of their company soar in no time.

Therefore, one should aim at diversifying their portfolios and try these smaller size, lower prices and thinner liquidity options, which are likely to create greater opportunities to profit from short-term changes in prices. Higher the risk, higher the reward is an age-old belief of the stock market, which stands true in the concept of small cap stocks.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.