The health care is facing many challenges, few of them are rising health care costs, changing patient demographics, evolving consumer expectations, new market entrants and complex health and technology ecosystems. The Australian health care industry is forecasted to continue growing strongly over the next four-five years due to Australia's changing patient demographics, rising frequency of several chronic diseases as well as increasing the health insurance coverage by private health insurers.

According to some market research report, it is anticipated that in 2019-2023, the global health care spending might increase with a CAGR of 5%, this would create many opportunities for the health care sector in upcoming years.

In this article, we are highlighting three ASX listed health care stocks key accomplishments in 2019 and the outlook of the company for the forthcoming year.

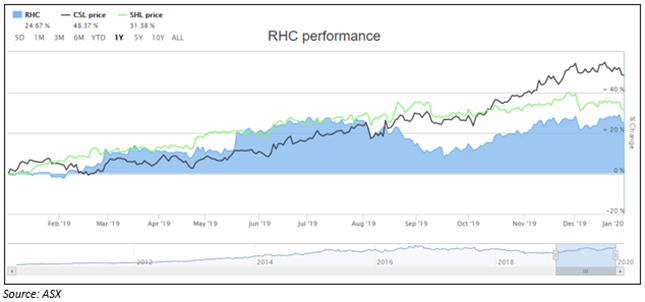

When we look at the performance of all three stocks on ASX for last year, all stocks have shown decent growth in 2019. All three companies have delivered a positive return in the last one year.

By seeing the performance of stocks and the achievements done in the financial year 2019, it is anticipated that the past achievement of the stocks could be a great asset for achieving set goals for the upcoming years. In last one-year CSL stock has delivered a positive return of 48.37%, RHC and SHL stock has delivered a positive return of 24.67% and 31.38%, respectively.

The below graph compares the return generated by all three stocks in the last one year-

Let us discuss in detail for RHC, CSL and SHL-

Ramsay Health Care Limited (ASX:RHC)

An ASX listed private hospital operator Ramsay Health Care Limited (ASX:RHC) was established in 1964 and owns and operates approximately 235 hospitals, psychiatric and rehabilitation units, treatment facilities, surgery centres as well as a nursing college in the UK, Australia, Malaysia, France, Indonesia and Italy. The company provides a comprehensive range of health care requirements from primary care to highly complex surgery, as well as mental health care and rehabilitation.

Group CFO Appointment-

On 18 December 2019, Ramsay unveiled the appointment of Mr Martyn Roberts as Group CFO and would begin in the role in the first half of 2020. Currently, Mr Roberts is working as Group CFO in at Coca-Cola Amatil.

Mr Roberts has a great working experience and has a strong track history of achievement in driving performance enhancement, before Amatil, he had worked for 7 years at Woolworths Ltd in various senior executive roles.

He is an accomplished CFO with 20 years’ experience, and his experience and achievements would be valuable for the Ramsay to accomplish its set goals for 2020.

AGM Highlights-

The company updated the market by its Annual general meeting (AGM) presentation on ASX, highlighting the achievements of the fiscal year 2019 and with the outlook of the company in the forthcoming year. The quick outlook highlights are-

- In 2019, the company was positioned as a leader in healthcare service provider having diversified portfolio.

- In the fiscal year 2020, the company expects stronger volume growth.

- In the financial year 2020, Ramsay would continue to target Core EPS growth on the basis of 2-4 per cent. This relates to negative Core EPS growth of -6 per cent to -4 per cent under the accounting standard AASB16 of the new lease. Ramsay’s guidance is based on Core EBITDAR growth of 8-10 per cent, which is unaltered by the standard of the new lease.

- Major Brownfields forecast for completion in the financial year 2020.

Stock Information-

RHC’s market capitalisation stands at around AUD 14.55 billion, with nearly 202.08 million shares outstanding. On 3 January 2019, the RHC closed the day at AUD 72.630, edging up by 0.861%. The RHC’s stock has 52 weeks low and high price at AUD 56.220 and AUD 74.850, respectively. The P/E ratio of the stock stands at 27.180x, with an annual dividend yield of nearly 2.1%.

A leader in providing in-licensed vaccines CSL Limited (ASX:CSL) is the biggest and fastest-growing protein-based biotechnology businesses. The company fully focused on developing new vaccines for rare and serious diseases and influenza. CSL’s innovations are applied across the globe for the treatment of various neurological disorders, hereditary angioedema, immunodeficiencies, bleeding disorders, and α1 antitrypsin deficiency.

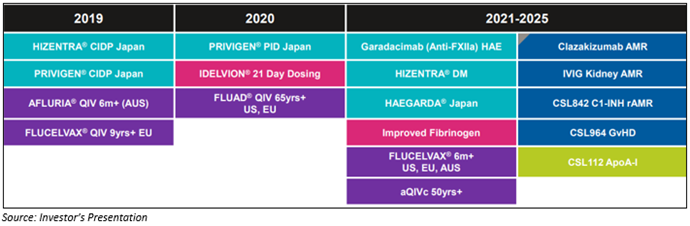

In early December, the company updated the market with its R&D briefing for the year 2019 discussing the clinical portfolio progression and regulatory approvals achieved in 2019. CSL Limited mentioned that in the fiscal year 2019, the company invested approximately USD 832 million into its research and development portfolio, representing 9.7 per cent of total revenues.

The highlights from the research and development briefing are-

- The company also unveiled the collaborations and key partnerships for different pre-clinical and clinical phases-

- Collaboration with Denteric for pre-clinical study on P. gingivalis/POD.

- Collaboration with Momenta and ASLAN pharma for phase 1 clinical study of CSL730 rFc Multimer and CSL334 / ASLAN004 IL-13R, respectively.

- For phase 2 study of Mavrilimumab GM-CSFR collaboration with Kiniksa.

- Collaboration with Vitaeris and Blood & Marrow Transpalnt clinical trials network for phase 3 study of Clazakizumab Anti-IL-6 and CSL964 GvHD treatment, respectively.

- The company has Significant target launch dates for upcoming products.

Stock Information-

CSL’s market capitalisation stands at around AUD 124.83 billion, with nearly 453.87 million shares outstanding. On 3 January 2019, the CSL stock closed the day at AUD 277.300, edging up by 0.822%. The CSL’s stock has 52 weeks low and high price at AUD 184.000 and AUD 287.900, respectively. The P/E ratio of the stock stands at 45.530x, with an annual dividend yield of nearly 0.97%.

Sonic Healthcare Limited (ASX:SHL)

Sydney headquartered ASX listed health care company Sonic Healthcare Limited (ASX:SHL) is into imaging, laboratory and primary medical care services to be provided to community health services, health care practitioners, hospitals and their collective patients. Sonic healthcare is third largest medical laboratory company in the world, operating in the USA, Germany, Switzerland, Australia, United Kingdom, Belgium, New Zealand and Ireland with more than 37,000 employees.

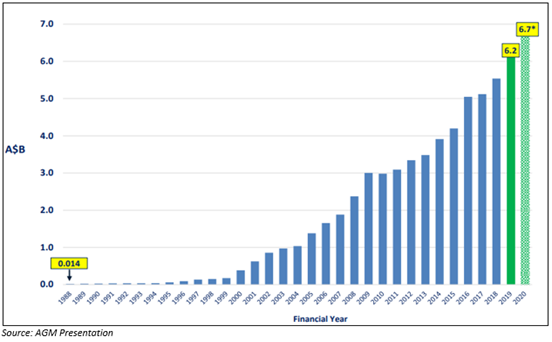

In November 2019, the company updated its Annual General Meeting presentation on ASX, discussing the financials for the year 2019 and the company’s outlook.

For the financial year 2019, Sonic healthcare generated revenue of approximately AUD 6.2 billion in the last financial year and the projected revenue for the fiscal year 2020 is nearly AUD 6.7 billion on the basis of the market consensus forecast.

|

* FY 2020 revenue, including a full year of Aurora acquisition, based on market consensus forecast, including FX rate assumptions. Illustrative only, not Sonic guidance. |

Outlook-

- Sonic healthcare well positioned for ongoing robust growth and have well planned pipeline of contract, joint venture and acquisition opportunities.

- The company has a strong balance sheet with headroom for expansion.

- Sonic healthcare has stable, experienced and vibrant global management teams, and geographical diversification offers growth opportunities and risk mitigation.

- Procurement and other synergy initiatives delivering ongoing benefits.

- Sonic’s global team of more than 1,000 pathologists, over 200 radiologists and up to thousands of qualified technical staff underpin its medical leadership culture.

Stock Information-

SHL’s market capitalisation stands at around AUD 13.6 billion, with nearly 475.02 million shares outstanding. On 3 January 2019, the SHL stock closed the day at AUD 28.900, edging up by 0.908%. The SHL’s stock has 52 weeks low and high price at AUD 21.420 and AUD 30.620, respectively. The P/E ratio of the stock stands at 23.380x, with an annual dividend yield of nearly 2.93%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.