Companies under the communications sector provides access to services like data, voice, video over wire, wireless networks and many more. This sector has improved the way people interact due to enhanced connectivity. Owing to rising demand in internet connections and mobile connectivity, telecommunications industry is competent to generate higher revenues in the coming years.

However, a decline in demand from fixed line services can hamper the revenue generation. Households in Australia pay a high price because of the exceptional structural traits of the Australian telecommunications market. Also, 2019 was marked as a crucial year for the industry as a number of situations play out.

The recent merger of two big companies Telstra and Optus gave a solid competition in the market, generating a greater scale and an ability to bundle and cross-sell mobile and fixed services. Increasing rumours for the launch of 5G services are attracting and retaining customers, giving the companies opportunities to plan new apps, which will drive growth in the coming years.

Rapidly evolving and rising products and services for instance, Skype, WhatsApp and Zoom, are bringing the significant change in the telecommunications sector. Educational and Entertainment services are directly accessible on mobile phones, leading to a broad and expanding range of services available to customers.

Let us have a look at communications sector stock- Telstra Corporation Limited

Telstra Corporation Limited (ASX: TLS)

Telstra Corporation Limited (ASX: TLS) is a telecommunication carrier which provides information and telecommunication services, including mobiles, internet, and pay television to domestic and international customers.

Dividend/Distribution â TLS: The company declared a fully franked dividend of 8 cents per share on ordinary fully paid shares (for the 6 months period closed 30 June 2019) which was paid on September 26, 2019, bringing the total dividend for FY19 to 16 cents per share, hence returning $1.9 billion to its shareholders.

FY20 guidance for NBN Coâs Corporate Plan: The company has recently updated its FY20 guidance after the NBN companyâs corporate plan of FY20. The change in NBN guidance impacted the Telstraâs cost reduction to decline from $660 million to $630 million, total income to lie in between $25.3 billion to $27.3 billion and updated EBITDA guidance of $7.4 billion to $7.9 billion. The company does not expect FY20 period to be the peak NBN headwind year and presently expects it to take place in FY21 period.

Financial Highlights

- The company managed to meet its guidance and achieved strong subscriber growth in both fixed and mobile, and built significant momentum in FY19, as stated in the annual report for the period closed 30 June this year.

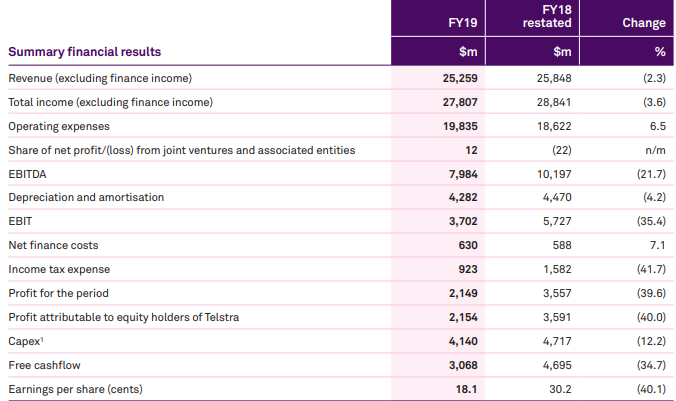

- During the year, EBITDA of the company went down by 21 percent to stand at $8 billion underpinned by the impact of the NBN, where TLS absorbed ~$600 million of negative recurring EBITDA headwind during the time.

- Total income went down by 3.6% to $27.8 billion resulting in decline in NPAT (Net Profit After Tax) by 39.6% to $2.1 billion in FY19.

Financial Performance (Source: Company Annual Report)

- During the year, free cashflow generated from operating and investing activities stood at $3,068 million representing a decline of 34.7%. This was primarily due to lower EBITDA including increased restructuring costs and working capital, counterbalanced by lower cash capital expenditure and tax paid.

- Further, during the period, balance sheet remains in a strong position with net assets of $14,530 million and net debt decreased by $12 million to $14,727 million, comprising the reduction in gross debt and a $25 million reduction in cash and cash equivalents.

Business Highlights

During the year, the company witnessed customer growth, with additional 378,000 net retail post-paid mobile services, including 181,000 from Belong, taking retail mobile post-paid handheld services to 8.2 million.

- The companyâs Internet of Things business surpassed the industry growth rates, with revenue growth of 19.4%. On an average 2,000 things are being linked to the companyâs IoT networks daily involving vehicles, machines, infrastructure, smart meters and a wide array of other sensors.

- TLS offers world class networks to its customers and is the first one to roll the next generation of technology (5G). Telstra leads the connectivity and networking space in Australia, as they have erected 600 mobile base stations as part of the Federal Governmentâs Mobile Black Spot Program. By the end of the program, TLS plans to build around 800 stations, 4x more than the rest of the industry combined.

- The launch of T-22 in June 2018 simplified the products and services of the company and is making good progress on the strategy. T-22 is underpinned by multi-billion-dollar strategic investment program to digitise and automate systems and deliver the networks for the future, including 5G.

What to Expect

- The cost reduction and portfolio management programmes are on track to reach the target of $2.5 billion by the end of 2022. The company also expects to sell three global data centres in Europe and Asia to I-Squared Capital, global private equity firm, the owners of HGC Global Communications in the first half of FY20.

- Total remaining restructuring costs from T22 initiatives are expected to be in the vicinity of $350 million with around $300 million in FY20.

- The company also expects the labour costs to fall and are also focusing for future non-labour cost reduction in energy, IT and software costs, business operations and logistics.

- The top management of the company in its recent investor day, stated that it is likely to see an increase of $1 billion in working capital due to exit of mobile lease, outflows from restructuring costs and an increase in NBN receivables.

Stock Performance: The stock of TLS last traded at the market price of $3.650, down by 2.145% from its previous close, as on December 04, 2019. As per ASX, the stock gave a return of 37.04% on the YTD basis and a return of 5.97% in the past 30 days. This resulted the stock to trade towards its 52-week high of $3.978. As on 4 December 2019, the market capitalisation of the company stood at $44.36 billion and last traded at a P/E multiple of 20.610x, earning a dividend yield of 2.68%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.