About Telecommunication sector:

The telecommunication sector comprises of companies which facilitate communication across the world, either through phones, the internet or through airwaves or cables, wires or wireless modes.

The telecom sector can be categorised under sub sectors like telecom equipment, telecom services and the wireless communication.

The major source of revenue generation in this industry is through telephone calls. However, the trend is changing with the advancement in network technology and the telecom industry is not limited to merely making phone calls but has reached a level where people are inclined towards the video, text, and data measures.

High-speed internet access which offers computer-based data applications, have become popular for personal and business use around the world. Big organisations are more concerned about the reliability and quality of the calls and secure data transfer. In order to meet the requirement, companies are ready to pay premium charges to telecom players.

In this article, we would look at two major companies from the telecommunication industry in Australia, Telstra and Vocus- look at their past performances and examine if the stocks are good for dividend.

Telstra Corporation Limited (ASX: TLS)

Telstra Corporation Limited (ASX:TLS) is a provider of telecommunications and information services like mobiles, internet and pay television in Australia.

EBITDA declined by 21.7% in FY2019:

- The total income of the company during FY2019 declined by 3.6% to $27.8 billion.

- EBITDA was down 21.7% to 8 billion.

- NPAT was down 39.6% to $2.1 billion.

The decline in the EBITDA was due to the nbn impact, where the company had taken care of ~ $600 million of negative recurring EBITDA headwind during the period. As per the companyâs estimation, nbn impacted the EBITDA by $1.7 billion since FY2016. The calls at the call centres dropped significantly by 22%.

The company also made a strong progress T22 strategy under which the company aimed to establish a connected future so that everyone thrives. The company during the period reduced the number of Consumer & Small Business plans from 1800 to 20 in the market. It also announced no lock-in plans across fixed and mobile in Australia and reduced the data charges.

TLS launched the commercial 5G service, entering the 5G Boom. To know more READ HERE.

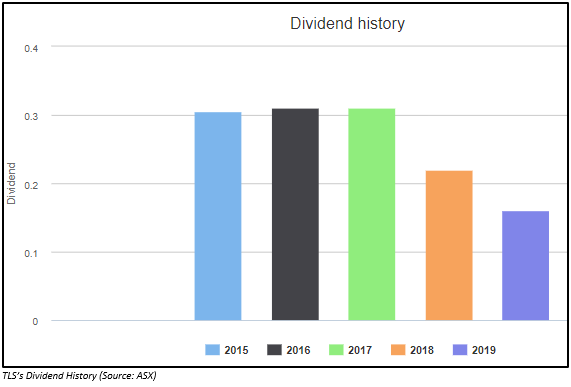

Dividend in FY2019 and in the past

The company announced a final dividend of 8 cents per share for FY2019. The total dividend for FY2019 was 16 cents per share. The below diagram highlights the dividend history of the company in the last five years. The company delivered constant dividend in FY2015, FY2016 and FY2017. However, from FY2018, the companyâs dividend has continued to decline through FY2019.

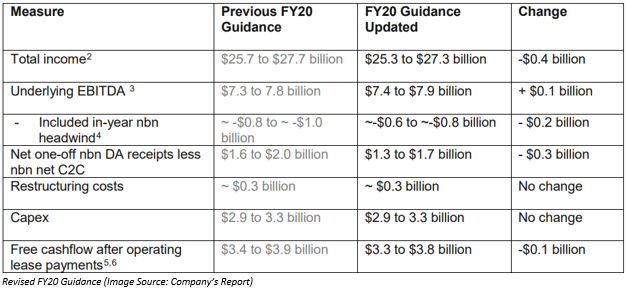

FY2020 Guidance:

In the FY2019 results announcement, TLS had expected the total income to range between $25.7 billion to $27.7 billion, underlying EBITDA in between $7.3 billion to $7.8 billion, capital expenses in the range of $2.9 billion to $3.3 billion and restructuring cost of ~ $300 million. It also expected that free cash flow, after making a payment of free cash flow would be in the range of $3.4 to $3.9 billion.

However, post the release of NBN Coâs corporate plan for 2020 and their outlook for FY2020, Telstra amended its guidance, depicted below:

Stock Information

The shares TLS have generated a decent YTD return of 28.96%. The shares on 11 October 2019 opened at a price of $3.530, at a gap up of $0.02 from its last closing price. By the end of the trading session on 11 October 2019, the stock quoted $3.570, up 1.7% from its previous closing price. TLS holds a market capitalisation of $41.75 billion with ~ 11.89 billion outstanding shares and a PE multiple of 19.390x.

Conclusion:

Although TLS is exposed to challenges due to the nbn impact, the launch of the 5G network would support the company in the future. Recently at the Telstra Vantage 2019, the company highlighted various innovative products beginning from 5G to IoT. Australian citizens are also noticeably adopting IoT, which is connected to the networks of the company. These factors are likely to help TLS deliver great results in the future and consequently influence the dividend

Vocus Group Limited (ASX: VOC)

Vocus Group Limited (ASX:VOC) is a specialist fibre player, which provides network services. It links all mainland capitals with Asia.

Underlying NPAT declined by 17% in FY2019:

- The revenue of the company in FY2019 improved by 0.4% to $1,892.3 million.

- The underlying EBITDA excluding share-based payments declined by 2% to $360.1 million.

- The underlying NPAT declined by 17% to $105.5 million.

- Capex (excluding Australia Singapore Cable) increased by 2% to $169.3 million.

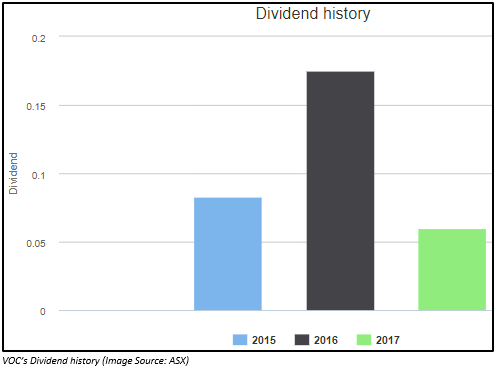

Dividend in FY2019 and in the past

The company did not declare its final dividend for FY2019 which ended 30 June 2019. VOC closed a new and enhanced syndicated debt facility with its lenders. Under the Syndicated Facility Agreement, the dividend would not be provided by the company unless its Net Leverage Ratio is below 2.25x for two consecutive testing dates. (Leverage ratio explains the capital amount that the company generates through debt and through equity).

However, in FY2015, FY2016 and FY2017, the company did provide dividend to its shareholders.

Outlook for FY20:

- The company expects its Underlying EBITDA to lie in between $359 to $379 million.

- The EBITDA growth in Vocus Network Services is anticipated to be in the range of $20 to $30 million, which would be balanced by a similar fall in the Retail.

- The capital expenditure (excluding ASC) would lie between $200 million to $210 million and cash conversion in between 90 to 95%.

Stock Information

The shares VOC have generated a YTD return of 8.79%. The shares on 11 October 2019 opened at a price of $3.370, at a gap up of $0.03 from its last closing price. By the end of the trading session on 11 October 2019, the stock quoted $3.400, up 1.8% from its previous closing price. VOC holds a market capitalisation of $2.09 billion with ~620.5 million outstanding shares and a PE multiple of 61.060x.

Conclusion:

FY2019 for VOC was challenging as depicted by the Groupâs EBITDA and NPAT. In the retail segment, the EBITDA was impacted due of loss in higher margin legacy products which were partially offset by lower margin NBN. The company did not provide dividend to its shareholders as its Net Leverage Ratio was not below 2.25x for two consecutive testing dates. It would be interesting to watch VOC unfold its strategies in the coming days.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.