Health care industry

Australian health care industry is not just on a strong growth path but also competes on the global scale. Health Care comprises of a dynamic sector including pharmaceuticals, medical devices, health insurance and hospitals. For investors, amid other sectors health care stands at the top of the list despite some risks and uncertainty due to a wavering stock market environment.

Multiple variables which needs to be looked upon that may affect investorâs investment strategy include fundamentals of a company, including market cap, profit earned by the company, PE ratio, share buyback, patents granted, clinical trials, regulatory approvals. While taking these factors into consideration, investors get an indication about the overvalued or undervalued stocks, stocks with better returns and the scope of the company in future. Often investors select picking those stocks that trade at a price less than intrinsic value or book value fishing out the undervalued ones.

Letâs go through some of the health care stocks as follows:

Paradigm Biopharmaceuticals Ltd (ASX:PAR)

ASX listed Australian bio pharmaceutical company, Paradigm Biopharmaceuticals Ltd is focused on repurposing an FDA approved drug named pentosan polysulphate sodium (PPS), with its lead clinical sign of curing bone marrow edema (BME) and treatment of joint pain and mobility in patients having mucopolysaccharidoses (MPS).Paradigmâs first IND Application gets USFDA clearance

An Expanded Access Investigational new drug application (IND) for a new drug pentosan polysulfate sodium (PPS), used for treating nearly ten patients having pain related with OA (knee osteoarthritis) with concurrent bone marrow lesions wherein the patients have failed to respond to standard of care, has been submitted by Paradigm Biopharmaceuticals on 7 August 2019.

Paradigm Biopharmaceuticals recently reported that this IND application got USFDA clearance within the 30-day review period.

Expanded Access also known as âcompassionate use,â allows patientsâ access to drugs & biologics used in the investigation. It also permits the access to medical devices that are used to diagnose, monitor, or treat patients with life-threatening conditions for which no comparable or satisfactory treatment therapy options are available.

Paradigmâs Chief Executive Officer, Mr. Paul Rennie commented that, âthe FDA approval authenticate Paradigmâs safety data, quality of the end-product & confirmation of an unmet medical need, also suggesting that safe and effective therapies are needed to treat severe chronic osteoarthritis is a necessityâ.

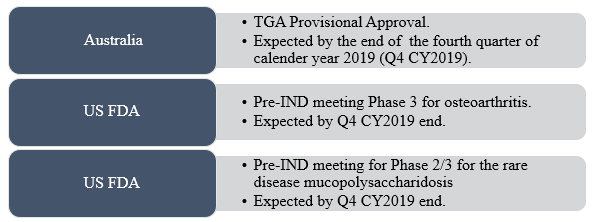

Paradigmâs future submissions

The preliminary report for the financial year ended 30 June 2019 delineated the progress made by Paradigm Limited which is briefed below-

Paradigms Operational Overview:

On 30 September 2019, PARâs shares were trading at $2.9, up by 14.625% (AEST 1:27 PM). Market capitalisation of the company stands at $487.17 million with 192.56 million outstanding shares with a significant TYD return of 155.23%.

Telix Pharmaceuticals Limited (ASX:TLX)

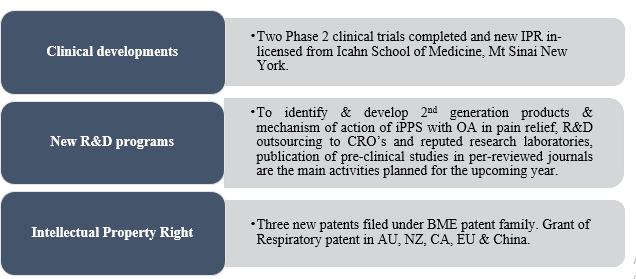

Headquartered in Melbourne, Clinical-stage Company Telix Pharmaceuticals Limited develops therapeutic and diagnostic products based on Molecularly Targeted Radiation (MTR) or targeted radiopharmaceuticals. Telix is developing a range of clinical-stage oncology products to address substantial unmet medical needs in renal, prostate and brain cancer (glioblastoma).Clearance to begin Renal Cancer Imaging Study in Japan

Telix Pharmaceuticals recently updated the market that Clinical Trial Notification (CTN) review, submitted to Japanese Pharmaceutical and Medical Devices Agency (PMDA) to initiate phase I/II study for the novel TLX250-CDx (89Zr-girentuximab) in Japan, is now completed. Below is the snippet of this latest development.

Stock Performance

TLXâs shares were trading at $1.62, up by 3.846% as on 30 September 2019 (AEST 1:36 PM). Market capitalisation of the company stands at $395.12 million with 253.28 million outstanding shares with a significant YTD return of 140.00%.

Nanosonics Limited (ASX: NAN)

Nanosonics Limited is engaged in developing groundbreaking technologies that can deliver better standards of care, to ensure better safety of patients, clinics, their staff and the environment. Nanosonics has invented a novel, automated trophon® EPR high level disinfection device for reducing cross contamination in patients, as well as reducing the spread of Health Acquired Infections (HAIs) marking its presence globally and has set a new standard of care in ultrasound probe disinfection practices.FY2019 Annual reports Highlights

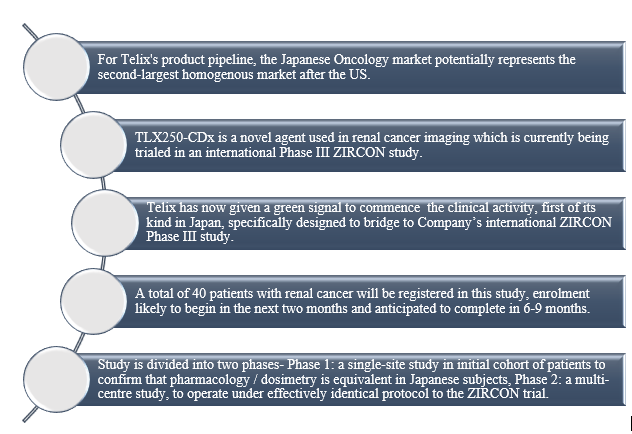

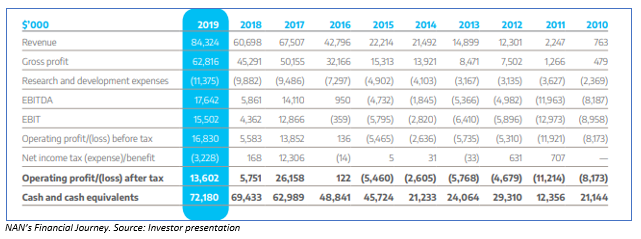

The main highlights relating to Nanosonics different core areas as briefed in the annual report for the year 2019 ended 30 June are:

- The trophon installed base recorded a growth of 18% to 20,930 an increase of over 10,000 units in the last three years alone.

- R&D investment grew to $11.4 million.

- Growth in operating profit by over 200%.

- Capital sales recorded an increase by 29% to $32.8 million compared to pcp.

- A 201% increase in operating PBT, noted at $16.8 million, compared to pcp.

- Cash and cash equivalents were recorded at $72.2 million

- Free cash flow for the given year was reported at $2.6 million.

NANâs core areas highlights

- Successfully launched trophon2.

- Received Gold Award at the Australian Good Design Awards.

- Enhanced geographical footprints by signing international distribution agreement with GE Healthcare covering the Nordics, Spain and Portugal with new agreements signed in Switzerland, Israel and Kuwait.

- Appointed four new executives including Regional Presidents for Asia Pacific and recently Europe, Chief Marketing Officer, Chief Strategy Officer and Chief Operating Officer.

- Strong progress in patent portfolio with twelve applications proceeding towards grant with four PCT (international) applications and four provisional applications in the new inventionsâ category being filed.

- New anticipated guidelines released by French Ministry of Health in Q4 FY19 in support of the requirement of high-level disinfection.

FY2020 Outlook

- Form the outlook front, the company is focused on three core areas and plans to establish trophon as standard of care, expand and invest in new geographic markets and develop and commercialise new products within its core area of infection prevention.

- For North America, Nanosonics Limited anticipates continued growth in the installed base. Operating cost expected to be ~ $67 million for FY2020.

Stock Performance

NANâs shares were trading at $6.365, down by 1.011% as on 30 September 2019 (AEST 1:44 PM). Market capitalisation of the company stands at $1.93 billion with 300.31 million outstanding shares with a significant YTD return of 131.29%.

CSL Limited (ASX: CSL)

CSL Limited, a leading pharmaceutical company with one of the largest & fastest-growing protein-based biotechnology businesses, is engaged in research and development, as well as manufacturing, commercialisation and delivery of novel biotherapies and influenza vaccines, with two core businesses; CSL Behring and Seqirus.

Change of Directorâs interest

The company, recently released updates on the change in one of the CSLâs directorâs relevant interest in securities effective 17 September 2019. According to the notice, the number of securities held by Mr Paul Perreault, after the change include 128,031 Ordinary Shares, 51,727 Performance Rights, 163,514 Performance Options & 54,113 Performance Share Units. The value of the transferred Ordinary Shares was $1,256,287.

Financial year 2019 highlights

- Reported US$1,919 million net profit after tax, increase of 17%.

- Full year dividend per share amounted to US$1.85.

- Continued strong growth in its core albumin and immunoglobulin and albumin therapies with PRIVIGEN® sales up by 23%, HIZENTRA® sales up by 22%, ALBUMIN sales up by 15%.

- Increased sales of CSLâs transformational products; HAEGARDA® (a treatment for patients with Hereditary Angioedema), up by 61% and IDELVION® (a therapy for Haemophilia B patients), up by 40%.

- Opened 30 new plasma centres in America.

- Total sales of CSLâs Seqirus product up by 19%.

- A dip in operational cash flow by 14% to US$1.6 billion, on previous corresponding period.

Stock Performance

CSLâs shares were trading at $233.93, down by 0.158% as on 30 September 2019 (AEST 1:52 PM). Market capitalisation of the company stands at $106.34 billion, with 453.85 million outstanding shares, and a YTD return of 26.39%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.