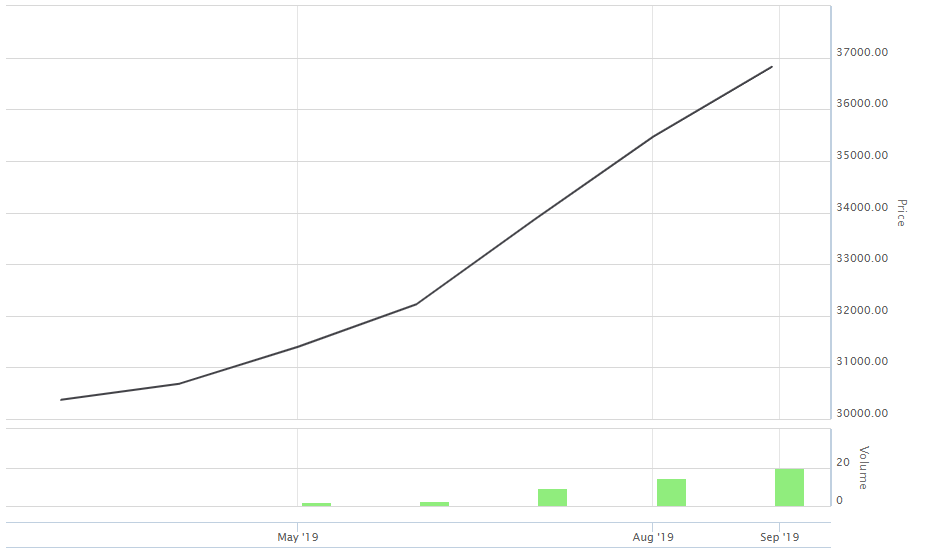

One of the best in the world, Australian health care sector is unceasingly advancing technologies to deliver the best health care services. Despite, a few uncertainties, health care sector caught investorsâ attention to invest in leading biotechnology players & health care service providers. On 5 September 2019, the S&P Index 200 Health Care (Sector) which trades under the code XHJ, was trading at 36.518.9 up by 0.78% or 284.2 points (at AEST 11:48 AM).

Also, the sector under discussion has shown a remarkable upward trend in the last six months period, as indicated by the below graph.

The three companies in Health care sectors are discussed below. Let us have a glimpse at their latest updates and performance on the ASX.

Oventus Medical Limited (ASX: OVN)

Company Profile: Oventus Medical Limited is a medical device company that deals in development and commercialisation of its unique treatment platform for people with breathing disorders; Obstructive Sleep Apnoea (OSA) and snoring.

Latest announcement: The newly developed O2Vent® Optima oral device, recently received regulatory clearance from US Food and Drug Administration (FDA), as declared on 2 September 2019, following the launch of O2Vent® Optima in Australian and Canadian markets, earlier in 2019.

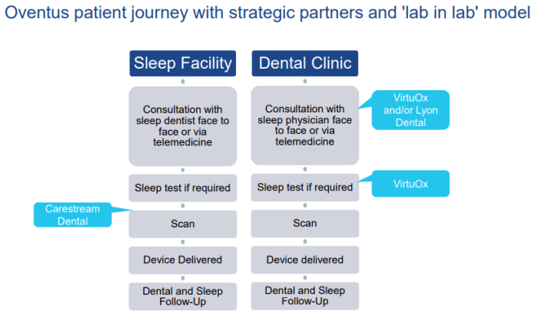

Also, in July and August this year, OVN signed material contracts with 3 American sleep groups. Under the terms and conditions of this agreement, the companies will adopt the OVN's Sleep treatment Platform, for treating OSA in a âlab in lab' business model, introduced for value- creation for all shareholders and streamline patients experience.

Source: Company's Investor Presentation

This regulatory clearance provides a green signal to Oventus to initiate O2Vent® Optima sales in the United States- a prime market for OVN along with Australia and Canada, and formally launch material agreements with three US sleep channels, announced recently.

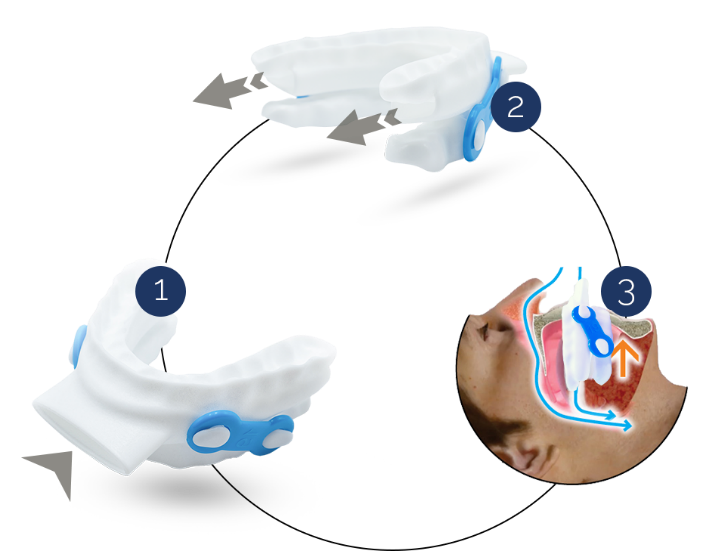

O2Vent® Optima: A brand-new product within the O2Vent® oral device range, O2Vent® Optima is a customised 3D-printed nylon oral appliance, developed by the company. The main features of this device include comfort and simplicity, a separate airway to further add stability to the upper airway for OSA patients.

O2Vent® Optima Source: Company Website

O2Vent® Optima Source: Company Website

Future Agreements: Oventus is expecting to secure more agreements across its core markets in the next 1-2 years, with vital regulatory clearances in the pipeline. With the robust cash balance, after the recent Placement and Entitlement Offer that combinedly raised A$9.3 million, and growing channels, Oventus is firmly placed to scale up sales substantially by the end of CY2019 and CY2020. It is further specified that the negotiations are going on with multiple groups across the entire US, AU & CA.

Stock Performance: OVN's shares were trading at A$0.515, up by 0.98 percent (as on 5 September 2019, AEST 11: 50 AM). The market cap stands at A$65.17 million and nearly 127.78 million outstanding shares. The stock generated a decent YTD return of 72.15%.

Starpharma Holdings Limited (ASX: SPL)

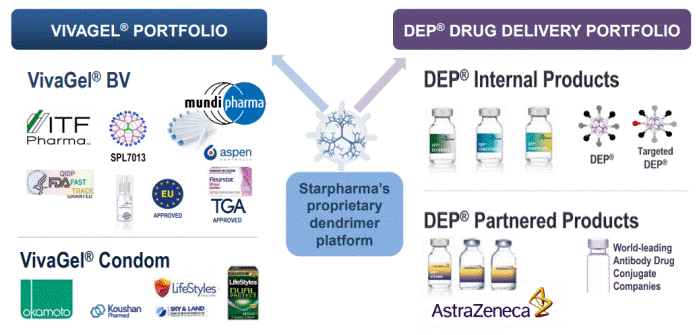

Company Profile: Listed on ASX in 2000, Starpharma Holdings Limited is focused on the development of its proprietary dendrimer products, shaped on SPL's underlying dendrimer nanotechnology with an aim for value creation & commercialisation in the pharmaceutical sector, life science, and various other applications. VivaGel® portfolio and DEP® drug delivery portfolio are the two main developmental programs of SPL.

SPL's products (Source: Company website)

SPL's products (Source: Company website)

Latest Announcement: The Company declared further regulatory clearance in Asia for VivaGel® BV on 3 September 2019, following SPL's first regulatory approval in South East Asian countries announced previously on 15 August 2019.

VivaGel® will be marketed as BETADINETM BV Gel, under the brand name of a leading pharmaceutical company Mundipharma and would be available over the counter in Asian pharmacies. Following VivaGel® BV's launch in Europe and Australia earlier this year, SPL is anticipating the launch of BETADINETM BV Gel in the next few months.

More FDA submissions have been made by SPL and Mundipharma, which would simplify and fast-track the future launch and registration process, anticipating future approvals for other regions in Mundipharma and countries across Asia.

Starpharma CEO, Dr Jackie Fairley was delighted to see the momentum gained for VivaGel® BV approvals in Asia. Expecting further approvals in all over Asia, SPL looks forward to delivering this innovative medicine to bacterial vaginosis patients.

About VivaGel® BV:

VivaGel® BV is SPL's womenâs health product, an Australian discovery entirely owned by Starpharma. It is a novel formulation and non-antibiotic treatment therapy, based on a proprietary dendrimer SPL7013, astodrimer sodium, and is used for the treatment of bacterial vaginosis (BV), a commonly occurring vaginal disease worldwide. It is available under the brand name Betadine BVTM in European markets and as Fleurstat BV gel in the Australian market.

Stock Performance: SPL's shares were trading at A$1.115, slipping by 0.889 percent (as on 4 September 2019, at AEST 11:59 AM). The market cap of the company stands at A$418.19 million and nearly 371.72 million outstanding shares. The stock generated a decent YTD return of 6.13%.

Mesoblast Limited (ASX: MSB)

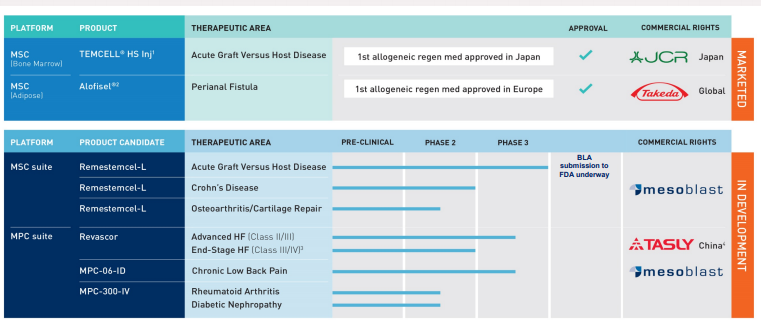

Company Profile: Mesoblast Limited is a premier global manufacturer of novel, off-the-shelf (allogeneic) cellular medicines for inflammatory diseases. MSB established a comprehensive portfolio of late-stage pipeline candidates with three candidates in Phase 3 trial leveraging its proprietary technology platform.

Mesoblast's Commercial and Late-stage product Pipeline is shown in below figure:

Latest Announcement: MSB had released financial results presentation and annual report for FY2019 on 30 August 2019, outlining robust operational development and financial highlights for Q42019 as well as FY2019.

FY2019 Key Corporate Highlights:

- MSB's update on its corporate operations mainly emphasised on its lead product candidate Remestemcel-L used for aGVHD for Steroid-Refractory Acute Graft Versus Host Disease (aGVHD).

- Acceptance and reimbursement of the product in Japan aGVHD market notified MSB's commercial plans for Remestemcel-L.

- A possible market opportunity for Remestemcel-L's in aGVHD in children and adults addressed to the US is expected to be 8 times higher than in Japan.

- FDA submission of Rolling Biologics License Application is in progress and FDA filing expected in CY2019.

- With the potential launch of Remestemcel-L in US markets planned, investment on commercial activities had increased.

- Another clinical program for aGVHD in adults is designed.

- Moreover, assessment of Remestemcel-L in children for chronic GVHD is planned, an investigator-initiated study for this purpose is also intended in the US.

- Revascor's Phase 3 trial for Advanced Heart Failure is expected to complete by CY2019 end.

- FDA provided guidelines on Revascor's market approval for End-stage Heart Failure.

- MPC-06-ID's Phase 3 trial for Chronic Low Back Pain is completed with safety and efficacy data recorded at 12 months. Its 24 months follow-up will be continued which is also expected to be finished by Q1CY2020, with readouts planned mid-CY2020.

FY2019 Key Financial Highlights:

- As at 30 June 2019, the Company held US$50.4 million (A$71.9 million) Cash.

- MSB recognised a total of US$16.7 million in revenue for FY2019 as compared to US$17.3 million for FY2018.

- A 37% year on year growth in royalty revenue from Japan Product sale in FY2019 when compared with FY2018, with 54% growth for Q42019.

- An increase of US$9.9 million reported owing to investment in Commercial Manufacturing.

- Operating net cash outflows observed a decrease for 2019 owing to increased expenditures from Strategic Partnerships.

Stock Performance: MSB's shares were trading at A$1.425, down by 0.35 percent (as on 5 September 2019, at AEST 12:01 PM). The market cap of the company stands at A$713.08 million and has nearly 498.66 million outstanding shares. The stock generated a YTD return of 13.04% and a return of 17.21% in the last 6 months period.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.