As per Australiaâs Budget for 2019-20, the total Commonwealth health spending is likely to grow from $81.8 billion in 2019-20 to $89.5 billion in 2022-23. This bright outlook cements that fact that the Australian healthcare sector is one of the best ones across the globe, let us look at how five healthcare companies, trading and listed on the ASX, address the investors sentiment.

Nanosonicsâ FY19 Results

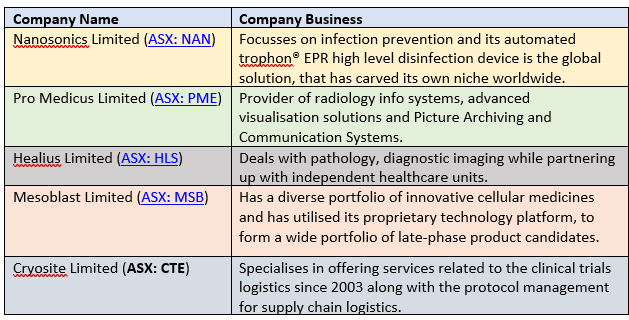

On 27 August 2019, Nanosonics Limited (ASX: NAN) released its FY19 Results closed 30 June this year and stated that the full year sales stood at $84.3 million, up 39% on pcp. The global installed base growth was up 18% to 20,930 units and capital sales noted at $32.8 million were up 29% on pcp. Operating PBT was at $16.8 million, soaring up 201% on pcp while the Cash and cash equivalents amounted to $72.2 million. The operating expenses amounted to $49.2 million, and NAN reported free cash flow for the year to be $2.6 million.

NANâs Financial history (Source: NANâs Report)

Also, the company on-boarded four new executives to the executive management team and the total number of employees grew by 27% to 286. During FY19 period, trophon® 2 was effectively launched in Europe, North America and Australia. The distribution agreement with GE Healthcare would enhance NANâs geographical footprint as it would include Norway, Denmark, Finland, Spain and Portugal along with Switzerland and Israel. NAN invested $11.4 million during the year on innovative research and development and was granted patents in the US, Europe, Canada and Australia, among others.

On the accolades front, for the second consecutive year, the company won an award at The Premierâs NSW Export Awards, taking out the Health and Biotechnology category award in October 2018. Moreover, its innovation program was recognised amongst the most innovative in ANZ region and ranked seventh in the AFR Boss, Most Innovative Companies Health Industry List.

Whereas, on the outlook front, for North America, NAN expects sustained growth in the installed base. The accelerated investment in growth with total FY20 operating expenses would likely be almost $67 million, and the FY20 profit would be heavily weighted to H2 FY20.

Pro Medicusâ FY19 Results

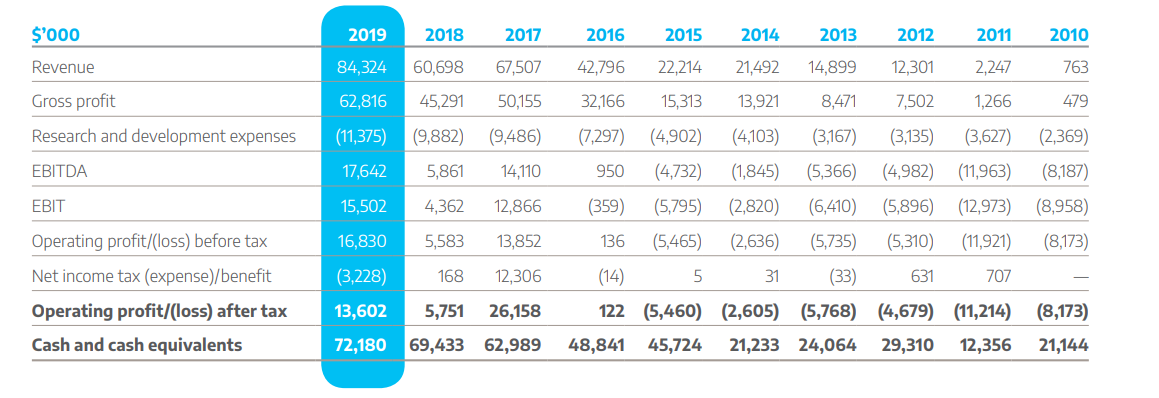

On 22 August 2019, Pro Medicus Limited (ASX:PME) closed on 30 June this year, announced its FY19 results, reporting after-tax profit standing at $19.1 million, zooming up by 91.9% on pcp. The revenue of $50.1 million was up 47.9%, and the EBIT margins increased to 51.6% compared to the pcp. PMEâs cash reserves were up 28% to $32.3 million, and during the year, it joined the S&P/ASX 200 index, which is based on the 200 largest ASX listed companies.

As part of these results, the company declared a fully franked final dividend of 4.5 cps, taking the FY19 dividend up 75% to 10.5 cps, which would be payable on 4 October 2019.

PME FY19 Highlights (Source: PME Report)

The highlight of the report was the three significant new contracts that PME had in its kitty- (a) 7-year agreement inked with Partners Healthcare for the prestigious Massachusetts General Hospital, (b) an extension to an existing contract with large German Government Hospital network and (c) 7-year deal with Duke Health, the largest health system in the North Carolina region.

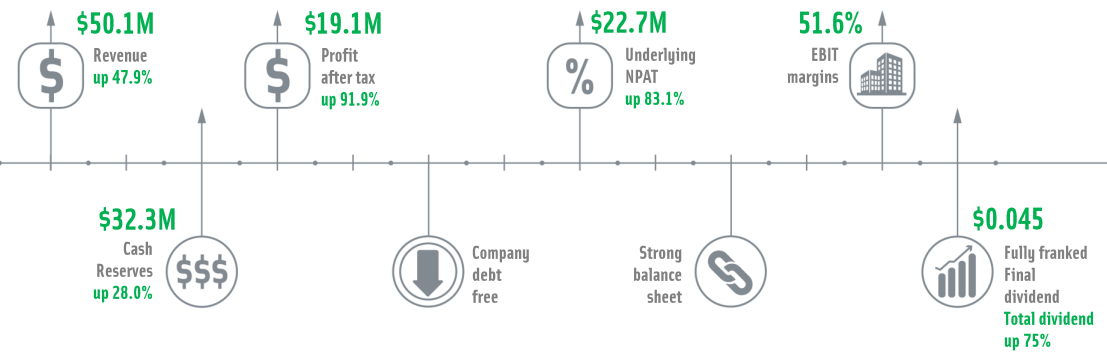

Healiusâ FY19 Results

On 27 August 2019, Healius Limited (ASX:HLS) released its annual report of 2019 closed on 30 June 2019, stating that the company had over 8 million medical centre patient consults and over 3 million radiography examinations. In FY19, HLS posted an underlying NPAT of an increase of 6.5% on revenue growth of 5.9%. Reported NPAT was $55.9 million, compared to $4.1 million in FY 2018. HLSâ largest segment, Pathology delivered revenue growth of 3.5% to $1.1 billion and underlying EBIT of $111 million. The Medical Centres delivered an EBIT 19% better on pcp and The Day Hospitals and IVF businesses grew revenue. On the other hand, Imaging grew revenue by 7.9% in the year, and its Underlying EBIT was up by 14.5%.

FY19 Financial Highlights (Source: HLSâ Report)

The company invested in $51.6 million of maintenance capex and $176.4 million of growth capex. The resulting net debt at 30 June 2019 was $678.2 million. As part of the results, the board declared a fully franked final dividend of 3.4 cps, equating to a pay-out ratio of 60% of Reported NPAT. This brings the total for the year to 7.2 cps. The declared dividend would be paid to the shareholders on 27 September 2019. It has record date of 30 August this year, with an ex date of 29 August this year.

During the year, HLS acquired Montserrat Day Hospitals and commenced an organisational re-design to simplify the management structures, improve divisional agility and autonomy, and drive an efficient group function.

On an outlook front, HLS expects to grow the underlying NPAT and would provide the guidance during its upcoming AGM.

Mesoblastâs FDA Meeting Update

In an update released on 27 August 2019, Dual-listed on ASX and NASDAQ, Mesoblast Limited (ASX:MSB) updated the media about its meeting with the USFDA regarding marketing authorisation of its allogeneic cell therapy product candidate Revascor, which consists of 150 million allogeneic MPCâs and aimed at aiding patients with moderate-advanced or end-stage chronic heart failure.

The FDA recapped that a reduction in epistaxis is an important clinical outcome in patients implanted with an LVAD and confirmed that Revascor reduced major mucosal bleeding events, as per the 159-patient placebo-controlled trial. This paves a way to support product marketing authorisation via BLA. Besides this, the FDA affirmed on a confirmatory Phase 3 trial of Revascor in LVAD patients, which is planned to be conducted with the InCHOIR in New York, in sync with an MoU.

Pleased with these key outcomes of the meeting, CEO Dr Silviu Itescu stated that this guidance was a major step forward for MSBâs cardiovascular program.

Cryositeâs Deed of Settlement

On 8 February 2019, Cryosite Limited (ASX: CTE) notified that it has entered into an agreement with the ACCC, resulting in contravening the Competition and Consumer Act 2010, post receiving extensive legal advice from external lawyers.

The matter was related to the ACCCâs allegation that the company had breached the CCA by including a competition restraint provision into its agreement inked during 2017 to license the collection, processing and storage of umbilical CBT and sell few CBT banking assets to Cell Care Australia, under the Cryosite brand. The company had no intention to breach the CCA and was not aware about the clause which would contravene the CCA.

The proceeding for the above had been going on in the Federal Court of Australia and on 27 August 2019, the company notified the media that it had orders to pay $1,100,000 in penalty and cost w.r.t contraventions of the CCA. As per a Deed of Settlement, CTE would be paid $1,000,000 in settlement, within 30 days, of a claim for loss and damage relating to the legal services.

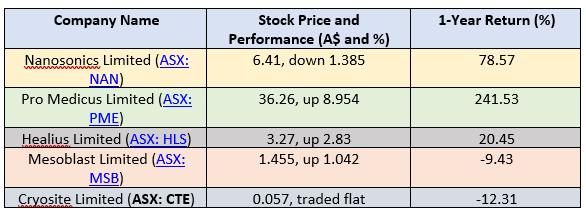

Let us now examine the stock and return conduct of the discussed companies, after the close of trading hours on the ASX on 28 August 2019:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.