According to the stock market folklore, Oliver Gingold, an early employee at the company which later became Dow Jones, coined the phrase âBlue-Chipâ long ago in 1923. The term is derived from the game of poker where the simplest sets of poker chips include white, red, and blue chips, with tradition dictating that the blue ones boast the highest value.

Why Investors Swear by Blue-chips?

In real life, Blue-chip stocks are shares of well-established, profitable and big companies with an excellent reputation and a long history of sound financial performance. These companies are known to have endured the test of time amidst varying market conditions and deliver high returns to the shareholders. Generally, Blue-chip stocks are expensive to buy since they are high quality and these companies are often market leaders in their respective industrial domains.

The most common parameters considered by investors to assess Blue-chip companies include:

- Consistent annual revenue over a long period of time;

- Stable debt-to-equity ratio;

- Average return on equity (RoE) and interest coverage ratio;

- Market capitalisation and price-to-earnings ratio (PE);

- Attractive dividend yields.

Reasons to Invest in Blue- chips

Reasons to invest in these stock market gems include the fact that these companies rarely go bankrupt, and even a after a price decline, the stock price tends to recover swiftly. They also have a proven business model with frequent reinvestment of earnings to expand further and a bright future outlook.

Moreover, these companies have been around for ~40 years or more, have a certain competitive advantage and a large market share, posing insurmountable competition for the relatively new companies.

Some of the prominent investment approaches for adding blue chip shares to onesâ portfolio include buying the shares, buying CFDs (Contract for difference) or futures, options and even binary options on the respective share. Around the world, big institutional funds are always looking to add blue chip shares to their basket whenever they are trending at good prices as they are speculative shares, that is, the price of blue-chip shares is not that volatile.

However, one big disadvantage of blue-chip companies is that they do not grow as fast as smaller, fast-growing companies, as the former are already past their phase of rapid expansion.

Letâs skim through the following five ASX-listed blue chips.

Sydney Airport (ASX: SYD)

100 years of Aviation! Sydney Airport (ASX: SYD) manages the airport in Sydney. It develops and maintains the airport infrastructure and leases terminal spaces to other airlines and retail companies. The company has an annual dividend yield of 4.56%.

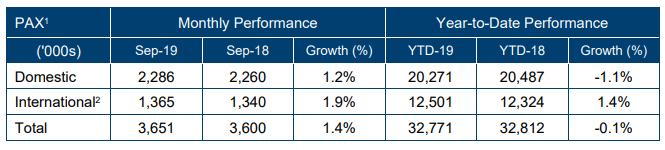

Traffic Performance Update- On 18 October 2019, Sydney Airport published its traffic performance data for the month of September 2019, which demonstrates continued growth in international passenger performance since the prior month. The number of international passengers increased by 1.9 per cent with growth holding steady at 1.4 per cent YTD.

With increasing focus of Federal Tourism Minister Simon Birmingham on India which showcases immense potential, the arrivals from India in the concerned month delivered their second consecutive month of double-digit growth, up 11.2 per cent on September 2018 and up 8.4 per cent YTD.

Other key highlights for September included the air services agreement between Australia and Nepal and Indonesian passenger growth of 16.1 per cent on September 2018.

Stock Performance- The market capitalisation of the SYD stock is AUD 19.06 billion with ~2.26 billion shares outstanding. On 18 October 2019, the SYD stock settled the dayâs trading at AUD 8.220, down 2.60%. SYD has delivered positive returns of 27.67% Year-to-date (YTD), 13.96% in the last six months, and 7.88% in the last three months.

Oil Search Limited (ASX: OSH)

Oil Search Limited (ASX:OSH), established in 1929, is an Australian Energy sector company with 29% interest in PNG LNG Project (operated by ExxonMobil) and ~60% interest in, and operator of, all PNGâs producing oil fields. Oil Search also has ~51% stake in significant oil assets located North Slope of Alaska, with major appraisal and exploration upside.

UBS Non - Deal Roadshow â UK Presentation Highlights â Oil Search recently presented at UBS Non - Deal Roadshow and published the presentation where in the companyâs YTD highlights (1H19) were stated as:

- Total production: 14.1 mmboe, up over 38% on the prior corresponding period (1H18), with production of 8.6 MTPA, 25% above nameplate by PNG LNG.

- Net profit after tax : USD 162 million for 1H19, DPS - five US cents.

- Oil Search executed the Final PNG LNG mid-term contract during the half year which took the total contracts volumes to 7.9 MTPA, reducing spot market exposure.

- Oil Search also signed Papua LNG Gas Agreement in April 2019 (endorsed in September 2019).

- Inaugural Pikka Unit drilling programme in Alaska revealed robust results with Record of Decision received and Option exercised. Now, OSH is gearing up to enter FEED before year end.

Stock Performance- The stock of Oil Search has a market capitalisation of around AUD 10.95 billion and ~1.52 billion shares outstanding. On 18 October 2019, the OSH stock settled the dayâs trading at a market price of AUD 7.190, up 0.139% by AUD 0.010. OSH has delivered positive returns of 3.46% YTD and 3.16% in the last three months.

Treasury Wine Estates Limited (ASX: TWE)

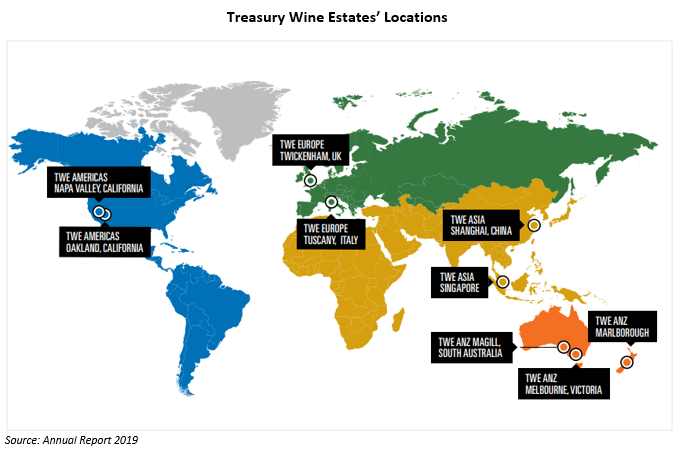

Treasury Wine Estates (ASX: TWE) is one of the worldâs leading wine companies with a portfolio of outstanding wine brands, prized viticultural assets and world-class production facilities. The company has delivered consistent value to shareholders as it continues to craft, market and sell quality wine for consumers through establishing sustainable partnerships with customers and other industry leaders, globally.

FY19 Highlights â The company released its Annual Report for the 12 months to 30 June 2019 on 28 August 2019 posting the following:

- EBITS up 25% to AUD 662.7 million;

- EBITS margin accretion of 1.6 percentage points to 23.4%.

- EPS (before material items and SGARA) up 17% to 60.4 cents per share.

- An increase of 14.9% in Return on Capital Employed.

- 5-year EBITS CAGR of 30% achieved through consistent EBITS growth.

- Final fully franked dividend of 20 cents per share paid out to shareholders; Annual dividend of 38 cents per share, up 19% on the prior corresponding period.

Going forth, TWE expects EBITS growth of 15% to 20% in FY20.

Stock Performance -The stock of Treasury Wine Estates has a market capitalisation of around AUD 13.62 billion with ~719.95 million shares outstanding. On 18 October 2019, the TWE stock settled the dayâs trading at AUD 18.600, down 1.69% by AUD 0.320. The stock has delivered positive returns of 17.73% in the last three months, 16.50% in the last six months and 28.88% YTD.

Sonic Healthcare Limited (ASX: SHL)

Sonic Healthcare Limited (ASX:SHL) is a medical diagnostics company with operations spanning across Australia, New Zealand, and Europe. It provides a comprehensive range of pathology and diagnostic imaging services to medical practitioners, hospitals and their patients while also offering administrative services and facilities to medical practitioners.

SHL to raise USD 550 million of long-term debt funding- On 10 October 2019, Sonic Healthcare announced that it has priced USD 550 million of notes in the US private placement market and the closing of the transaction is expected in January 2020, post completion of the final investor due diligence and documentation.

The timing is close to the expiry dates of existing USD debt facilities, which would be repaid from the proceeds of the note issue.

Stock Performance - Sonic Healthcare has a market capitalisation of around AUD 13.73 billion with ~474.9 million shares outstanding. On 18 October 2019, the SHL stock settled the trading at AUD 28.630, down 1.003%. SHL has delivered positive returns of 32.66% YTD, 17.27% in the last six months and 3.66% in the last three months.

Wesfarmers Limited (ASX: WES)

Perth, Australia-based Wesfarmers Limited (ASX: WES), established in 1914 is engaged in diverse business operations including retail, coal mining and production, gas processing and distribution, industrial and safety product distribution, chemicals and fertilizers manufacturing, and others globally.

New sustainability website- On 15 October 2019, the Company notified that it had launched a new sustainability website which would provide improved information and frequent updates on issues and areas critical to the Groupâs continued long-term performance.

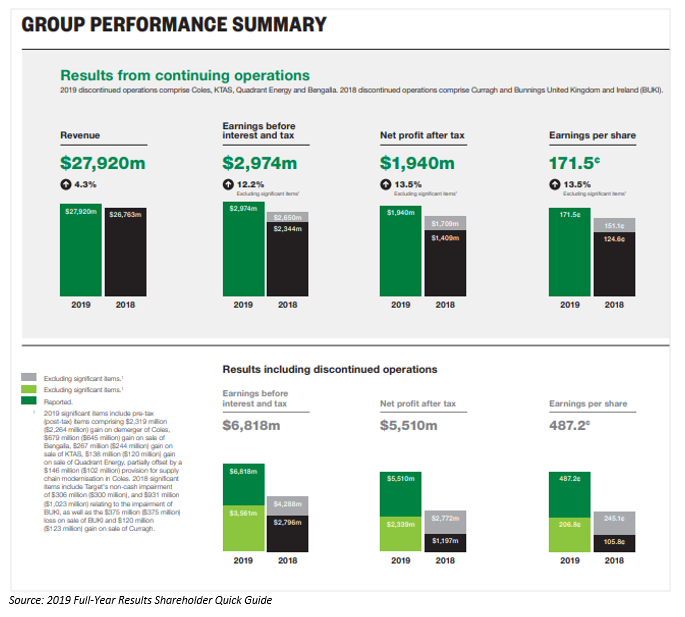

A snapshot of Wesfarmersâ financial results for the full year 2019 is given below-

Stock Performance- The stock of Wesfarmers Limited has a market cap of around AUD 45.86 billion with ~1.13 billion shares outstanding. On 18 October 2019, the WES stock settled the market trading at AUD 40.290, down 0.396%. WES has delivered impressive positive returns of 32.61% YTD, 16.61% in the last six months and 6.89% in the last three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_01_09_2025_07_01_12_631371.jpg)