What is Guidance?

Guidance, also known as earnings guidance, is the forward-looking statement which the company provides to its investors about its estimate of future earnings. Guidance also gives an idea about the companyâs revenue estimate as well as capital expenditures. The company guidance gives a clearer picture of it expect its financial performance would be in the upcoming financial year or in the remainder of the current financial year. The management, which runs the business, is aware of the challenges and is in a better position to predict the companyâs performance in the foreseeable future.

Why is guidance critically viewed for IT Stocks?

Running an IT business involves investing a considerable amount of capital in product development which the company funds from its own reserves or goes for capital raising from the market or from private equity investors. IT companies have more human resources engaged for the development of their products or providing services to the client. As a result, they have to pay a lot of money in the form of salaries and wages. These companies also require systems to develop new software or product, which involves further cost. When these companies go for expansion or increase their geographical footprint, they require funds to support the process.

Since many investors and shareholders invest their hard-earned money in anticipation of better returns from the company, they keep an eye on the companyâs guidance. Based on the business model and growth prospects in the future, these shareholders keep track of how the business is performing and the utilization of capital for future growth. Apart from this, the investors also look at the business models of these companies. The volatility of the shares depends on the prospects of businesses the company is into. Majority of IT companies derive their revenues from contracts for particular software or services which they source from various companies from different sectors. The profitability of companies depends on the successes of these deliverables. People associated with such projects have a better notion of the project pipeline in the future, which is an area of interest to the investors.

In this article, we would cover five IT stocks and have a look at their recent result declarations along with outlook or guidance.

ELMO Software Limited

Company Overview:

ELMO Software Limited (ASX: ELO) is the fastest growing human resource technology company which provides innovative cloud HR, payroll and rostering / time & attendance technologies across 1000+ companies in the Asia Pacific region.

FY2019 Highlights:

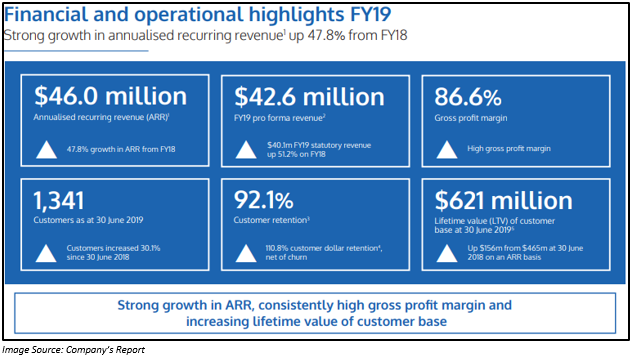

- The companyâs revenue from the operating activities increased by 51.2% to $40.053 million as compared to the previous corresponding period (pcp).

- Itâs loss in FY2019 increased by 341% to $13.180 million on pcp.

- The company reported strong growth in the annualized recurring revenue. The growth was 47.8% and it went up to $46 million versus pcp.

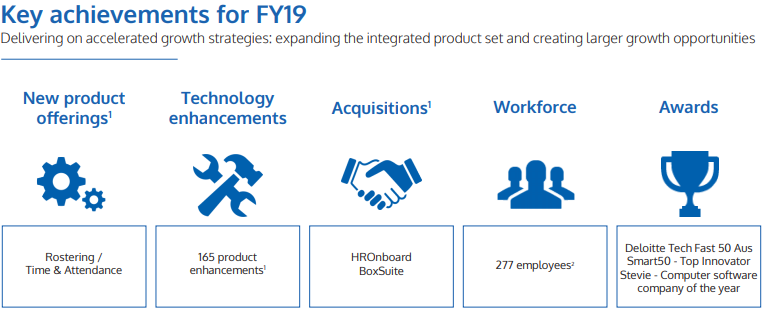

Key Achievements in FY2019

- Expanded its product suite.

- Made new product offering in FY2019.

- Worked on Technology improvement.

- Made new acquisitions like HROnboard and BoxSuite

- ELOâs market opportunity grew and reached 23,813 organisations and approximately $2.4 billion opportunities in ANZ in FY2019.

- It's market opportunity expanded with its entrance into payroll and rostering / time & attendance recently.

- There was robust growth in the number of customers.

Outlook:

- Increase usage of its solutions amongst the present customers by encouraging them to get subscribed to its other modules.

- Increase its geographical spread in New Zealand and Australia.

- Expansion of the product offering

- Look for further acquisition of companies into HR management software.

Recent development after FY2019 Results declaration:

- ELO entered into a partnership with the University of Technology Sydney for developing an AI-driven Predictive Analytics solution.

- ELO completed A$55 million institutional placement. Also, the existing pre-IPO shareholders of the company sold ~ 5.8 million shares under a secondary sell-down at the Placement Price.

Audinate Group Limited

Company Overview:

Audinate Group Limited (ASX: AD8) is the provider of professional audio networking technologies across the globe.

FY2019 Highlights:

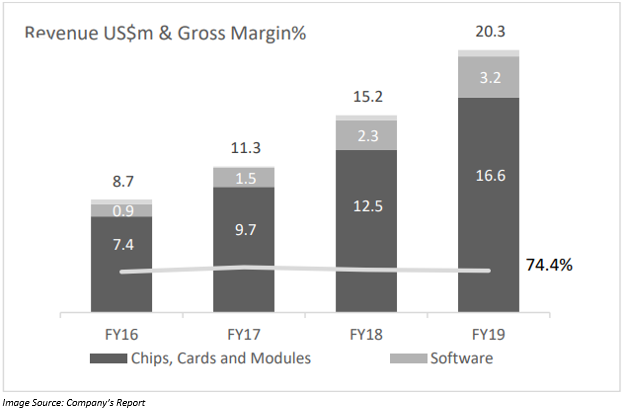

- In FY2019, revenue of the company increased by 44% to A$28.3 million on previous corresponding period.

- EBITDA increased by 395% to A$2.8 million and operating cash flow by 249% to A$3.6 million.

- Total number of Dante-enabled products during the period increased by 30% to 2,134.

Outlook:

- The company would invest in order to increase the engineering and R&D functions twice in the next two years.

- Involve a business infrastructure platform to help the company to achieve its long-term growth.

- Develop next generation Dante audio as well as video software implementations.

- Work on Dante AV to position it as a technology of choice for OEMs

- Expansion of total addressable market by introducing video & software products.

Data#3 Limited

Data#3 Limited (ASX:DTL) is one of the leading providers of IT services and solutions in Australia.

FY2019 Highlights:

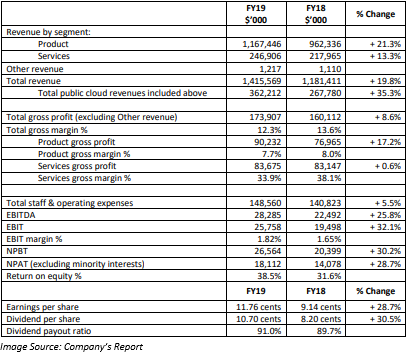

- DTLâs revenue in FY2019 increased by 19.8% to $1.4 billion.

- The net profit before tax increased by 30.2% to $26.6 million.

- The net profit after tax without minority interest grew up by 28.7% to $18.1 million.

- EPS went up by 28.7% to 11.76 cents per share.

- DTL declared a fully franked dividend of 10.70 cents per share, representing a growth of 30.5%.

- DTLâs balance sheet remained strong for the period with very less debt.

Objectives and Outlook:

The company is confident that it would be able to deliver on its long-term strategy. The company would focus on building its strength and also improve shareholder value. Overall, the company aims to provide sustainable earnings growth.

Objective Corporation LimitedCompany Overview:

Objective Corporation Limited (ASX: OCL) is a software company that is into the business of enterprise content management.

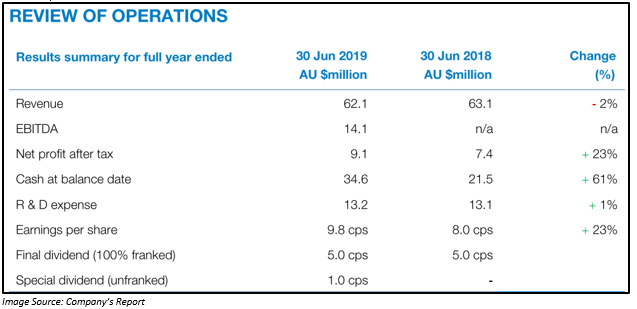

FY2019 Highlights:

- In FY2019, OCLâs revenue from ordinary activities decreased by 1.7% to $62.060 million. However, its net profit after tax increased by 23% to $9.060 million.

- Recurring revenue increased by 13% on pcp and it accounted for 70% of the total revenue generated in FY2019. As on 30 June 2019, the annual recurring revenue increased by 15% to $46.6 million on pcp.

- The company declared a final dividend of 5 cents per share and a special dividend of 1 cent per share.

- The company invested $13.2 million in research and development during the period.

- During the period, the company acquired Alpha Group, which is the developer of cloud-based digital building development consent software solutions based in New Zealand.

- The business was able to generate operating cash flow of $23.4 million, representing a growth of $12.1 million on pcp.

Outlook:

- In FY2020, the company would utilize the strong cash flows in its existing products and would also launch the new product via acquisitions which were strategically aligned to its business.

- The company in FY2020 would also look for further opportunities to acquire companies as per its disciplined financial and target customer metrics. These acquisitions would help the company to accelerate product development and service its clients.

Rhipe Limited

Company Overview:

Rhipe Limited (ASX:RHP) is a cloud channel company which offers its partners with a end to end cloud solution, thus, supporting its partners in growing as well as thriving in the emerging Cloud economy. It is known for its expertise in the subscription software licensing domain in the APAC region.

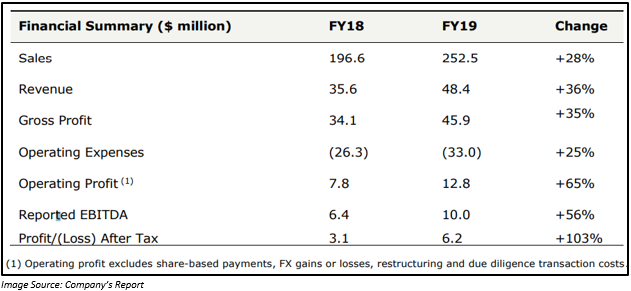

FY2019 Highlights:

- In FY2019, the company reported a revenue growth of 36% to $48.356 million.

- The net profit after tax grew significantly by 103% to $6.214 million.

- RHP announced a final dividend of 2 cents per share.

- The sales from software products and services increased by 28% to $252.5 million and Group EBITDA by 56% to $10 million.

- RHP had net cash and cash equivalents of $25.5 million by the end of FY2019 on 30 June 2019.

Outlook:

- The company expects that in FY2020, its public cloud business would continue to be the growth engine for the corporates. The sales, as well as revenue, would also improve when more businesses in the APAC would shift their workloads to the cloud. In order to achieve this, the company would be investing in a number of areas such as:

- Front office sales, marketing as well as technical employees, to help the company in growing customer numbers in all geographies.

- Microsoft Dynamics channel staff

- Development of Prism along with that of âSmartEncryptâ

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.