What are small cap stocks?

Small cap stocks are those stocks whose market cap ranges from $300 million to $2 billion. These stocks, as compared to the large cap stocks, gives its investors a better rate of return.

Below are the four ASX listed small cap technology stocks for which we have covered their recent updates. Letâs take a look.

Audinate Group Limited

Recent Update/s

FY2019 Results:

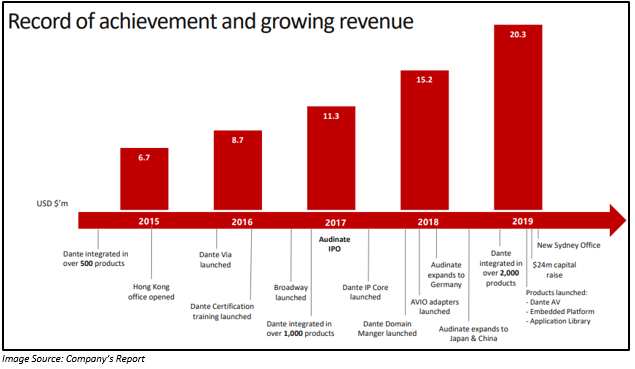

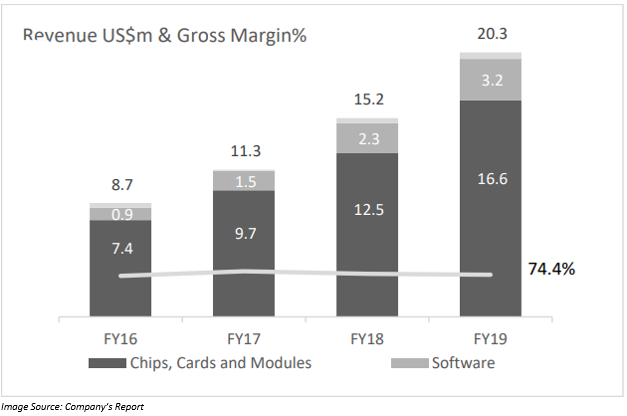

On 23 August 2019, Audinate Group Limited (ASX:AD8), the top provider of professional digital audio networking technologies announced its FY2019 results for the year ended 30 June 2019. In FY2019, the companyâs revenue increased by 44% to A$28.3 million as compared to the corresponding period of prior year. There was a massive increase in EBITDA by 395% to $2.8 million over the year-ago period. Cash flow from operations increased by 249% year over year to A$3.6 million.

CEO, Lee Ellison stated that AD8âs strong result was the outcome of the growth in the earnings and operating cashflows more than the revenue which was possible because the companyâs business began to scale with its Dante-enabled products. The result also shows the success of the passionate team at Audinate which is supporting the company to achieve its growth strategy.

The company also made an investment in its people, with nineteen new roles associated with sales and engineering. There were other costs as well that was related to the companyâs Sydney office as well as the second year of Long-Term Incentive expenses. All these factors helped in increasing the operating expenses of the company by 30% to $18.3 million. NPAT for FY2019 was $0.7 million.

The balance sheet of the company strengthened after the successful capital raising. The company raised $20 million through placement and $4 million through oversubscribed Share Purchase Plan which got completed on 10 July 2019.

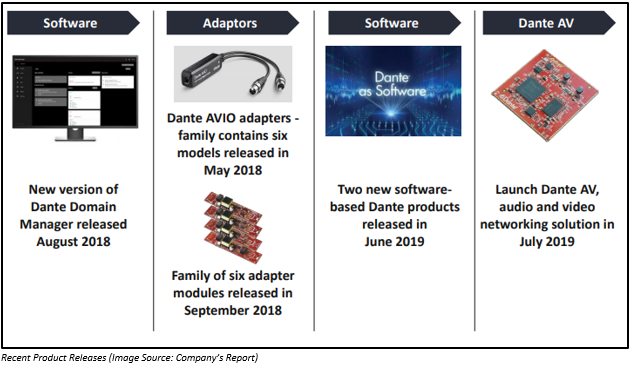

The company also highlighted its significant expansion in its product offering. The number of Dante enabled products that are available for sale increased by 30% year over year to 2,134 products. Two new software products, namely the Dante Application Library⢠and Dante Embedded Platformâ¢, were launched by the company in June 2019.

The company also highlighted on the retirement of CEO Lee Ellison on 13 September 2019, and his successor would be the co-founder of the company, Aidan Williams.

Outlook:

- In FY2020, AD8 would start investing in order to double the engineering and R&D function in the upcoming two years.

- Would place the business infrastructure platform to provide support to the company with respect to its long-term growth.

- Would be focusing on the development of next generation Dante audio as well as the implementation of video software.

- Would work on Dante AV with an aim to deliver technology that is preferred by OEMs.

- Expand its Total Addressable Market by adding video and software products.

Stock Performance:

The shares of AD8 have generated an excellent YTD return of 93.82%. The opening price of the share of AD8 was A$7.000, up by A$0.10 from its previous closing price. By the end of the trading session on 30 August 2019, the closing price of the share was A$7.080, up by 2.609% as compared to its previous closing price. AD8 has a market cap of A$ 447.93 million with ~ 64.92 million outstanding shares.

Isentia Group Limited

Recent Update/s:

FY2019 Results

Isentia Group Limited (ASX:ISD), the leading integrated Media Intelligence and Insights business in the APAC region which operates in 11 markets has released its FY2019 results for the year ended 30 June 2019. The revenue generated by the company in FY2019 was in line with its FY2019 guidance. The revenue in FY2019 was $122.5 million, and Underlying EBITDA was $23.1 million and both of them in the lower to mid-range of the guidance. Net debt which was $43.1 million at 30 June 2018 got reduced and reached $28.3 million by FY2019 end. The underlying NPATA for FY2019 was $9.2 million. However, the company experienced a net loss of $34.3 million as a result of $41 million non-cash write-down of earlier recognized intangible assets.

During FY2019 in February 2019, the company revealed its novel strategy which would provide a way to transform the business over the following three years. In the second half of FY2019, the company implemented a range of actions like developing new workflows for press production and Daily Briefings, implementation of new product management processes and also appointed product and technology teams in the Asia region. These steps are taken with a view to execute that strategy.

Outlook:

In FY2020, the board and the companyâs management would be focusing on the successful execution of the next phase of its 3-year strategic plan. The company expects that the rate of revenue decline will be slower in FY2020. The company would also be making operating and capital investment with respect to the creation of new products as well as technology. Based on these, the company expects its EBITDA in FY2020 to be in between $20 million to $23 million.

Stock Performance:

The shares of ISD have generated a decent YTD return of 29.63%. The opening price of the share of ISD was A$0.330, down by A$0.020 from its previous closing price. By the end of the trading session on 30 August 2019, the closing price of the share was A$0.340, down by 2.857% as compared to its previous closing price. ISD has a market cap of A$70 million with ~ 200 million outstanding shares.

RPMGlobal Holdings LimitedRecent Update:

FY2019 Results

RPMGlobal Holdings Limited (ASX:RUL) is a mining technology company which provides mining software, mining advisory services, technical consulting and training in the area of mine planning and on 23 August 2019 had released its full year results for the year ended 30 June 2019.

The revenue of RPMGlobal Holdings Limited in FY2019 increased by 8.7% to $80.1 million compared to the corresponding prior-year period. The company reported a growth in revenue from all its divisions. Software divisionâs revenue growth was up by 9.2%, Advisory by 8.4% and GeoGAS by 2.2% over the corresponding prior-year period.

During the period, the company sold $10.3 million in total subscription revenue, which increased by $8.6 million from the previous year. As a result of an increase in the subscription licensing, the sale of the perpetual license declined by $1.5 million to $12.1 million by FY2019 end. Overall, the total value of contracted software subscriptions and perpetual licenses that were sold in 2019 was $22.4 million, which means there was a growth of $7.1 million (46%) over the corresponding prior-year period.

The annual recurring revenue from the subscription licenses increased by 230% to $4.3 million. Total Annual Recurring Revenue along with the Maintenance and Subscription revenue during the period, increased by 21% to $26.1 million.

The EBITDA in FY2019 increased by 34.1% to $5.9 million. The net profit before tax for FY2019 was $1.7 million, up by 183% over the corresponding period of prior year. However, the net loss during the period was $5.9 million.

The balance sheet of the company shows a fall in the net asset as a result of increased total liabilities and a fall in the total asset.

The net cash closing balance by the FY2019 end was $28.2 million.

Outlook:

The company expects a continues growth in Advisory and software divisions. The company expects that based on right economic incentives, the customer would move from perpetual software licensing to subscription licensing.

Stock Performance:

The shares of RUL have generated a YTD return of 12.40%. the share of RUL opened flat at A$ 0.680. By the end of the trading session on 30 August 2019, the closing price of the share was A$ 0.680. RUL has a market cap of A$147.13 million with ~ 216.37 million outstanding shares.

Quantify Technology Holdings Limited

Recent Update:

Distribution Agreement with 8Digital:

Quantify Technology Holdings Limited (ASX:QFY) on 23 August 2019 announced that it had signed a distribution agreement with 8Digital for the distribution of its products in Queensland. It includes displaying its devices in display suites. The initial agreement is for a period of 1 year, and it can be rolled over.

On the other hand, 8Digital is a company with a strong sales pipeline, and it focuses on combining technology into high-end residential properties.

This agreement with 8Digital forms a part of the strategy of Quantify to form a national footprint of leading distributors which focuses on the new build and retrofit market.

Karl Silverlock, the Founder and Director of 8Digital, stated that there is a change in the smart buildings industry in the last 5 years. 8Digital is implementing this change. He also stated that both the companies have a common vision and 8Digital is excited to provide Quantifyâs product range in Queensland. At the same time, interest is also seen amongst the customers with respect to the companyâs solution.

Stock Performance:

The shares of QFY have generated a negative YTD return of 42.86%. The shares of QFY traded flat on ASX and closed at a price of A$0.004 on 30 August 2019. QFY has a market cap of A$5.96 million with ~ 1.49 billion outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.