The benchmark index S&P/ASX 200 was trading at 6,405.5 on 19 August 2019 (AEST 03:28 PM), up 0.93% from its previous close. In this article, we will be discussing five companies operating in diverse sectors. Let us have a look at these stocksâ updates and performance on the ASX.

Quantify Technology Holdings Limited

Quantify Technology Holdings Limited (ASX:QFY) is an Australia-based company, specialised in truly intelligent buildings technology. It is a provider of Internet of Things devices. Affordable and easy-to-install, the companyâs building blocks, qDevices, have an intelligent, network-connected framework. They replace AC light switches/dimmers and power outlets to offer energy management and reporting, as well as voice-enabled, app and touch control applications. The company was founded in 2015 and is headquartered in Perth, Western Australia.

Agreement with Intelligent Home Technology Centre:

In a press release dated 16 August 2019, QFY announced to have entered a comprehensive distribution agreement with Intelligent Home Technology Centre. The agreement is for the distribution, installation, demonstration and sales of QFYâs devices across Western Australia via the display suite method. The term of the contract has been fixed for one year.

General Meeting Results:

On 12 August 2019, QFY unveiled the result of resolutions considered by shareholders at the companyâs general meeting. The resolutions that were passed are listed below.

- Prior issue of shares under the placement

- Issue of new options under the placement

- Issue of new options to the underwriters

- Participation of director in the placement â Brett Savill

- Participation of director in the placement â Peter Rossdeutscher.

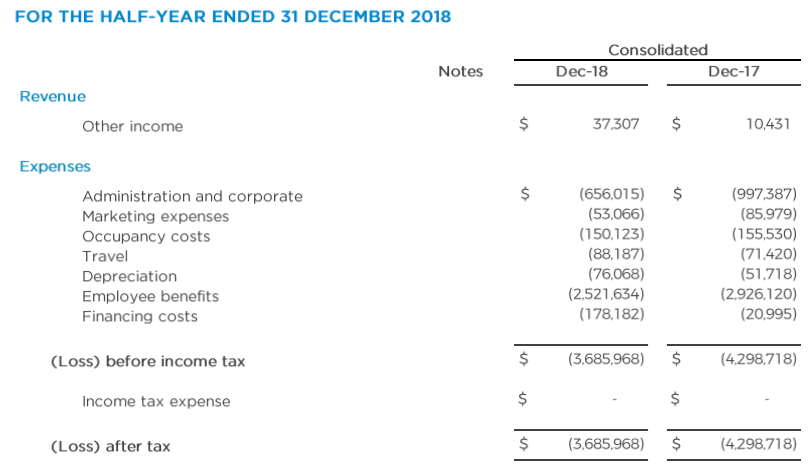

H1FY19 Results:

For H1FY19 ended 31 December 2018, QFY reported revenue of $ 37,307 and a net loss of $ 3,685,968.

Source: Companyâs Report

Source: Companyâs Report

Stock Update:

The stock of QFY was trading at A$ 0.005 on 19 August 2019 (AEST 01:55 PM). The stock has delivered a negative return of 16.67% and 28.57% during the last one month and three months, respectively. It has a market capitalisation of A$ 6.18 million with approximately 1.24 billion outstanding shares.

CV Check Limited

CV Check Limited (ASX:CV1) is an online services provider, engaged in offering its check products via the CVCheck brand on its proprietary online platform cvcheck.com. The primary business of CV1 is based in Australia and New Zealand. The company is based in Australia with headquarters in Osborne Park, Western Australia.

Completion of $ 3 Million Placement:

On 16 August 2019, CV1 announced to have secured firm commitments for $ 3 million (before costs) worth of a placement to shares to eligible institutional, sophisticated and professional investors. The company would use the funds raised for working capital purposes in addition to boosting its activities towards achieving its strategic goals. The above placement includes the issue of 18.8 million shares at a price of $ 0.16 per share. The shares would be allotted under CV1âs available capacity as per ASX Listing Rule 7.1.

Cash Flow Position:

On 31 July, the company released its Q4FY19 cash flow numbers. Its operating as well as investing cash flow grew by 104% pcp. For the fourth quarter, cash receipts stood at $ 3.2 million. At the end of the quarter, the company had cash balance of $ 3.1 million. Its annualised recurring revenue (ARR) stood at $ 9.2 million for FY19, which was driven by new large enterprise contracts as well as increasing average revenue per account. FY19 revenue was $ 12.4 million, with 70% of sales registered from B2B customers.

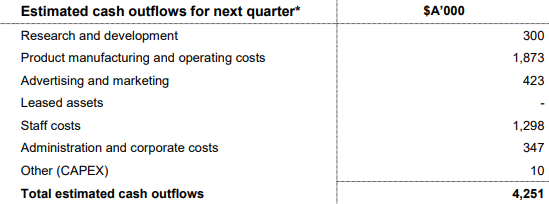

For the next quarter ending September 2019, the company expects cash outflows of A$ 4.251 million.

Source: Companyâs Report

FY20 Outlook:

The company plans to strengthen tender pipeline, as well as boost average revenue per account and integrated account management during the financial year 2020. CV1 is expected retain same momentum in the ARR growth for FY20.

Stock Update:

CV1 has delivered 37.50% and 103.70% during the last three and six months, respectively. On 19 August 2019 (AEST 02:17 PM), the stock was trading at A$ 0.170. It has a market capitalisation of A$ 45.04 million and 272.98 million outstanding shares.

LiveTiles Limited

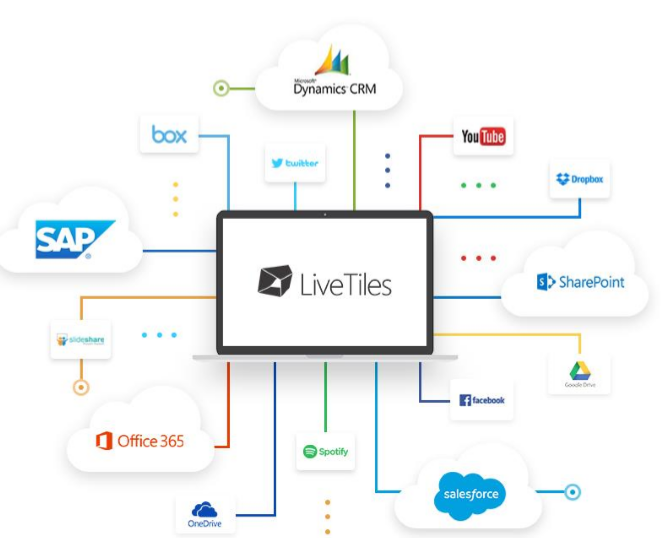

LiveTiles Limited (ASX:LVT) is a software provider, catering to markets including commercial, government and education. The intelligent workplace software provider ranks among rapidly growing SaaS companies, globally. LVT is a registered partner of Microsoft. Some of the companyâs products are LiveTiles for SAP Software, LiveTiles MX, LiveTiles Mosaic, LiveTiles Intelligent Workplace and LiveTiles Design. Its diversified customer base is spread across the regions including Europe, Middle East and Asia-Pacific, in addition to countries like United States and United Kingdom. The company has a diversified customer base spread across the United States, United Kingdom, Europe, Middle East and Asia-Pacific.

Source: Companyâs Report

Source: Companyâs Report

Update on R&D Tax Refund:

On 16 August 2019, LVT gave an update related to progress concerning the research & development tax refunds in Australia. The company has received a tax refund related to Australian research and development amounting $ 3.8 million in respect of the FY17 and FY18. However, the company expects to receive another ~$ 7 million in refunds for the previous financial years. LVT is likely to lodge its FY19 claim in the coming weeks.

Update on LiveTilesâ AI Cyber-Security Solution:

In June 2019, the company announced the launched a cyber security solution named LiveTiles AI. With a press release on 9 August, the company announced that the product is being directly offered through LVTâs partners as well as the Microsoft co-sell arrangement in 39 countries. Corporate, as well as government and educational organisations are expressing strong interest in the solution. The company developed the solution in partnership with Nucleus Cyber.

Stock Update:

On 19 August 2019 (AEST 02:48 PM), the stock price of LVT was trading at A$ 0.455. It has a market capitalisation of A$ 297.3 million and 660.67 million outstanding shares. 52-week trading range of LVT is at A$ 0.275 to A$ 0.670. LVT has delivered a positive return of 3.45% in the last three months and 32.35% in the past six months.

Kibaran Resources Limited

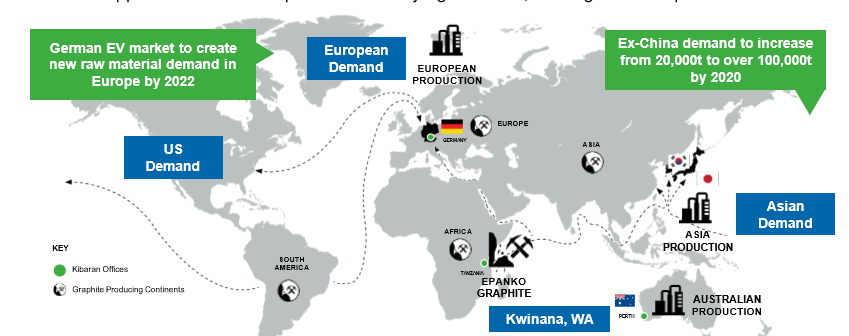

Kibaran Resources Limited (ASX:KNL) is an explorer and developer of graphite, focused on mineral-rich landscapes of Tanzania. The company, along with the government of Tanzania, is engaged in progressing the Epanko development plan. It owns a 100% stake in the Epanko deposit.

Update on Kwinana Facility, Western Australia:

In a market update on 16 August 2019, the company announced that it is progressing with the pre-development activities, owing to positive findings of the engineering study of the proposed battery graphite production facility in the Kwinana Industrial Area, Western Australia. The plant is expected to entail an upfront capital cost of US$22.8 million for an initial capacity of 5,000 tonnes per annum. Further, there will be a CAPEX requirement of US$49.2 million for production expansion to 20,000 tonnes per annum of battery-grade graphite.

KNL is confident of securing sales agreement, owing to positive feedback received from the extensive customer product qualification program undertaken and the strong European customer support. According to the company, long-term demand for graphite for use in battery is expected to remain positive, aided by rising penetration rates of EV vehicles (from 2% in 2018 to 25% by 2025).

Source: Companyâs Report

Source: Companyâs Report

Stock Update:

With a market capitalisation of A$ 35.11 million and approximately 292.62 million outstanding shares, KNL last traded at A$ 0.120 on 16 August 2019. Its YTD return stands at negative 11.11%.

Nanollose Limited

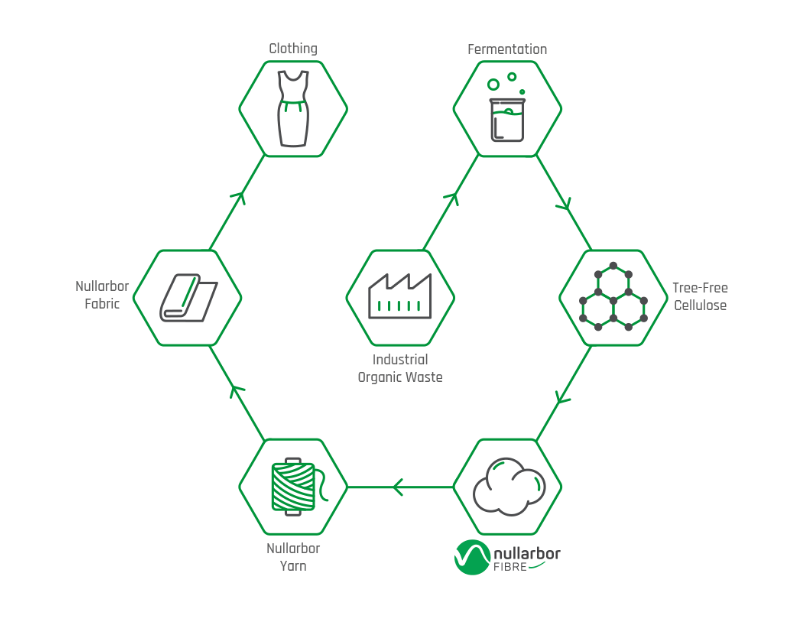

Biotechnology company, Nanollose Limited (ASX:NC6) is working on technologies related to the manufacturing, processing and applications of microbial cellulose. Cellulose is extensively used in everyday life such as clothing, paper and hygiene products.

Companyâs Website

Companyâs Website

Collaboration with Codi Group:

In a market update on 16 August 2019, the company announced to have inked a âcollaboration agreementâ with Codi International BV, a unit of Codi Group. Under the three-year accord, the two companies would work together on the development of commercially viable consumer wipe products. For this development, the Tree-Free nonwoven fibre of NC6 would be used.

The two companies would consider entering into a formal agreement in order to create a long-term business relationship, if Nanolloseâs fibre demonstrates that it can achieve commercial viability for the production of wipes.

Under the agreement, Codi would also get access to a licence to use NC6âs trademarked Tree-Free branding where reasonably required. After the development of a commercial product, the two companies would make further arrangements, concerning the conditions for the use of these trademarks.

Stock Update:

NC6 has delivered returns of 44.07% and 6.25% during the last three months and six months, respectively. The stock of NC6 was trading at A$ 0.085 on 19 August 2019 (AEST 03:15 PM). NC6 has a market cap of A$ 6.37 million and approximately 75 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.