Chinaâs demand for commodities has increased drastically over the years. It dominates many of the worldâs commodity market with about 50% demand for base metals. Factors such as economic development, industrialisation, urbanisation, and rising per capita incomes, are all crucial. As a result of this, China is a major commodity consumer particularly in base metals. Any slowdown in its economy can cause stress to metal prices.

Major commodities like iron ore and coal are strongly affected by the Chinaâs demand as they are the major consumers of metals.

Base metals prices dropped: There was decline in base metal prices after the China released its weak economic data on 16th September 2019. This has raised caused concerns about the demand from the worldâs second largest economy. Chinaâs industrial production grew slowest by the slowest pace in the last 17 and a half years in August This caused the causing base metal prices to fall fell.

Impact on metal prices: Most base metals prices dropped after the above news with LME Lead dropping the highest by 2.28%. LME Copper prices dropped by 1.96% to $5,761/tonne. Other base metals like LME nickel declined by 1.82%, LME zinc fell by 1.86%, and LME tin prices were flat on 18th September 2019.

Codelcoâs Chief Executive Officer is also expecting copper prices to remain under pressure due to continued uncertainties caused by global trade tension.

Due to the uncertainties in Chinaâs economic growth, top metals and mining companies of Australia like BHP and South32 were down today.

ASX Listed Metals and Mining Companies

BHP Group Limited

About the company: BHP Group Limited (ASX: BHP) is into the production of copper, gold, iron ore, coal, aluminium, borates, titanium dioxide and other minerals and metals. The market capitalisation of the company stood at A$111.62 billion as on 18th September 2019.

The Board Urged Shareholders to Vote Against both Resolutions at the Annual General Meeting on 7th November 2019: With respect to Resolution 1, which will be as a special resolution to amend the constitution of the company. The company stated, by ordinary resolution, the shareholders in general meeting may ask for information, make a request or can express an opinion, about the way in which power of the company partially or wholly bestowed in the directors has been or should be exercised. However, such a resolution must be related to an issue of material relevance to the company or the companyâs business and cannot support action which would violate any law and can be related to any personal claim.

And, resolution 2, proposed as an ordinary resolution, recommends that BHP suspend memberships of industry associations that undertake lobbying, advertising and/or advocacy relating to climate and/or energy policy, and whose record of advocacy since January 2018 is inconsistent with the goals of the Paris Agreement.

The company has broadcasted a 5-year $400 million Climate Investment Program to develop opportunities to lessen emissions from BHPâs own operations, and those made from the use of its products.

As per the release, the Board urged shareholders to vote against both resolutions.

Financial Highlights: The company reported a profit of US$8.3 billion, which includes an exceptional loss of US$818 million (FY18: US$3.7 billion, which includes a US$5.2 billion exceptional loss). The exceptional loss in FY19 is related to the Samarco dam failure. The company reported profit from operations of US$16.1 billion, which was due to increase in higher commodity prices, favourable impact of exchange rate movements and lower depreciation and amortisation charges.

Operational Highlights: The company exceeded the full year production guidance for petroleum and met the revised guidance for iron ore and copper. Energy coal and Metallurgical coal production were below the companyâs guidance. Adverse weather conditions and lesser wash plant yields resulted in this outcome.

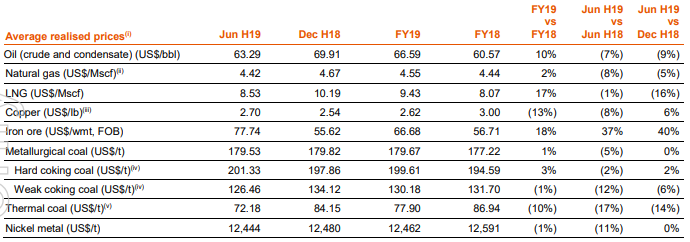

Average Realised Price Source: Companyâs Report

Final Dividend to be Paid on 25 September 2019: The Board of Directors decided to give a dividend of US 78 cents per share (fully franked) as final dividend. The total ordinary dividends stood at US$1.33 per share for the full-year 2019.

Stock performance: On the stockâs performance front, it produced returns of 4.52% and -5.65% on one month and three months, respectively. The stock closed at $37.790 on 18thSeptember, 2019 and has a P/E multiple of 16.580X, and an annual dividend yield of 5.06%.

Rio Tinto Limited

About the Company: Rio Tinto Limited (ASX: RIO) is into the business of exploration, development, production, processing and marketing of minerals and metals. The market capitalisation of the company stood at A$34.39 billion as on 18th September 2019.

Interim dividend: An interim dividend of 151 US cents per share and a special dividend of 61 US cents per share for the half year ended 30 June 2019 was announced by the company. The Rio Tinto shareholders will be paid an interim dividend of 219.08 Australian cents per ordinary share and a special dividend of 88.50 Australian cents per ordinary share. Rio Tinto Plc shareholders will be paid an interim dividend of 123.32 British pence per ordinary share and a special dividend of 49.82 British pence per ordinary share. The dividend will be paid on 19th September 2019.

Discovery of Copper-Gold Mineralisation: Rio Tinto has found copper-gold mineralisation at the Winu project. The outcomes from 14 diamond drill holes shows moderately wide juncture of vein style copper mineralisation related with gold and silver under relatively shallow cover. Drilling is on-going with three reverse circulation (RC) rigs and 8 diamond which are drilling at Winu and the results of this will be reported in 1Q20.

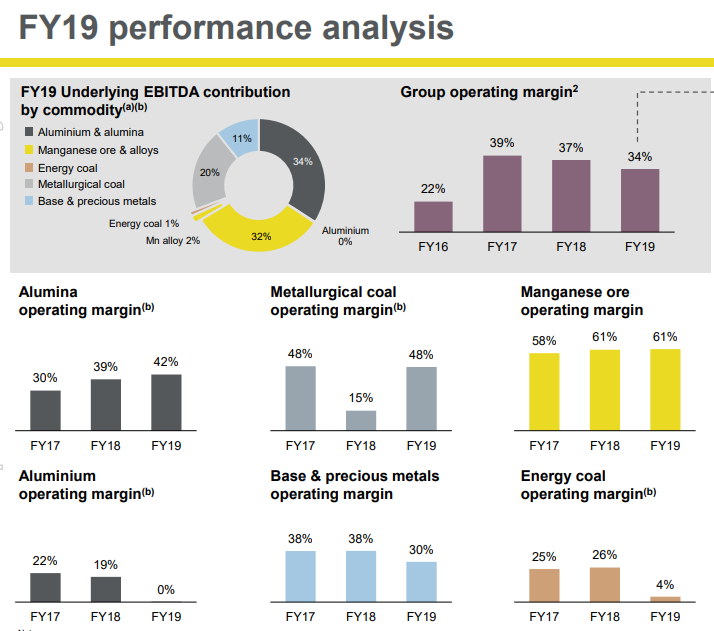

Strong Revenue in First Half: The company reported a consolidated sales revenue of $20.7 billion which exceeded revenue in the corresponding period of prior year by 9%. The increase in iron ore prices counter-balanced the impact of lesser volumes and decline in aluminium prices. The company reported an EBITDA of $10.3 billion up by 19% than 1H18, which excludes $0.6 billion input from coking coal. The increase in EBITDA was mainly due to increase in iron ore prices which were partially offset due to higher raw material costs and lower volumes.

Financial Results Source: Companyâs Report

Stock performance: On the stockâs performance front, it produced returns of 9.05% and -9.90% on one month and three months, respectively. The stock closed at $92.920 on 18th September 2019. It has a PE multiple of 8.100X, and an annual dividend yield of 5.07%.

South32 Limited

About the Company: South32 Limited (ASX: S32) is a mining and metals company which produces bauxite, alumina, aluminium, energy and metallurgical coal. The market capitalisation of the company stood at A$13.65 billion as on 18th September 2019.

Notice for AGM: The company has announced that its Annual General Meeting will be held on 24th October 2019 at 10:30 AM.

South Africa Energy Coal Divestment: South32 Limited announced that it has entered into negotiations to sell South Africa Energy Coal business to Seriti Resources Holdings Proprietary Limited. Seritiâs proposal has a modest up-front cash payment with a deferred payment structure in which the companies will share commodity price upside for an agreed time period.

Source: Companyâs Report

Stock performance: On the stockâs performance front, it produced returns of -3.19% and --13.88% on one month and three months, respectively. of the stock closed at $2.720 on 18th September 2019. It has a PE multiple of 24.860X, and an annual dividend yield of 4.15%.

Fortescue Metals Group

About the Company: Fortescue Metals Group Ltd (ASX: FMG) mines, processes and transports iron ore for export. The market capitalisation of the company stood at A$27.68 billion as on 18th September 2019.

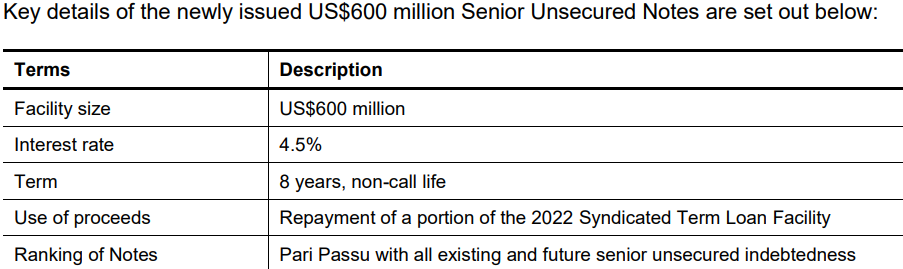

Successfully completed offering of High Yield Bond: The company announced that it has successfully completed US$600 million offering of Senior Unsecured Notes at an interest rate of 4.5 percent which will mature on 15th September 2027. Proceeds from the unsecured notes issue will be used for partial repayment of US$ 600 million term loan of the outstanding US$ 1.4 billion. In addition to that, Fortescue is also negotiating with the existing term loan lenders for the extension of Term Loan maturities amounting to US$600 million to 2025 on the same terms and conditions. The balance Term Loan of US$200 million will be repaid from operating cash.

Source: Companyâs Report

Approval received for Joint Venture: South Australian ministerial has approved for the Farm-in and JV agreement between Tasman Resources Ltd and FMG Resources Pty Ltd., a subsidiary of Fortescue Metals Group Ltd. Summary of the agreement is as follows:

- Fortescue may earn a 51% beneficial interest by sole funding A$4 million plus GST on exploration expenditure within 3 years;

- Fortescue must expend a minimum of A$1 million before it can withdraw. If it withdraws before expending A$4 million, it will receive no interest;

- If the interest of either party in the Joint Venture falls below 10%, the other party has the right to purchase all that interest at 90% of its then fair market value;

- Fortescue will be the manager while earnings its interest as well as during the JV.

Stock performance: On the stockâs performance front, it produced returns of 17.36% and 6.14% on one month and three months, respectively. of the stock closed at $9.100 on 18th September 2019. with PE multiple of 6.120x, and an annual dividend yield of 4.78%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.