What âEx-Dividendâ means?

The Ex-Dividend defines the companyâs stock, which are on trade without having information on any upcoming dividend. If an investor is making entry into stock on or post ex-dividend date, that investor would not be entitled to the declared dividend. However, the seller of the stock will be eligible for the dividend. To confirm whether the investor will get dividend or not, an investor should keep an eye on key dates such as âRecord Dateâ and Ex-Dividend Dateâ. Hence, the investor should be on the companyâs register on the âRecord Dateâ for being eligible for declared dividend.

Generally, on the date of Ex-Dividend, the stock of the company trades slightly lower compared to the previous dayâs prices, reflecting slightly lower demand for the stock as investors have no immediate added incentive for buying that stock. At the time of writing, on 5th September 2019 (AEST 3: 31 PM) the benchmark index, the S&P/ ASX 200 is trading 6,620 with a rise of 1.0% over its previous close.

Air New Zealand Limited

Air New Zealand Limited (ASX: AIZ) is an Airline company, which is having its focus on connecting the world to New Zealand. Recently, the company has announced that it will be conducting its annual general meeting on 25th September 2019 in New Zealand.

Earnings and Dividend

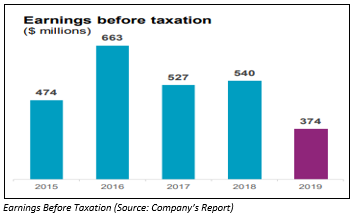

When it comes to the earnings and profitability, the company delivered EBT amounting to $374 million in FY19 as compared to $540 million in FY18. It posted Net profit after taxation (NPAT) amounting to $270 million and operating cash flow of $986 million for FY19.

The company has declared a final dividend amounting to 11.0 cps, which brings the full-year total ordinary dividends for FY19 to 22.0 cps, which is in accordance with the previous year. The record and payment date for the dividend stood at 6th September 2019 and 18th September 2019, respectively. As per ASX, the ex-date of dividend stood at 5th September 2019.

Outlook

Air New Zealand Limited is expecting EBT to be in the ambit of $350 million to $450 million for FY20 on the back of current market conditions and assumption of average jet fuel price of US$75 per barrel.

Moving to stock price performance, the stock of Air New Zealand Limited last traded at A$2.660 per share on the trading session of 5th September 2019. In the time period of one month and six months, it witnessed a rise of 4.96% and 13.64%, respectively.

BHP Group Limited

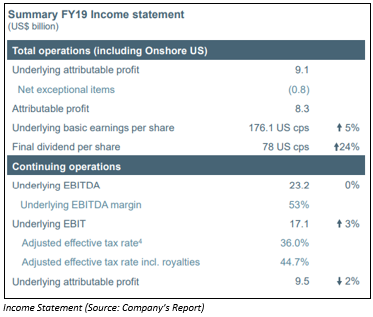

BHP Group Limited (ASX: BHP) is into the exploration of minerals as well as production and processing of coal, iron ore etc. The company recently updated the market with its full-year 2019 results, wherein it reported underlying EBITDA amounting to US$23.2 billion and posted Underlying EBIT with a rise of 3% year over year.

The company has recorded final dividend amounting to 78 US cents per share with inclusion of an additional amount of 25 US cents per share, and which is above the payout policy of minimum 50%. The total ordinary dividends declared amounted to US$1.33 per share. As per ASX, the ex-date of dividend stood at 5th September 2019.

Moving to stock price performance, the stock of BHP Group Limited last traded at A$36.110 per share, with a fall of 0.578% on the trading session of 5th September 2019.

Corporate Travel Management Limited

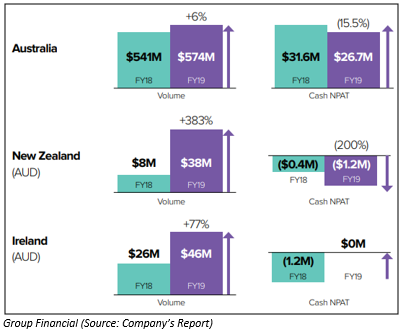

Corporate Travel Management Limited (ASX: CTD) is into managing the purchase and the delivery of travel services for its clients. When it comes to the FY19 performance, it reported a rise of 30% in total transaction value, which stood at $6.46 billion, which resulted from market share gains in all operating regions including the US, Europe, Australia, New Zealand and Asia. It reported a statutory net profit after tax attributable to owners of the company increased by 12% to $86.2million.

The Board of the company has declared a final dividend amounting to 22 cents per share for the half year, which brings the full year dividend to 40 cents, reflecting a rise of 11% for the year. Franked by 50%,the dividend would be paid by the company on 3rd October 2019. As per ASX, the ex-date of dividend stood at 5th September 2019.

Moving to the past performance, the stock of Corporate Travel Management Limited last traded at A$18.270 per share, with a rise of 1.783% on the trading session of 5th September 2019. In the time scenario of one month and six months, it witnessed a fall of 17.85% and 33.00%, respectively.

FlexiGroup Limited

FlexiGroup Limited (ASX: FXL) is primarily into leasing and rental financing services. The company recently published its FY19 results wherein it reported 1.76 million active customers, reflecting a rise of 8% on the previous year. It posted a cash net profit after tax amounting to $76.1 million, which is in accordance with the guidance.

The Board of Directors of the company has declared final dividend amounting to 3.85 cents per share, fully franked, which takes the FY19 total dividend to 7.70 cents per share. It added that this dividend is in accordance with 1H FY19 payout and remains within the companyâs stated payout ratio range of 30-40% of Cash NPAT. As per ASX, the ex-date of dividend stood at 5th September 2019, and payment date for the dividend is 11th October 2019.

Moving to price performance, the stock of FlexiGroup Limited last traded at A$1.860 per share, with a rise of 1.087% on the trading session of 5th September 2019. In the time period of one month and six months, it witnessed a rise of 3.95% and 11.18%, respectively.

Monash IVF Group Limited

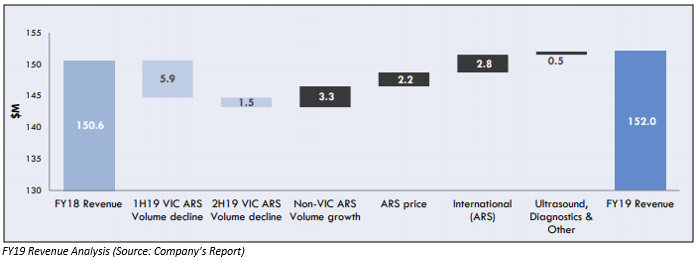

Monash IVF Group Limited (ASX: MVF) provides assisted reproductive services and ultrasound services. In FY19, the company reported revenues amounting to $152.0 million as compared to $150.6 million in FY18, reflecting a rise of 0.9% year over year. It posted underlying NPAT of $20.9 million with a decline of 2.3% year over year.

The company has declared a final dividend of 3 cps, fully franked, which bring the full year dividends (fully franked) consistent with the previous comparable period. As per ASX, the ex-date of dividend stood at 5th September 2019 and payment date for the dividend is 11th October 2019.

Moving to price performance, the stock of Monash IVF Group Limited last traded at A$1.020 per share, with a fall of 1.449% on the trading session of 5th September 2019. In the time period of one month and six months, it witnessed a fall of 28.37% and 4.61%, respectively.

Ramsay Health Care Limited

Ramsay Health Care Limited (ASX: RHC) is a global hospital group, which owns and operates a number of healthcare facilities. On the financial performance front, the company delivered core net profit after tax amounting to $590.9 million, reflecting a rise of 2.0% in FY19. It posted revenue of $11.4 billion, with an increase of 24.4% over the year-ago period.

The Board of Directors of the company has declared a final dividend amounting to 91.5 cents, fully franked, reflecting a rise of 5.8% on previous corresponding period, which brings the full year dividend to 151.5 cents fully franked, with a rise of 5.2% on the previous year. The record date and payment date for the dividend are 6th September 2019 and 30th September 2019, respectively. As per ASX, the ex-date of dividend stood at 5th September 2019.

Moving to the past performance, the stock of Ramsay Health Care Limited last traded at A$63.560 per share, with a fall of 1.274% on the trading session of 5th September 2019.

Whitehaven Coal Limited

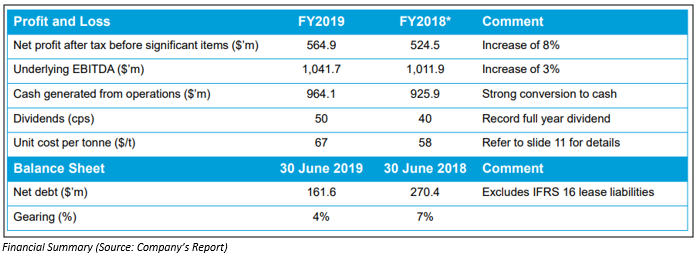

Whitehaven Coal Limited (ASX: WHC) is engaged in the development and operation of coal mine in NSW. In FY19, the company reported a net profit after tax amounting to $527.9 million as compared to $ 524.5 million in FY18. The cash generated from operation stood at $964.1 million with net debt of $161.6 million as on 30th June 2019, and gearing declined to 4% from 7% at the end of the previous year.

The company has declared dividend amounting to 30 cents per share shareholders. The dividend declared by the company comprised an ordinary dividend amounting to 13 cps, which is franked to 50% and also include a special dividend of 17cps, which is unfranked. As per ASX, the ex-date of dividend stood at 5th September 2019 and payment date for the dividend is 19th September 2019.

Moving to stock price performance, the stock of Whitehaven Coal Limited last traded at A$3.200 per share, with a fall of 9.348% on the trading session of 5th September 2019.

Yancoal Australia Limited

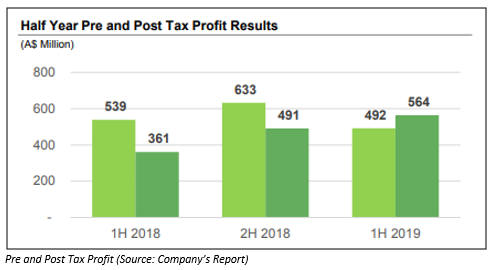

Yancoal Australia Limited (ASX: YAL) is primarily involved in operation and development of open-cut coal mines. Recently, the company has released its results for the first half of the financial year 2019, wherein it delivered revenue from operating activities amounting to $ 2,350 million as at 30th June 2019 in comparison to $ 2,347 million as of 30th June 2018. The following picture provides an idea of the profits of the company:

When it comes to return to shareholders, the Board of the company has declared an interim cash dividend amounting to A$136.7 million for the 1H FY19. The record date for the interim dividend is 6th September 2019. As per ASX, the ex-date of dividend stood at 5th September 2019.

On the stockâs performance front, YAL last traded at a price of A$2.980 per share with a decline of 11.68% and 8.39% in the time period of one month and three months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.