The metals and mining sector of Australia has always been under the radar of sophisticated investors. The nation has been a great supplier of minerals and non- minerals products and the sector under discussion has been export-oriented with an anticipation of increasing the export. When it comes to giving returns to the shareholders, the metals and mining related companies have always pleased the investor with good returns in the form of dividend.

On the given background, let us now discuss five such stocks and understand them better:

Ausdrill Limited

Ausdrill Limited (ASX:ASL) provides complete mining value chain across Australia, Africa and around the world. As per the previous announcement dated 20th Aug 2019, the company has adopted the new Brand name âPerentiâ. Also, the trading name of the group entity is âPerenti Globalâ.

Recently, the company through a release dated 30th Aug 2019 announced that Gresham Private Equity Limited and its associated entities have advised ASL that it has entered into a Block Trade Agreement in order to sell 48,045,233 Perenti (ASL) shares at a price of $1.88 per share. Also, the agreement is fully underwritten by J.P. Morgan Securities Australia Limited.

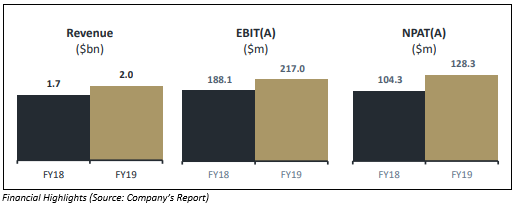

A look at FY19 Operational and Financial Performance: On 28 August 2019, the company declared annual results for the period closed 30 June this year. It reported proforma revenue amounting to $1.970 billion, reflecting a rise of 14.2%, while it delivered statutory revenue of $1.638 billion with a rise of 89.1%. It posted proforma and statutory EBIT of $217.0 million and $207.2 million, reflecting a rise of 15.4% and 101%, respectively. Adding to that, the statutory net profit after tax of the company stood at $181.3 million.

Dividend: The company declared a final dividend of 3.5 cps for the year ended 30 June 2019, which brings the full-year dividend to 7 cps. The record date and payment date for the fully franked final dividend stood at 9th October 2019 and 23rd October 2019, respectively.

Moving to the stock performance, ASLâs stock was trading at A$2.065 per share (at AEST 12:22 PM) with a rise of 3.509% during the trading session of 2 September 2019. In the time frame of three months and six months, it provided a return of 32.12% and 14.99%, respectively. When it comes to time period of the last one month, ASL provided a return of 1.01%.

Macmahon Holdings Limited

Macmahon Holdings Limited (ASX: MAH) provides mining and consulting services to the mining companies across Australia, Southeast Asia and South Africa. Recently, the company through a release dated 30th August 2019 provided the market with the solid full year report.

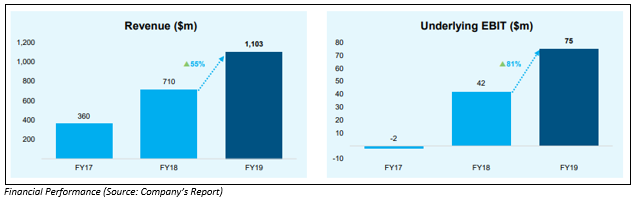

A Quick Walk through the latest Earnings Release: The company has reported another strong year, with earnings and revenue growth for the year ended 30 June 2019, which is in accordance with the guidance. The company reported revenue amounting to $1,103.0 million, reflecting a rise of 55% on the back of increased activity throughout its contract of mining projects in Australia and Indonesia. It posted a statutory net profit after tax of $46.1 million in FY19 as compared to $33.2 million in FY18.

Dividend: The Board of the company has declared a final dividend of 0.5 cps, which is partially franked to 30%. The record date and the payment has been mentioned as 14 October 2019 and 29 October 2019, respectively.

Outlook: Macmahon Holdings Limited is well placed to achieve growth in FY20, with secured work in hand amounting to $1.2 billion. For FY20, it anticipates revenue in the range of $1.2-1.3 billion, and EBIT to be in between $80-90 million.

Moving to the stock performance, MAHâs stock was trading at A$0.22 per share with a rise of 7.317% during the trading session of 2 September 2019. In the time frame of three months and six months, it generated a return of 10.81% and -12.77%, respectively.

Fortescue Metals Group Ltd

Fortescue Metals Group Ltd (ASX: FMG) is involved in the development, production, exploration, sale and processing of iron ore. Recently, on 28 August this year, the company, via a release announced that it has appointed Dr Ya-Qin Zhang as Non-Executive Director, w.e.f. 1st September 2019.

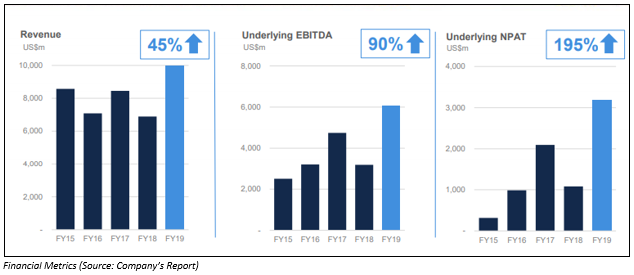

Operational and Financial Performance: On 26 August 2019, FMG declared its annual report for the period closed 30 June 2019. For FY19 period, the companyâs Total Recordable Injury Frequency Rate stood at 2.8, reflecting a rise of 24% in comparison to 30 June 2018. The company shipped total ore amounting to 167.7 million tonnes with a fall of 1% as compared to FY18. It reported Underlying EBITDA and Underlying NPAT amounting to US$6.0 billion and US$3.2 billion, reflecting a rise of 90% and 195% from FY18.

The company has declared a final dividend amounting to A$0.24 per share, fully franked. This makes the full year 2019 dividend to stand at A$1.14. Also, the declared dividend of A$0.24 cps has an ex date of 2 September this year, with a record date of 3 September this year and payment date as 2 October 2019.

On the financial front for FY19 period, the company reported cash from operations of US$5.0 billion, reflecting a robust rise of 64%. The net cash from the operating activities stood at US$4.4 billion, which represents the continued strength of underlying operating cash margins.

Moving to the stock performance, FMGâs stock was trading at A$7.79 per share (at AEST 12: 49 PM) with a slip of 2.625% during the trading session of 2 September 2019. In the time frame of past one month and three months, it gave a return of -2.68% and 0.25%, respectively.

Rio Tinto Limited

Rio Tinto Limited (ASX: RIO) is primarily involved into exploration and development of minerals and metals.

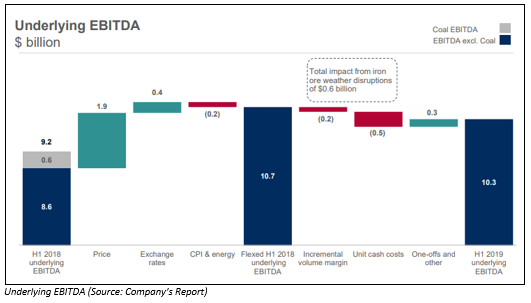

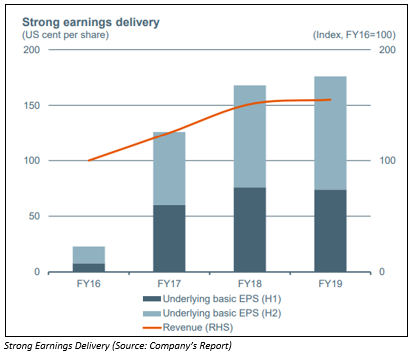

A look at First Half Performance: In the 1H FY19 result declared on 1 August this year for the period ending 30 June 2019, the company has reported strong financial performance, wherein the underlying EBITDA amounted to $10.3 billion with an EBITDA margin of 47%. It added that the financial performance had been fueled by its Pilbara operations with an EBITDA margin of 72%, which is being supported by strong iron ore prices. The company delivered consolidated sales revenue amounting to $20.7 billion, reflecting a growth of 9% in comparison to 1H FY18, which excluded the amount of $0.8 billion as a contribution from the coking coal assets divested in 2018. RIO posted free cash flow amounting to $3.9 billion with a rise of 35% as compared to 1H FY18.

2019 Cash Returns paid to Shareholders: As per the 1H FY19 results, the company has declared interim dividend amounting to US 151 cps, which is equivalent to $2.5 billion. It also declared special dividend equating to $1.0 billion, and equivalent to 61 US cents per share. The above-stated dividend brings cash returns of $3.5 billion to shareholders.

Moving to the stock performance, RIOâs stock was trading at A$88.56 per share with a rise of 1.119% during the trading session of 2 September 2019. In the time frame of the last one month and three months, it gave a return of -10.65% and -12.46%, respectively.

BHP Group Limited

BHP Group Limited (ASX: BHP) is a producer of major commodities such as iron ore, metallurgical coal and copper.

Change in Directors Interest: Recently, BHP Group Limited through a release dated 28th August 2019 announced that Susan Kilsby has made a change to her holdings in the company by acquiring 2,900 ordinary shares in BHP Group Plc at a consideration of GBP 17.13 per share on 23rd August 2019.

In another update of 23 August 2019, the company stated that another director Andrew Mackenzie has also made a change to his holdings in the company by acquiring and disposing 63,486 and 31,309 ordinary shares respectively on 21st August 2019.

Financial Performance: In the financial year report 2019, ending 30 June this year, the company reported Underlying EBITDA of US$23.2 billion with EBITDA margins of 53% and free cash flow amounting to US$10.0 billion. It reported attributable profit amounting to US$8.3 billion and Underlying attributable profit stood at US$9.1 billion, reflecting a rise of 2% from the previous year.

On the shareholder returns front, it recorded the final dividend amounting to 78 US cps including an additional amount of 25 US cps, which is above the 50% minimum payout policy. The return on capital employed (ROCE) stood at 18% with a rise of 15% from 1H FY19.

Moving to the stock performance, BHPâs stock was trading at A$36.445 per share (at AEST 1:20 PM) with a rise of 0.427% during the trading session of 2 September 2019. In the time frame of past one month and three months, it provided a return of -11.12% and -3.74%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.